Bloomberg Market Specialist Soujit Ghosh and Ross Etwell contributed to this article. The original version appeared first on the Bloomberg Terminal.

Background

Apple Inc.’s flagging rally will be put to the test again as its new product launches face wilting U.S. consumption and Chinese regulatory curbs.

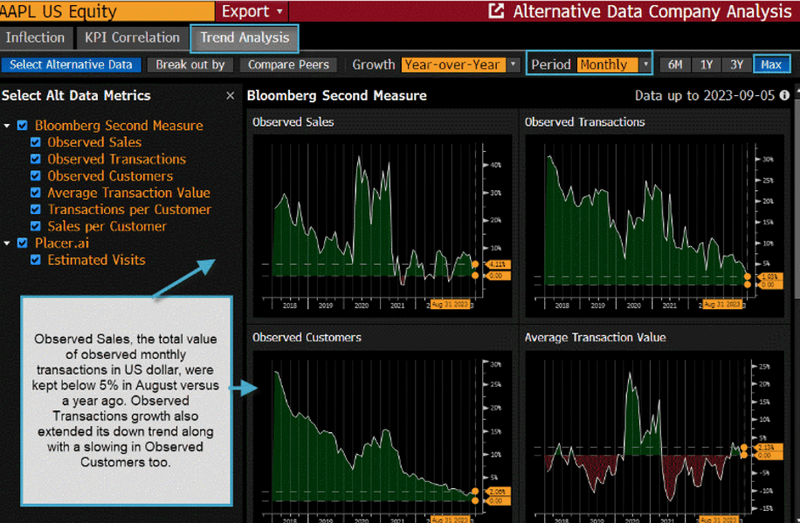

Early signs of U.S. consumer transaction data compiled by Bloomberg show Apple’s observed sales remain anemic for the current quarter, with analysts forecasting iPhone revenue growth to fall below zero over the next couple of quarters. Bloomberg Intelligence, meanwhile, says Apple’s overexposure to China for manufacturing is a concern amid rising geopolitical tensions.

The issue

Growth is slowing for Apple in multiple metrics. Observed sales — the total value of observed monthly transactions in U.S. dollars — saw August growth below 5% versus a year ago. Growth also slowed for observed transactions growth and observed customers growth. While Apple’s U.S. consumer sales growth in August was higher year-over-year than in July, the company’s sales growth rate was below levels seen between February and June. Apple’s observed transactions growth extended its down trend along with a slowing in observed customers growth.

Apple shares have fallen 11% from a record high in July after the company reported a third-straight quarter of declining sales in early August. China remains a critical market for Apple, with sales from greater China having tripled since 2012.

Meanwhile, Chinese regulators expanded a ban on iPhone use across government-backed agencies and state companies. Still, BI doesn’t expect the Chinese ban to have a noticeable impact on sales, calling it an extension of similar restrictions on PC sales and the use of U.S.-made software.

A larger concern is the company’s manufacturing footprint. “Apple’s overexposure to China for manufacturing and any disruptions due to either parts shortages or geopolitical issues could seriously hinder its ability to fulfill orders,” Anurag Rana, BI’s senior tech analyst, wrote in August.

Apple suppliers have more than 19% of their facilities in China, second only to the U.S., with about 18% of its suppliers headquartered in the Chinese mainland.

Apple’s iPhone sales are forecast to see year-on-year declines over the next couple of quarters, while Samsung Electronics Co. and Xiaomi Corp. are predicted to see double-digit growth in handset sales. In Japan, Alphabet Inc.’s Google Pixel is eroding the iPhone’s dominance, as the Apple device’s market share has dropped to 46% in the June quarter, a 12-percentage-point decline from the same period last year.

That said, there are indications of renewed consumer interest in certain new iPhones. Wait times for the basic model are nearly twice as long as for its predecessor, while pre-order wait times for the premium iPhone 15 Pro Max set a record.

Apple is positioning itself as a premium smartphone, with a $100 price increase on the iPhone 15 Pro Max (up 9%) announced at Apple’s Sept. 12 product launch event.

Tracking

Use Bloomberg’s new ALTD function for intra-quarter insights on demand using consumer transaction and foot traffic data. Run SPLC, KPIC and MODL to analyze fundamentals.

For more information on this or other functionality on the Bloomberg Professional Service, click here to request a demo with a Bloomberg sales representative. Existing clients can press <HELP HELP> on their Bloomberg keyboard.