Bloomberg Professional Services

This article was written by Steve Hou, PhD, Quantitative Researcher at Bloomberg.

Analyst ratings are one of the most widely followed metrics for equity investors with ANR<GO> being one of most frequently visited functions on the Bloomberg Terminal. Analysts are closely followed because they usually possess deep knowledge about the industries they cover and regularly uncover new fundamental information about individual companies. The fact that analyst upgrade and downgrade recommendations instantaneously move stock prices reflects the weight that investors place on their knowledge and analyses.

Analyst recommendations are also often questioned. Specifically, analysts are commonly perceived as exhibiting a bullish bias. This is documented in the academic finance literature and in the linked whitepaper. It turns out analysts often are not wrong, but may be late. By the time analysts collectively come to love a stock, it may be too late to buy as most of the upside has already been priced in.

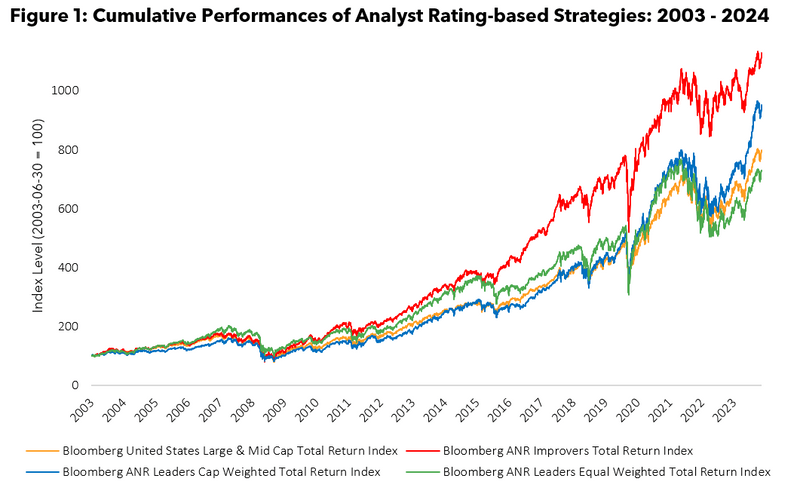

So how can investors extract useful information from analyst recommendations of stocks? An obvious thing to do is to invest in stocks with the highest analyst ratings. Indeed, a rich finance academic literature has shown that the most highly rated stocks tend to outperform the least highly rated stocks. Figure 1 shows that equity indices comprising 50 US stocks with the highest consensus analyst ratings, whether it’s equal-weighted or market-cap weighted, have at various times kept up or outperformed the broader US stock market index.

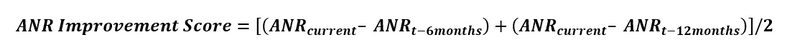

Can investors take a different approach than investing in stocks that are most beloved by analysts? Indeed. By defining an “improvement score” that follows (similar as a typical stock price momentum signal), a contrarian ANR improvers strategy intentionally avoids the buy-rated stocks and invests instead in those stocks, whose consensus ratings have seen the most increase recently. Figure 1 shows that such a strategy has earned significantly higher returns than both the broader market and the most highly rated stocks. Further, the excess returns are highly orthogonal to traditional sources of equity factor risk premiums.

Why have the ANR improvers performed strongly over the long run? While the linked whitepaper dives into greater details on the construction and factor characters of the above-mentioned indices, it is worth touching on the core intuition: ANR improvers represent a bet on the asymmetric opportunities in turnaround companies.

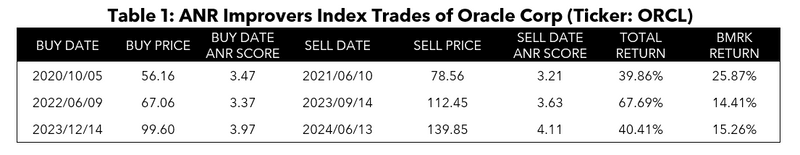

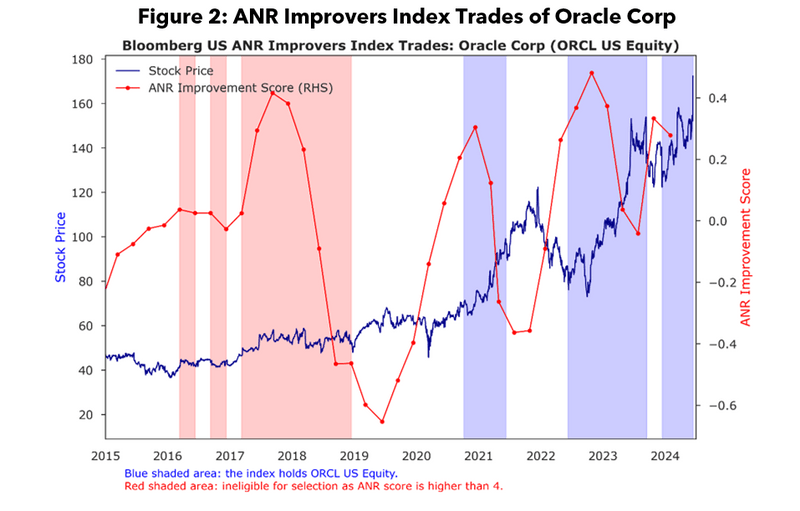

The intuition of the ANR improvement signal may be demonstrated by an example: how the ANR Improvers Index has traded the stock Oracle Corp (Ticker: ORCL). Since 2020, the BANR Index has held Oracle three separate times. The transactions are tabulated in Table 1. Fortuitously, all three transactions were profitable and in fact the returns exceeded the those of the benchmark index Bloomberg US Large & Mid-Cap Index.

