Weakening climate voting invites activist, regulator action

This analysis is by Bloomberg Intelligence ESG Analyst Andrius Tilvikas and Bloomberg Intelligence Director of ESG Research EMEA & APAC Adeline Diab. It appeared first on the Bloomberg Terminal.

The voluntary nature of management say-on-climate, with proposals down 31% after the 2023 AGM season, and the weakening corporate climate agenda are inviting both activist groups and regulators to intervene. France setting a mandatory say-on-climate vote and Australia’s new carbon-credit legislation that forced Rio Tinto to write off $1.2 billion are recent examples of the potential investment implications for companies globally.

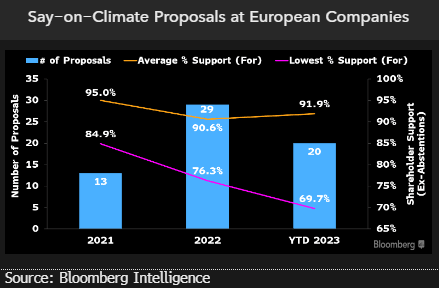

Management say-on-climate proposals plunge 31%

The number of management say-on-climate proposals in Europe dropped by 31% to 20 this year, according to our analysis, with investor scrutiny waning. No proposals were rejected, and the approval rate is rising again after a dip in 2022. Glencore is a notable exception — support has declined by more than 25% compared with 2021, to 69.7%.

The voluntary nature of say-on-climate proposals in Europe creates risk that investors may not be able to express their views on the matter consistently. BP didn’t hold a vote on its amended climate transition strategy at the 2023 AGM, leaving investors in search for other ways to express their discontent — support for the board chair dropped to 90.2% from 96.1% in 2022.

Shareholder proposals on climate tripled in Europe

Shareholder proposals on climate have tripled this year after a drop in 2022 amid concerns about climate strategies and transition progress. Activist group “Follow This” focused the on oil and gas sector in particular and filed climate resolutions at Shell, BP and TotalEnergies requesting to set medium-term Scope 3 emission reduction targets. The advisory vote at Total received a significant 30.4% investor backing, while binding votes at Shell and BP had 19.3% and 16.3% support, respectively.

Separately, a coalition of Glencore investors including LGIM and HSBC AM and collectively representing $2.2 trillion of AUM co-filed a shareholder resolution requesting disclosure on how company’s thermal coal production and expenditure aligns with the Paris Agreement goals. The proposal received 28.8% investor support.

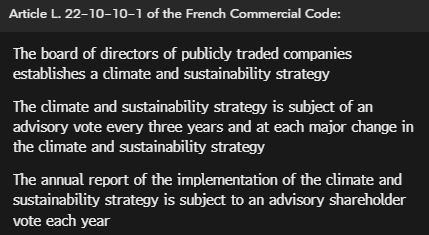

France adopts mandatory rules for say-on-climate vote

Given the flaws of the voluntary vote on climate, France adopted a law requiring all publicly listed companies to present their climate strategies and changes to them for a shareholder vote. This gives investors a right to an advisory vote on the company’s climate strategy every three years and an annual ballot on its implementation. The law mirrors a European practice of triannual shareholder vote on executive remuneration policy and an annual vote on remuneration reports.

This amendment would prevent companies from making adjustments to their climate strategies without providing investors with an opportunity to have a say on it, as was the case with BP earlier this year. Only nine French companies had a management say-on-climate proposal in 2023.

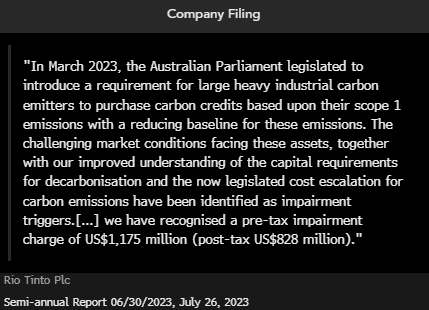

Carbon legislation may expedite stranded assets

Australia passed a key emission-reduction legislation to meet its national commitments, which could have broad implications for companies globally and raise risks of stranded assets. This already led to Rio Tinto’s $1.2 billion pretax impairment charge (15% of 1H pretax profit). The company also acknowledged it’s unlikely to achieve its 2025 targets of 15% reduction in Scope 1 and 2 emissions and would need to buy carbon offsets.

These challenges could exacerbate further as the pace for reductions needed is increasing. Rio set a midterm target of a 50% reduction in Scope 1 and 2 emissions by 2030. As the first deadline of 2025 climate goals is approaching, we expect more companies failing to meet short-term goals and amending their climate strategies.