This article was written by Bradley Foster, Global Head of Content (Enterprise), and Scott Coulter, Global Default Risk Data Product Manager.

How do you manage credit and counterparty risk in this volatile and uncertain environment? That’s the question on every risk manager’s mind, as bankruptcies from COVID-19 and the subsequent economic shutdown continues to mount. Many risk departments are left questioning their existing risk practices and looking for new and innovative ways to keep up with the fast pace of the current market.

A recent analysis of Bloomberg’s Default Risk (DRSK) models during the period of market dislocation caused by the pandemic showed interesting results that may provide some insights on these questions and more.

The analysis found that during a 100-day period when S&P, Moody’s and Fitch downgraded over 60% of S&P 500 by two or more notches, Bloomberg’s DRSK model produced early warning signals for 90% of these downgrades, downgrading them by the same severity an average of 29 days earlier.

Rating & volatility

In mid-March, during the early stages of the pandemic, S&P stated that 1 in 10 companies in the US could face bankruptcy. Six months on, it seems the wave of bankruptcies is largely still ahead of us.

In a recent public statement, the SEC’s COVID-19 Market Monitoring Group highlighted concerns about the delays in ratings, stating “ratings downgrades are generally lagging indicators of cost of debt capital.” These lags have increasingly been a concern for risk management departments not just in the current environment but even if we go back to the previous credit crisis.

Ratings continue to be pervasive in risk departments across the globe, driven largely by prescriptive regulatory rules that rely on them. But as the SEC highlights, the current market is revealing the shortcomings of these metrics in exactly the type of scenarios that these rules are supposed help protect against.

Most large banks supplement external ratings with CDS data and their own internal probability of default models. But even these strategies struggled recently. At the height of the crisis, only a handful of companies actually provided earning warnings, a key input in most of these models. Similarly, single name CDS spreads, often used as proxies for counterparty risk management showed cracks of their own, due to the illiquidity of single name CDSs.

As a result and in the face of other challenges, risk managers continue to seek new credit approaches and datasets to add to their toolkit.

Right now, the key attribute of these new data sets is timeliness.

New approaches to credit risk management

Bloomberg has seen increased appetite for alternatives to traditional fundamentals-based ratings approaches. Without a doubt, the most common way to try to compensate for the lags highlighted by the SEC has been to take an approach that incorporates market-based inputs, betting that these inputs inherently price in estimates of credit and default risk. However, such approaches bring their own challenges.

In the recent market rally that followed the initial drop in equity prices, tech stocks continue to bolster the equity markets to new heights and bond prices seem to have come unhinged from fundamentals with the European Central Bank and the Federal Reserve buying up the market and compressing spreads. In this environment, skeptics of more market-derived approaches to estimating default risk had criticized these approaches for arguably misrepresenting the true risk in this period of seemingly inflated equity and bond prices.

A risk manager synthesizing the information in the recent headlines could feel ‘damned if you do, damned if you don’t’.

Bloomberg DRSK model: A hybrid approach for the current market

To review the performance of Bloomberg’s DRSK models in the current climate, Bloomberg used the S&P 500 as a proxy for the credit exposure of a cross section of banks. We collected all of the ratings downgrades by S&P, Moody’s and Fitch on S&P 500 issuers over a 100-day period from Feb 10th, 2020 to May 20th, 2020. We filtered these for only those issuers that were downgraded by at least two notches and identified that 61.4% of the issuer in the S&P 500 (307 issuers) were downgraded by at least two notches in this period.

We then collected DRSK data on the same set of issuers for a similar period. DRSK assigns a notch on a 21-notch scale to issuers based on the one-year probability of default, and we looked at how that data moved during the period before the downgrade occurred. Specifically, we looked to see if DRSK downgraded these issuers by at least two notches and when.

Subsequently, we compared the two-time series. In doing so, we were able to assess how often the DRSK data changed before the rating downgrade occurred, and how much earlier.

We found that during this 100-day period, for the 307 issuers downgraded by two or more notches, the DRSK output produced early warning signals for 90.0% of downgrades, on average 29 days earlier.