As can be seen in Figure 2, all three times the BANR Index buys Oracle when the ANR improvement score rises (its consensus analyst rating increases over the past 6 to 12 months) and sells when the improvement score falls. In one of those instances (“2020-10-05 – 2021-06-10”), the stock price continues its previous uptrend. In the other two instances (“2022-06-09-2023-09-04” and “2023-12-14 – 2024-06-13”), Oracle’s stock prices staged reversals of their prior downtrends.

The Oracle trades show an example that the analyst rating momentum does not simply follow stock prices. Rather the improvement score anticipates a turnaround of the stock. This point is further demonstrated systematically in the white paper. Oracle is dropped as of the rebalance on Jun 14, 2024, as its consensus analyst rating has climbed above 4 or a “buy”, hence ineligible for ANR improvers.

The Oracle example also illustrates the nature of the ANR improvers signal that when it picks up a turnaround stock, it often captures “idiosyncratic” risks surrounding the company. In the case of Oracle, which had been going through a sectoral recession post the COVID Work-from-Home demand, the turnaround came at the heel of the generative AI revolution and a surge in demand for high performance computing servers for training foundational AI models.

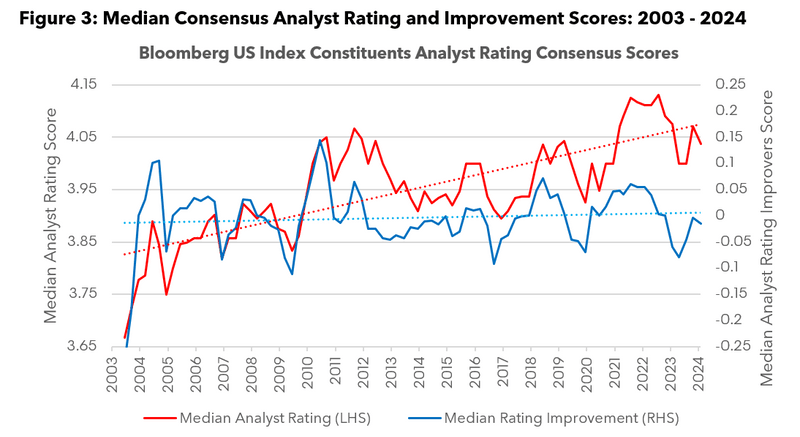

Back on the aggregate level, the analyst ratings of individual stocks have experienced significant inflation globally over the last twenty years. As Figure 3 shows, the median US large and mid-cap universe stock saw its consensus ANR score increase steadily from under 3.7 to almost 4 (half the stocks in the universe are “buys” or “strong buys”). In contrast, the ANR improvement score of the median stock fluctuates symmetrically around 0. The ANR improvement scores may be arguably unaffected by the ratings inflation.

Since 2023, the strong performance of the broader stock market has represented the momentum strength of the most beloved mega cap stocks while the rest of the index has generally languished. There is a wide discussion of a shrinkage of “market breadth”. This can also be seen through the soaring returns of the market cap weighted version of the ANR Leaders Index since 2023. Should such a trend either reverse itself or the returns broaden out, ANR improvers represent a strong candidate for providing strong orthogonal returns.

- Invesco Ltd has launched the Invesco Pricing Power ETF based on the BANR Index under the ticker UPGD.

This article provides a summary of key concepts from our latest whitepaper, “When Analysts Change Their Minds.”

BLOOMBERG, BLOOMBERG INDICES and Bloomberg Analyst Rating Improvers Index (the “Indices”) are trademarks or service marks of Bloomberg Finance L.P. Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited, the administrator of the Indices (collectively, “Bloomberg”) or Bloomberg’s licensors own all proprietary rights in the Indices. Bloomberg does not guarantee the timeliness, accuracy or completeness of any data or information relating to the Indices. Bloomberg makes no warranty, express or implied, as to the Indices or any data or values relating thereto or results to be obtained therefrom, and expressly disclaims all warranties of merchantability and fitness for a particular purpose with respect thereto. It is not possible to invest directly in an Index. Back-tested performance is not actual performance. Past performance is not an indication of future results. To the maximum extent allowed by law, Bloomberg, its licensors, and its and their respective employees, contractors, agents, suppliers and vendors shall have no liability or responsibility whatsoever for any injury or damages – whether direct, indirect, consequential, incidental, punitive or otherwise – arising in connection with the Indices or any data or values relating thereto – whether arising from their negligence or otherwise. This document constitutes the provision of factual information, rather than financial product advice. Nothing in the Indices shall constitute or be construed as an offering of financial instruments or as investment advice or investment recommendations (i.e., recommendations as to whether or not to “buy”, “sell”, “hold”, or to enter or not to enter into any other transaction involving any specific interest or interests) by Bloomberg or a recommendation as to an investment or other strategy by Bloomberg. Data and other information available via the Indices should not be considered as information sufficient upon which to base an investment decision. All information provided by the Indices is impersonal and not tailored to the needs of any person, entity or group of persons. Bloomberg does not express an opinion on the future or expected value of any security or other interest and do not explicitly or implicitly recommend or suggest an investment strategy of any kind. Customers should consider obtaining independent advice before making any financial decisions. © 2024 Bloomberg. All rights reserved. This document and its contents may not be forwarded or redistributed without the prior consent of Bloomberg.

The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products.