This analysis is by Bloomberg Intelligence Director for Market Structure Research Larry R Tabb and Senior Government Analyst Sarah Jane Mahmud. It appeared first on the Bloomberg Terminal.

Algorithmic wheels can improve long-term execution quality and, while takeup is on the rise, our European Equity Trading Study reveals usage lags behind the U.S. and many challenges remain. Algo wheels are software tools that automatically assign orders to a broker’s algo, based on the best fit to a preset list of conditions.

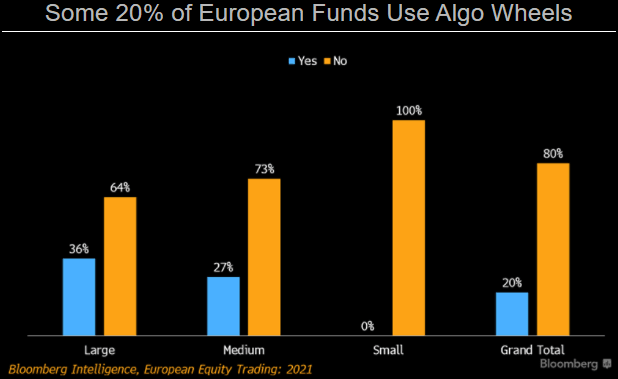

Algo wheels win favor among largest funds

Europe’s bigger buy-side firms make greater use of algo wheels than their smaller peers, our survey reveals. Yet usage lags behind that of their U.S. counterparts — 64% in our comparable U.S. survey use these tools to help allocate order flow. Algo-wheel usage may rise as Brexit further fragments the European marketplace and data issues make measuring performance more challenging. MiFID II best-execution regulation may push both parties toward wheels, removing human bias from broker and model selection.

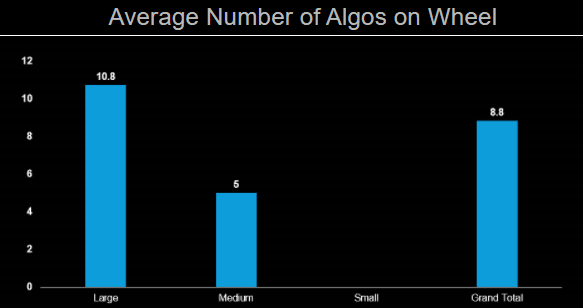

Firms spin almost nine providers on algo wheel

Europe’s buy-side firms use an average of 8.8. providers on their algo wheel to help allocate order flow, marginally more than their counterparts across the Atlantic where, according to our U.S. survey, they use 8.4. Europe’s midsize firms, in particular, use far fewer providers than their U.S. peers that reported citing an average of 10.7.

While it may appear sensible to to add more — especially to boost best-execution by removing human bias — the inherently fragmented nature of Europe’s financial markets means firms may not trade enough to use a wider range of algos; using too many brokers or trading models could conflict with the overall goal to concentrate commissions with fewer brokers in a bid to preserve relationships.

Algo wheels don’t come without challenges

A slew of smaller buyside firms we spoke to are more skeptical of algo wheels, chiefly due to the size of their fund and the infrequency of their trading. Yet, they’d be tempted should they grow. One of the biggest challenges is knowing when to use the wheel because flows must be concentrated in order to aggregate sufficient volume with each broker and model so as to generate meaningful statistics on stocks during different parts of the day amid variable liquidity conditions. Comparing the performance of two algorithms when one is trading less liquid names, for example, would be comparing apples with oranges.

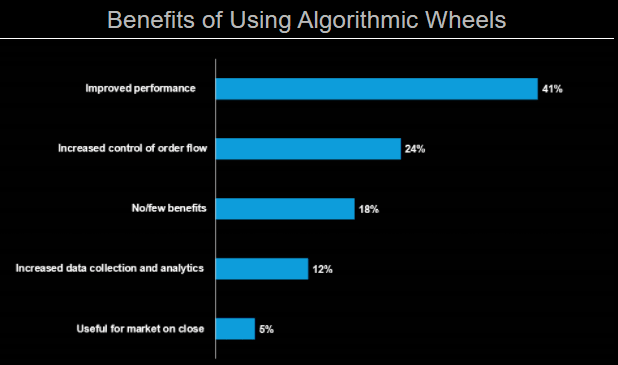

Some 18% of those we surveyed see no or few benefits in using an algo wheel. Some 15% also claim it’s harder to add an algo with a wheel in place.

- “We have no need for algo wheels. If we had more systematic flow, we may consider it.”

- Mid-Sized Swiss Asset Manager

- “Algo wheels are really trying to figure out who can do executions for them as cheaply as possible across the spectrum of countries.”

- “That’s fine but they’re also the people that tend to get really the worst execution. Algo wheels don’t impact us at all other than when we see one at work, it’s obvious to see what they’re doing.”

- Small U.K. Asset Manager

Traders use wheels to improve performance, control flow

While 18% of European funds in our study see little to no benefit to algorithmic wheels, the vast majority use these tools to improve execution performance and increase control of order flow. Wheels heighten performance by randomly allocating similar orders to different brokers’ algos and comparing the results. Without a wheel, humans are likely to be biased by marketing pitches or broker obligations.

Transitioning to a wheel takes the trader bias out of the allocation decision. By comparing brokers’ models, a trader can normalize algorithms and use data to spotlight and reward the better performers with more order flow.

Bloomberg L.P., the parent of Bloomberg Intelligence, also offers one or more of the products or services identified in this research. Any views in this note are those of the author and Bloomberg Intelligence and don’t necessarily reflect those of Bloomberg L.P.