This analysis is by Bloomberg Intelligence Senior Litigation Analyst Elliott Z Stein. It appeared first on the Bloomberg Terminal.

Credit Suisse appears poised to incur legal settlement and penalty costs related to Archegos, possibly totaling $1.2 billion. An investor lawsuit is in the process of settling. While the amount isn’t yet known, we think it could be about $200 million and may presage regulator penalties that we think could cost up to $1 billion. Other banks – particularly Nomura, in our view – that served as prime brokers for Archegos are also at risk of regulator penalties. We think Goldman Sachs and Morgan Stanley will handily win dismissal of lawsuits alleging they committed securities fraud when selling shares of ViacomCBS, Tencent, Vipshop and Gaotu Techedu amid the Archegos turmoil.

Credit Suisse archegos penalty risk likely less than $1 Billion

Credit Suisse’s exposure to Archegos-related regulatory penalties is likely less than $1 billion, using JPMorgan’s $920 million “London Whale” fines as a comparable. The Swiss bank’s steps to address risk-management lapses should help keep the amounts below that threshold. Nomura is among other Archegos prime brokers that we think is susceptible to regulatory penalties.

JPMorgan ‘whale’ fine offers comparable

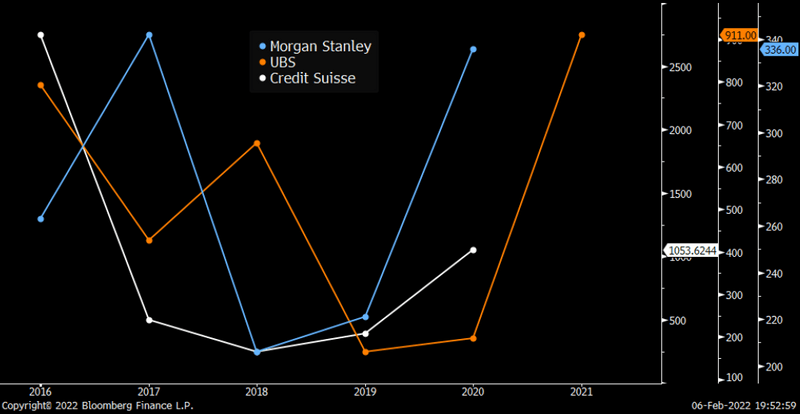

Predicting Credit Suisse’s potential regulatory penalties for Archegos-related lapses is difficult, but JPMorgan’s $920 million fine in 2013 from U.S. and U.K. authorities for control deficiencies related to the $6.2 billion so-called London Whale trading loss may offer a fair comparison. We think the most likely penalties for Credit Suisse stem from risk-management failures and misrepresentations of those processes. Among other banks serving as Archegos’ prime broker, Nomura may be most susceptible to actions by regulators. The Japanese banks’ $2.9 billion loss, though smaller than Credit Suisse’s $5.5 billion, was similarly outsized relative to its prime-broker business. Morgan Stanley’s $1 billion and UBS’ $774 million in losses were more proportional to their prime broker businesses, which should temper any fines.

Bank litigation expense compared

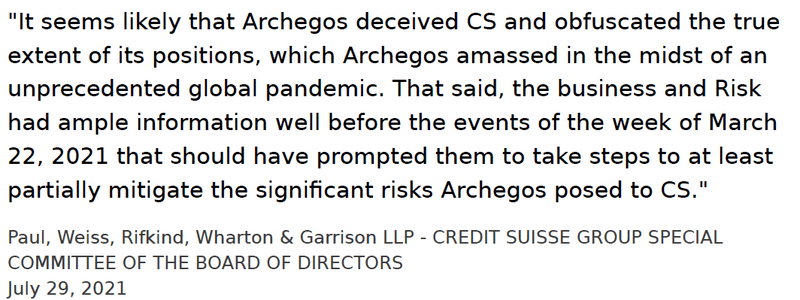

Credit Suisse remediation a mitigating factor

Credit Suisse’s July 29 special committee report concerning its relationship with Archegos may limit regulator fallout, yet won’t prevent penalties. The report noted the bank’s seriousness in identifying and fixing its risk-management failures, which regulators are likely to take into account when determining appropriate action. The bank’s management response to the report further outlined remedial steps taken in the wake of Archegos. Still, given the extent of the failures, regulatory penalties are inevitable and will likely be imposed by U.S., U.K. and Swiss authorities.

Some Credit Suisse remediation steps thus far:

- Reviewing and upgrading risk governance and underlying

reporting, reducing risk. - Recruiting additional resources for the risk function while creating

new risk roles. - Demanding a significant reduction of risk-weighted assets and

leverage exposure. - All hedge fund clients have been moved to dynamic margining.

Archegos wrongdoing wouldn’t absolve banks

Wrongdoing by Archegos — Bloomberg reported on Oct. 8 that the SEC was investigating the family investment office for possible market manipulation — wouldn’t absolve its prime-broker banks, including Credit Suisse and Nomura. Regulators can still penalize the banks for risk-management failures in insufficiently addressing red flags. And misrepresentations of risk-management processes could constitute securities fraud violations. A potential DOJ antitrust probe — reported by Bloomberg in June — adds to the penalty possibilities for the prime-broker banks, though we think that’s less likely. Sharing competitively sensitive information can be a violation, but the banks’ proper motives and involvement of legal counsel mitigate against that outcome.

Company presentation

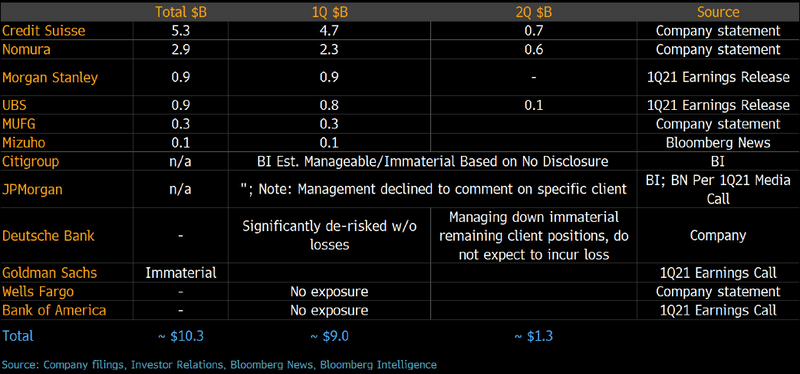

Archegos global bank losses weigh in 2Q

Losses related to the Archegos hedge fund collapse have damped equities-trading results across a range of banks, with Credit Suisse on the higher end, followed by Nomura. Morgan Stanley’s $911 million loss, fully accrued in 1Q, exceeded those at its U.S. peers, though we note the bank is a much more significant prime brokerage competitor than global rivals disclosing higher losses. Wells Fargo had no losses related to closing out its exposure, and BofA had no exposure. UBS’ loss is $861 million including 2Q impacts. Deutsche Bank said it had significantly cut risk without incurring losses.

Losses were about $1.3 billion in 2Q after $9 billion in 1Q across a handful of banks, based on disclosures and estimates. Credit Suisse, UBS and Nomura’s 2Q results included impacts in line with flagged estimates.

Global banks archegos-related losses