Bloomberg Intelligence carbon strategy tilts to quality and limits drawdowns

This analysis is by Bloomberg Intelligence Director of ESG Research Adeline Diab and Bloomberg Intelligence ESG Analyst Rahul Mahtani. It appeared first on the Bloomberg Terminal.

A newly-launched BI Carbon portfolio — with long and short positions in high and low-scoring BI Carbon stocks — may help to limit drawdowns while providing exposure to companies leading their sectors’ decarbonization. The strategy is also quality-oriented, with two-fifths of the portfolio’s long positions in the most profitable companies in the universe.

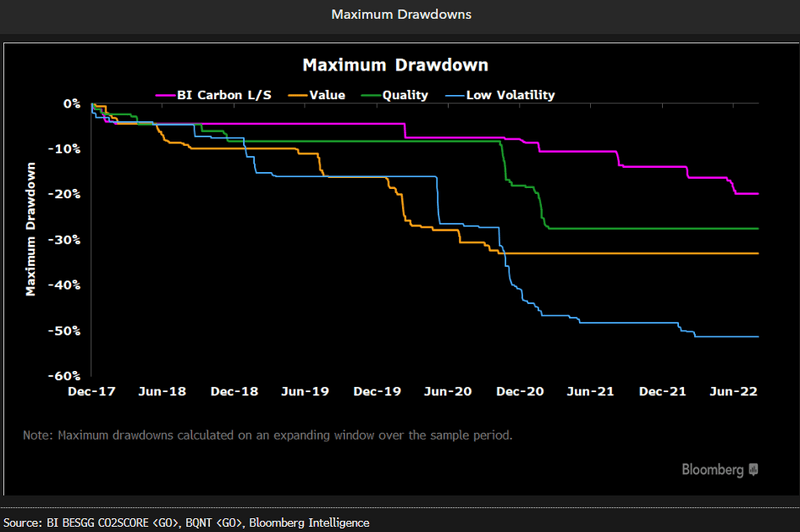

Reduced downside risks with lower drawdowns (correct)

The BI Carbon strategy’s maximum drawdown is reduced compared with equity factors, reflecting its ability to limit downside risks while focusing on portfolio-carbon goals. By holding long and short positions in 30% of stocks in each sector with the highest and lowest BI Carbon scores respectively, the strategy captures the spread between companies with the most and least ambitious climate goals. This spread can also provide protection against downside risks as its maximum drawdown of 19.8% since 2018 is the smallest vs. other standard equity factors, including value (32.9%), quality (27.4%), and low volatility (51.3%).

BI Carbon scores reflect companies’ current emissions and targets up to 2030, relative to their sector. Both the data and methodology are available at BI BESGG CO2SCORE <GO>. (Corrects target year.)

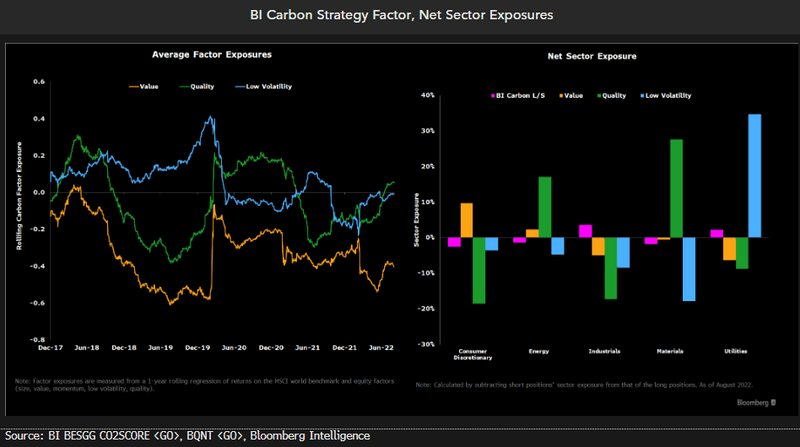

Growing tilt to quality while value exposure remains negative

Exposures to quality and growth are the main factor drivers for the BI Carbon portfolio, and these tilts are driven mainly by the portfolio’s long positions in profitable and highly valued companies. The quality exposure has been increasing since March 2022, turning positive in July. By contrast, its value exposure remains consistently negative over the past four years, at minus 0.4 in August.

In addition, the strategy’s sector-neutrality — based on long and short positions in the highest and lowest ranked companies in each sector — has contributed to the portfolio’s negligible exposure to low volatility, which is concentrated in utilities and net short in materials.

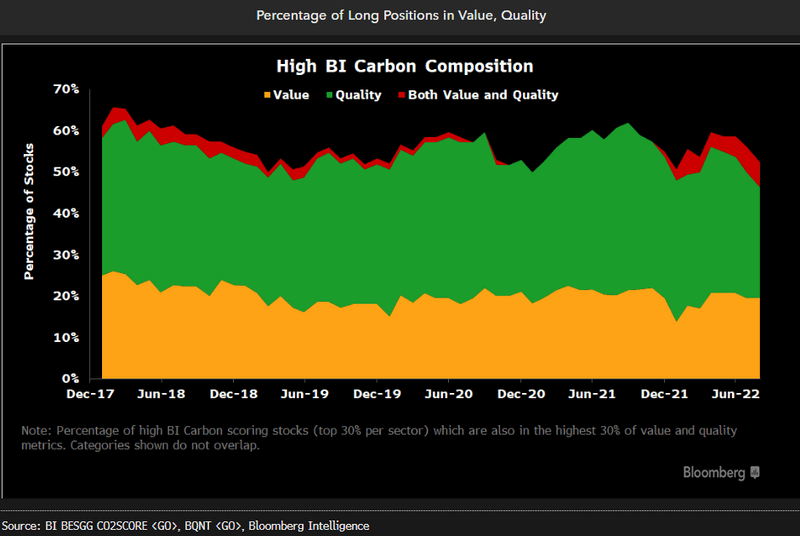

BI carbon strategy retains high-scoring profitable companies

The BI Carbon portfolio aims to hold long positions in companies with the most ambitious carbon-reduction goals, and these stocks also tend to be the most profitable in the universe. Specifically, the proportion of long positions in stocks that were also ranked in the top 30% of profitability averaged 37% in 2022. These companies include Tesla, TotalEnergies, and Fortesque Metals in automobiles, energy and materials, respectively. The strong presence of quality stocks with high carbon scores suggests that it’s compatible to pursue both climate and financial goals across sectors. At the same time, a separate 20% of the long positions’ are in companies with low valuations despite the portfolio’s overall negative exposure to the value factor.