Bloomberg Professional Services

This article was written by Christian Lelong, Sustainable Finance Analytics Product Manager, and Nadia Humphreys, Head of Sustainable Finance Data Solutions at Bloomberg

As sustainable finance is facing some headwinds, the steady evolution of reporting under the European Union (EU) Taxonomy is both underappreciated and a reason for optimism. Data collected by Bloomberg, for just under 2,000 reporting companies, shows a significant increase in Taxonomy alignment, and reveals that large EU firms are also becoming more sustainable, as average alignment with the Taxonomy has increased year-on-year.

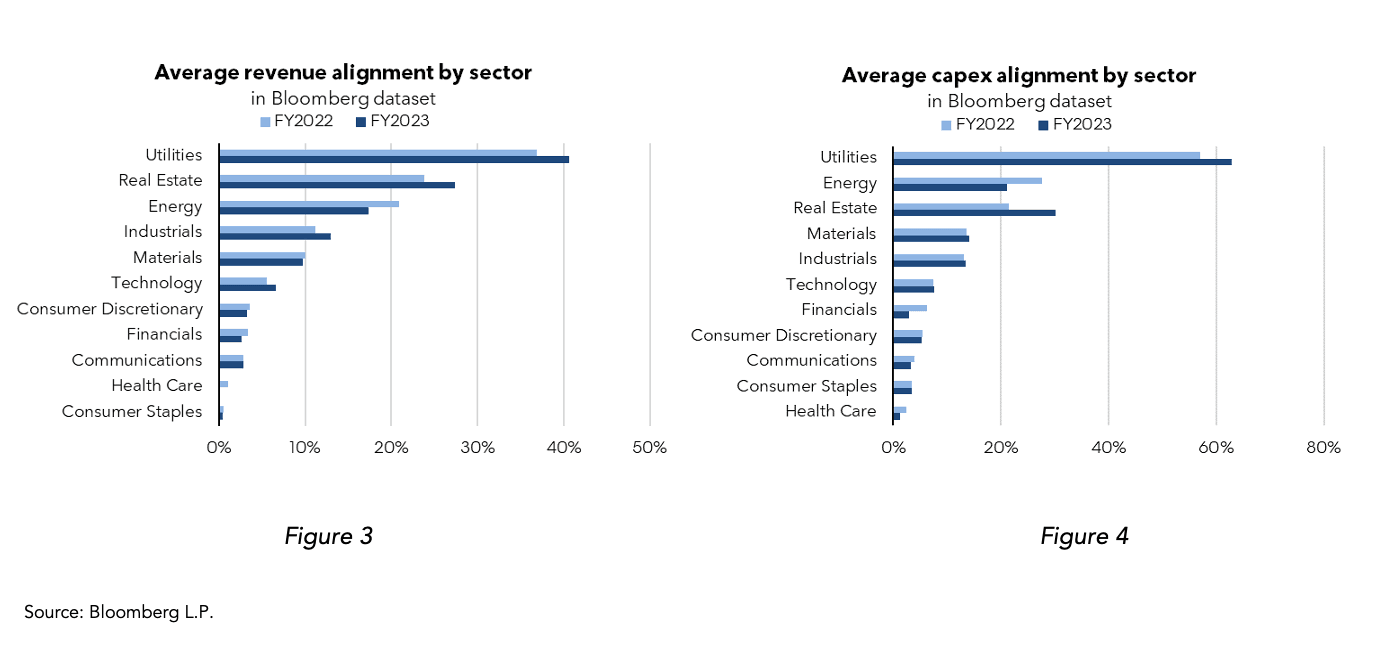

Note, the EU Taxonomy is a measure of environmental sustainability, and on that basis the year-on-year increase in average Taxonomy alignment across EU-based firms that reported on both FY2022 and FY2023 (from 9.3% to 10.4% for revenue, from 13.0% to 13.8% for capex) shows that those firms have become more sustainable.

These developments should alert investors to the value Taxonomy data can bring to sustainable investment decision-making in Europe. Bloomberg typically publishes Taxonomy data within 10 business days from the date of acquisition of the relevant company documents. For this article we’ve therefore been able to look at the full 2024 dataset for reporting year 2023.

EU Taxonomy alignment on the rise

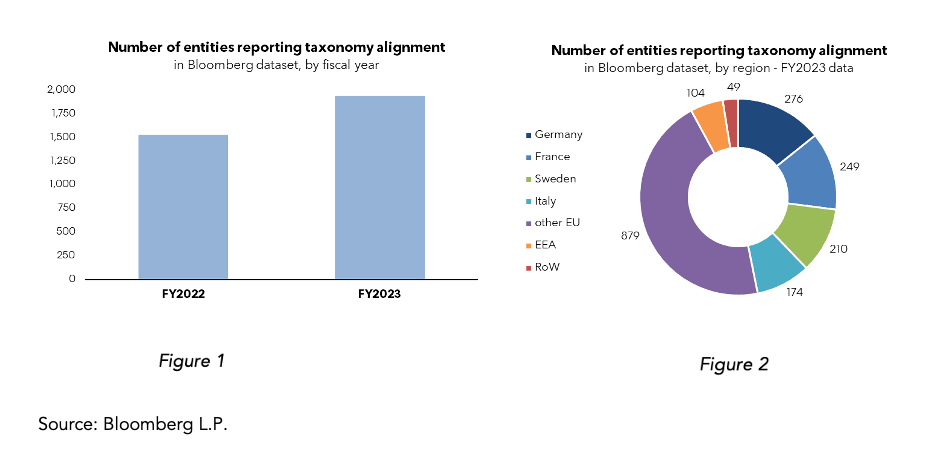

Bloomberg data shows that the number of companies reporting Taxonomy alignment increased by 27% between FY2022 and FY2023 (Figure 1). This increase was driven largely by EU financial firms that were required to report entity-level alignment for the first time. That said, the expansion of the Taxonomy dataset was broad-based from a geographical perspective, including from companies domiciled outside the EU (Figure 2).

