ARTICLE

Big tech 2025 capex may hit $200 billion as gen-AI demand booms

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Industry Analyst Anurag Rana and Bloomberg Intelligence Senior Associate Analyst Andrew Girard. It appeared first on the Bloomberg Terminal.

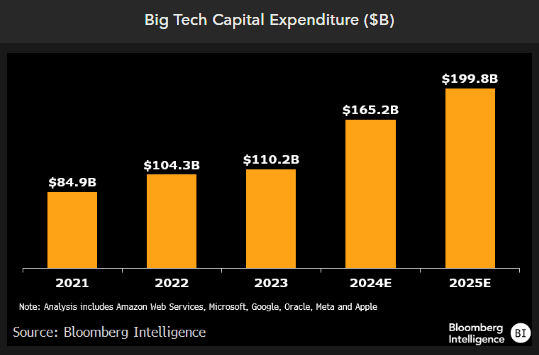

Microsoft, Amazon Web Services, Google and other big tech companies could collectively amp up capital spending to about $200 billion in 2025, representing a two-year gain that’s triple the 2020-23 average as generative-AI demand spurs outlays on data centers and new products, our analysis shows. It may take 2-3 years to see the financial benefit, which we anticipate will come in the form of higher cloud utilization, copilots and large language model licensing.

Incremental capex of $90 billion above 2023

Our analysis of the top tech companies shows over $90 billion in incremental capital spending in 2024-25 vs. 2023, dedicated mostly to expanding generative-AI infrastructure. This group, which includes Amazon Web Services, Microsoft, Google, Oracle, Meta and Apple, added an average of $14 billion annually to capex from 2020-23. The $90 billion increase over a two-year period illustrates the increased demand and interest by clients, and appears different than other hyped technologies, such as the metaverse.

Our calculations point to an additional $55 billion in 2024 and $35 billion the following year, totaling $200 billion spent in 2025 as these enterprises aggressively prioritize data-center expansion and creating copilots.

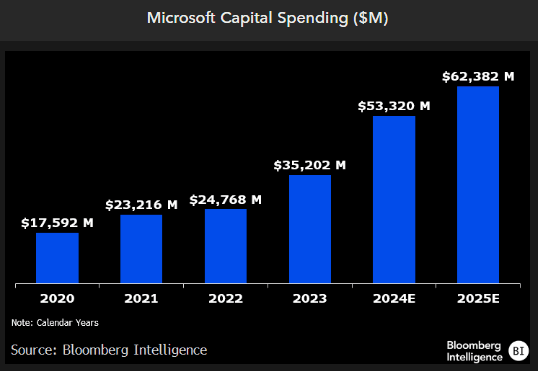

Microsoft leads pack, followed by Google

Microsoft is at the forefront of capital spending among big tech providers, followed closely by Google and AWS, which we believe will mostly go toward expanding their respective data-center footprints and buying more AI-related chips and hardware. We calculate Microsoft’s capital outlay could hit $53 billion in 2024 and $62 billion in 2025, mostly to meet greater demand for OpenAI workloads, both from consumers and companies. For reference, Microsoft had $17.6 billion in capital expenditures in 2020, and the 2025 amount would likely be more than 3.5x that amount, with majority of incremental spending tied to cloud services.

Majority of capex tied to GPUs, data centers

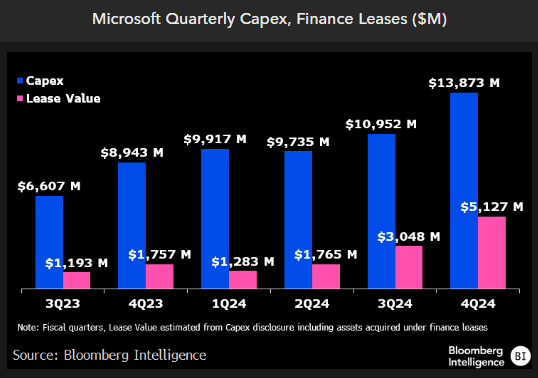

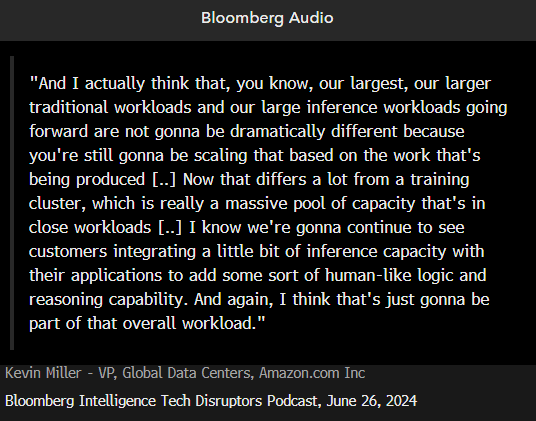

The bulk of this capital spending will likely go toward expanding AI infrastructure, which includes creation or retrofitting of data centers and buying GPUs. A new data center takes roughly 18-30 months to build, according to AWS Global Data Centers Vice President Kevin Miller, who discussed the topic on BI’s Tech Disruptors podcast. In addition to building these facilities, the top three cloud providers are also leasing computing capacity from small providers like Oracle.

Leases tied to capital expenditures over the past 12 months totaled $11 billion for Microsoft, roughly 20% of the total outlay of $56 billion. Our calculations lead to $13.6 billion of spending tied to leases in 2025, which can be viewed as easier to shut down if demand dries up.

Cloud sales likely to see biggest lift

For Microsoft, AWS, Google and Oracle, their respective cloud sales are likely to be the biggest and more direct beneficiaries of increased generative-AI spending, based on our analysis. Some large corporations may pursue buying AI-related servers, GPUs and other hardware for their on-premise IT infrastructure, but we anticipate most clients will embrace a cloud-based model, especially as these big tech companies already have a strong infrastructure in place for inferencing.

Though AI workloads are net new revenue for cloud providers, this revenue stream may cannibalize traditional workloads, given that IT budgets are tight.

Copilots, LLM licensing new revenue sources

In addition to consumption of cloud services, providers could also see increased revenue from copilots and licensing of their large language models. For example, both Anthropic and AWS generate revenue when a client uses the former’s LLM and the latter’s cloud infrastructure. Over time, we expect cloud providers to work closely with most LLM providers, and vice-versa.

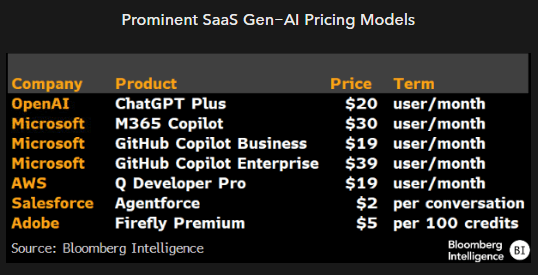

Software vendors are also likely to monetize gen AI by charging a subscription or consumption fee for access at the application layer, most commonly with a copilot. Examples here include Salesforce’s Agentforce or GitHub Copilot.