These results provide strong evidence of the predictive power of the DRSK model as an early warning indicator of the potential for increased risk and make the case for using DRSK data to complement alternative approaches.

Bloomberg’s Public Company DRSK model uses a hybrid approach, combining the use of both market and scrubbed fundamentals inputs. It aims to combine the timeliness of a market-derived model with the reliability and coverage of a fundamentals approach. As a result, DRSK is able to provide an alternative to both fundamentals and market-based approaches, through a methodology that incorporates both.

In many cases, DRSK data is used in combination with other Bloomberg default risk data sets such as our Market Implied Probability of Default, Credit Benchmark consensus data along with traditional ratings data sets provided by the Rating Agencies. This allows risk managers to paint a more comprehensive, holistic picture of the credit profile of issuers using multiple dimensions and measures of risk.

These models and data have seen increased usage as clients look for ways to supplement or benchmark their existing fundamentals approaches, market-based approaches, or both. Extensive global coverage and daily recalculation of 400,000+ issuers’ implied CDS spreads and default probabilities over a variety of tenors allow them to do this.

As risk managers prepare for the uncertain months and years to come, it is critical to examine all the tools needed for the current market to help in what might lay ahead.

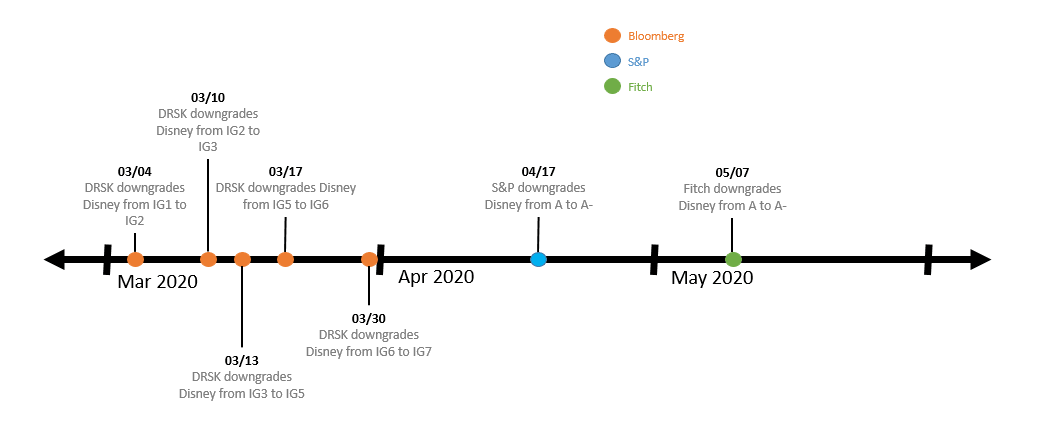

Downgrades of The Walt Disney Company

The timeline above shows the downgrades by both DRSK and the major rating agencies for The Walt Disney Company, an S&P 500 member, during the 100-day period analyzed.

Bloomberg’s DRSK models & Data in Data License and MARS

Bloomberg’s DRSK models use scrubbed fundamental data and cutting-edge quantitative models to provide transparent and timely quantitative estimates of an issuer’s default probabilities, default risk and 5-year CDS spread. Bloomberg Data License and MARS Credit Risk allows you to leverage the high-quality data provided by the Bloomberg Professional® service, but in your enterprise applications.

With Bloomberg Data License, every function and system across your firm can use exactly the same data, without discrepancies. Data requested via Data License can be shared with your organization’s majority-owned subsidiaries using internal applications. This allows decision makers in various parts of your organization (within the same business division) to have a single data source to make comparisons.

MARS Credit Risk leverages Bloomberg’s extensive risk analytics and rich data sets to provide obligor and obligation-level credit analytics, including application of parameter scenarios, presented through the terminal on MARS <GO> and through API. It integrates with the Multi Asset Risk System (MARS) suite of Risk Management products, to provide a robust risk management solution.