At the intersection of value & momentum: Multifactor portfolio

This analysis is by Bloomberg Intelligence Equity Strategist Christopher Cain and Chief Equity Strategist Gina Martin Adams. It appeared first on the Bloomberg Terminal.

BI’s multifactor model portfolio aims to identify S&P 500 and Russell 1000 stocks with the most favorable combination of strong momentum, high quality, low volatility and inexpensive valuations. Our decile 1 multifactor portfolio remains overweight industrials, while decile 1 companies based on value and momentum may be compelling given the first factor’s potentially long runway of outperformance.

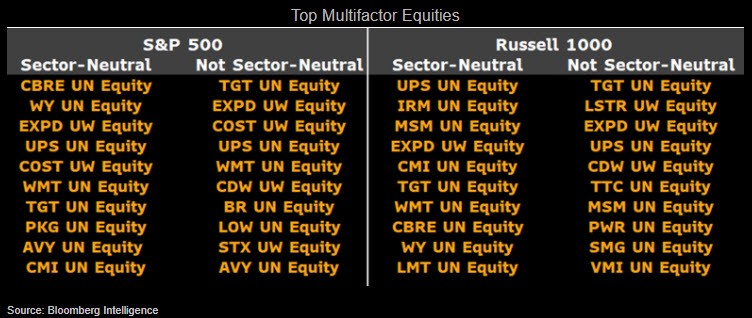

Target, UPS, CBRE remain top-rated equities

On a sector-neutral basis, real estate company CBRE Group is the highest ranking multifactor stock in the S&P, 500 while Target is the highest rated after removing sector constraints. UPS is rated best in the Russell 1000 (sector neutralized), with Target again at the top of the list without sector restrictions.

The top 10 multifactor equities with and without sector neutralization are displayed for each index. See the blue links to the right to view a complete, interactive grid of multifactor scores for each universe.

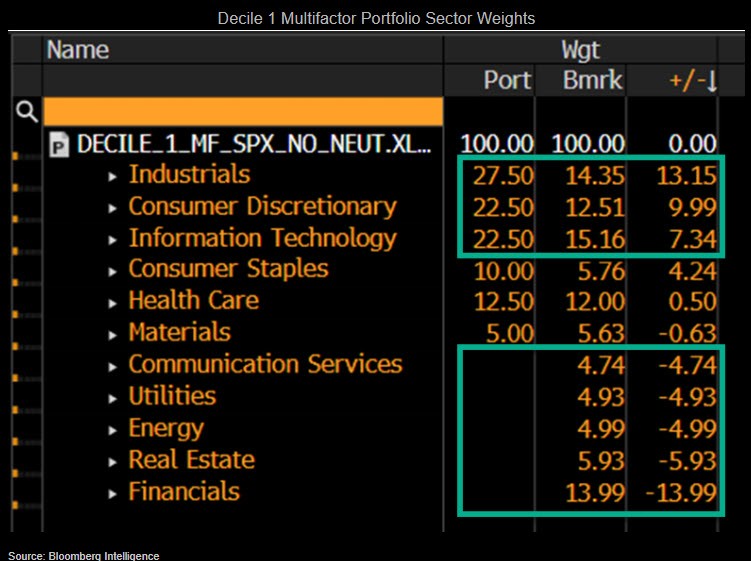

Industrials favored in S&P 500 decile 1 group

An analysis of our S&P 500 decile 1 multifactor portfolio without sector constraints reveals a heavy overweight in industrial shares. The consumer discretionary and information technology sectors are also overweight, while five sectors have no decile 1 representatives, causing significant underweighting.

Our decile 1 multifactor portfolio is 27.5% comprised of industrial shares, 13.15 percentage points more than the S&P 500 equal-weight index (14.35%). Consumer discretionary comes in at 22.5% (9.99 percentage points overweight) and tech at 22.5% (7.34). Communications, utilities, energy, real estate and financials have no representatives in our decile 1 portfolio.

Intersection of value and momentum

BI’s multifactor grid is used to identify the companies in the Russell 1000 that fall into decile 1 based on both value — those with inexpensive valuations — and momentum — those with strong six- and 12-month total returns (skipping the most recent two weeks). This combination is compelling considering our view that the value rotation in the U.S. potentially has a lot of room to run as valuations normalize.

Seven stocks in the Russell 1000 make our decile 1 momentum and value list, highlighted by Bunge, which also has the highest multifactor score of the group, followed by Dick’s Sporting Goods and Foot Locker.

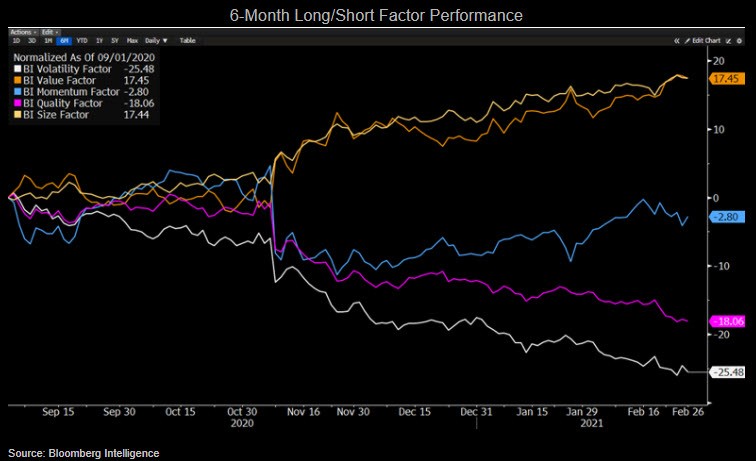

Size tops BI’s factor scorecard

BI’s factor scorecard, designed to inform portfolio strategy around five main equity factors using recent long/short performance and valuations, has size on top, followed by value, the same combination that led the 3Q20 chart.

The size factor continues to work, showing strong long/short returns over the past three (positive 7.35%) and six (17.44%) months. BI’s value factor is also performing well, up 7.58% over three months and 17.45% over six. Valuations for each factor point to potentially a long runway of outperformance. BI momentum has put up some good numbers recently and noteworthy valuations, especially for Q1 vs. the index. The struggling low-volatility and quality factors bring up the rear of our rankings.

Size, value perform; quality, low volatility suffer

Value and size have outperformed our other major U.S. equity factors over the past six months, with positive trends helping them stay atop our scorecard.

BI’s long/short size factor leads the way, up 17.45% since September, followed closely by long/short value, which gained 17.44% during the period. Momentum sits in the middle of the pack after a very tough end to 2020 (including Nov. 9’s largest one-day decline on record). The factor has staged a bit of a comeback and is now down just slightly — 2.8% — over the past six months. Quality (down 18.06%) and low volatility (minus 25.48%) bring up the rear, as the current risk-on environment remains a drag on these more defensive factors.