ARTICLE

Life insurers leverage AI to aid labor efficiency, lower costs

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Insurance Industry Analyst Jeffrey Flynn. It appeared first on the Bloomberg Terminal.

Life insurers are working artificial-intelligence tools into their business models at a deliberate pace, particularly at larger peers, aiming to boost efficiency in service operations and leverage extensive data troves. This may mostly manifest in cost benefits from muted staffing growth, yet the technology also offers underwriting and sales use cases. Business lines with cumbersome medical records could be fertile ground.

Workforce productivity reflects technology

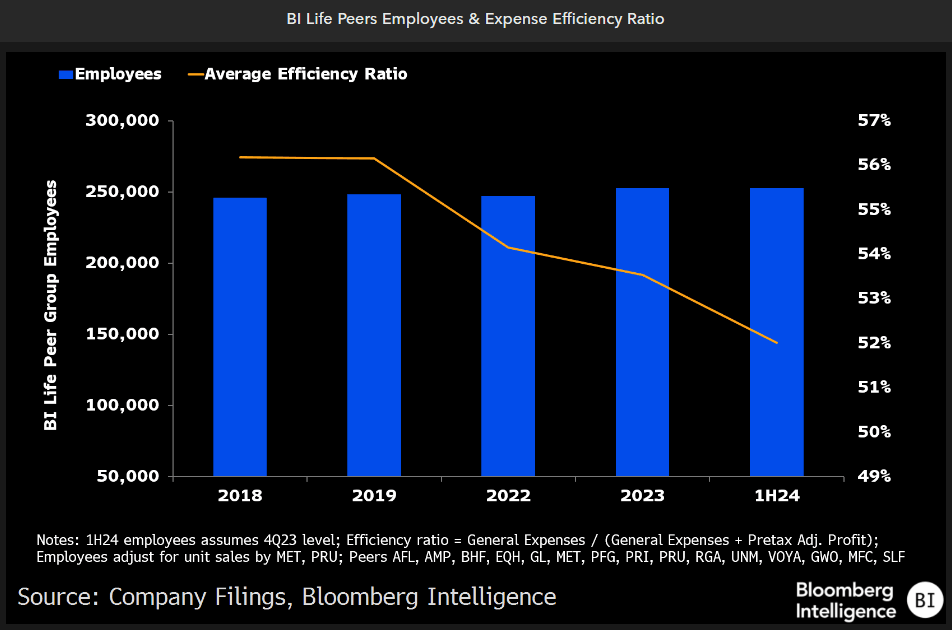

As AI spending ramps up, BI life insurance peers can support their recent track record of higher profit with little employee growth. Since 2018, combined staffing was up less than 1% a year. Technology and automation investments have played a key role, while companies like Great-West, Ameriprise, Manulife and Prudential point to AI and generative AI as a way to further lift efficiency — likely aided by lower back-office, claims and customer-service hiring. Great-West in May said it began natural language processing at its call centers, which should pare volume and operating costs.

The group’s expense efficiency may improve in 2025-27, but likely at a slower pace given several cost programs in recent years. We calculate earnings sensitivity to general expenses at about 150%, where a 1% reduction may add 1.5% to profit.

Tailwinds extend beyond expense control

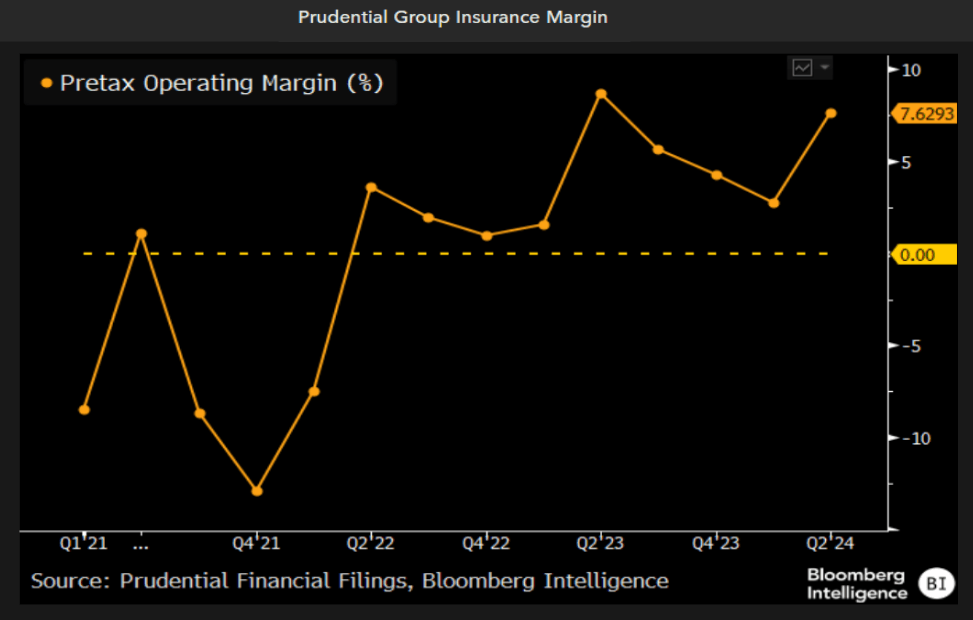

Life insurers’ loss ratios and sales trends will also be positively impacted by AI, we believe, though such benefits may be more targeted and company-specific vs. general productivity gains. In certain lines, like long-term care, disability and medical stop-loss, AI tools can help adjusters process complex health information, which should support claimants recovering or returning to work more quickly. For example, Prudential is partnering with EvolutionIQ, an AI-powered claims system, in its group business, where the insurer recently pared its loss-ratio target by two percentage points. Sun Life has highlighted gen AI’s ability to summarize this type of data at its PinnacleCare unit.

On the sales side, Ameriprise recently said AI helps to identify new business, while Voya cited a greater ability to quote complex coverages.

More capacity at larger peers to drive AI

Compared with the pre-pandemic pace, BI life peers have posted an average 400-bp improvement in their expense efficiency ratio. This reflects a more favorable economic backdrop, productivity-enhancing technology investments and a focus on cost control tied to the past decade’s low interest rates. Larger-capitalization peers, including MetLife, Ameriprise, Manulife and Prudential, have seen moderately more improvement over this period. This could remain the case, as these insurers have greater resources for researching, testing and deploying AI and other tech tools.

Sun Life has given over 2,000 of its employees access to gen-AI capabilities, while Great-West is investigating more than 50 AI use cases in the US. (The general expense efficiency ratio equals expenses divided by the sum of expenses and pretax profit.)