The size of the company universe matters because EU Taxonomy disclosures make it possible to create diversified portfolios and identify sustainability leaders. The threshold for companies with reporting requirements falls to 250 employees in 2026 (for reporting year 2025), so the Taxonomy universe -and its value to market participants- is set for further growth.

Another key insight from our data is that large EU firms are becoming more sustainable. As Taxonomy requires the reporting of both revenue and capital expenditure that is aligned to the EU’s green goals, it provides clarity on the green credentials of both the current performance and future investments of the company. The data shows that average revenue and capex alignment increased year-on-year in most sectors (Figures 3 and 4). The evolution of capital expenditure is particularly significant, since it suggests that the trend is accelerating as those investments bear fruit. This green shift is most evident in the Utilities sector, with an average capex alignment over 60%.

The value of the EU Taxonomy will increase as more companies are set to report (under the growing scope of CSRD) and early stage usability problems are resolved. The low year-on-year variance of company alignment is indicative of the quality of reported data and enhances the value to portfolio managers of the EU Taxonomy as an investment screening tool.

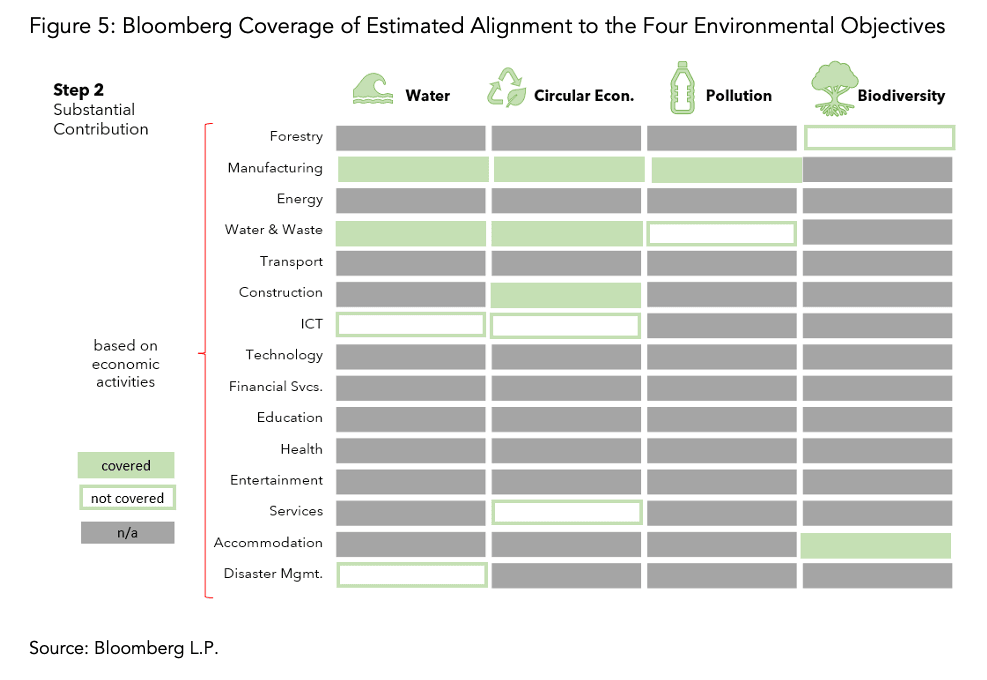

Bloomberg’s Taxonomy dataset was expanded in January 2025 to include both reported and estimated alignment for the four remaining environmental objectives (water, circular economy, pollution, and biodiversity). The Bloomberg methodology for estimation relies exclusively on company-reported data to implement the technical screening criteria of the regulation, and the list of activities covered reflects the availability of company disclosures for a given objective. Of note, we consider some activities difficult to implement unless companies provide more transparency in their sustainability reporting.

Companies tend to disclose more information on carbon emissions than on deforestation or water pollution, and this is reflected in low estimates for environmental objectives relative to those for climate objectives. The new models estimate Substantial Contribution using six input fields on average per model. The average disclosure of these input fields is 58%, and a single missing value can result in a failed test. As a result, market participants will see very conservative estimates from Bloomberg for a subset of activities eligible to the new objectives (note, over 3,400 companies are tested for estimated alignment to the 4 environmental objectives) until the standard of sustainability reporting improves in key jurisdictions around the world.

What’s next for taxonomies globally?

The development of taxonomies in other countries and regions also signals the growing value of this type of data. Looking just outside the European Union, three non-EU countries have adopted the EU Taxonomy because they are members of the European Economy Area (EEA). A further 20 jurisdictions have published Taxonomy frameworks (some, such as Mexico, Brazil and Canada, have been inspired by the EU Taxonomy), a figure that doubles if we consider countries that are presently developing a Taxonomy. Mandatory taxonomies are the minority, with the recently –announced Brazilian Taxonomy, which will become mandatory for certain entities in 2026, being the only Taxonomy to require disclosures after the EU’s.

The International Platform on Sustainable Finance (IPSF), has focused its work on promoting interoperability between jurisdictional approaches to Taxonomy development, through initiatives such as the Multijurisdictional-Common Ground Taxonomy. Importantly, the IPSF can also play a critical role in facilitating dialogue between policymakers around equivalence and recognition frameworks for global taxonomies, to help streamline obligations for global market players having to comply with multiple regimes.

Interested in Bloomberg’s ESG data offering? See our solutions page here.