This analysis is by Bloomberg Intelligence ETF Analyst Athanasios Psarofagis & ESG Strategist Shaheen Contractor. It appeared first on the Bloomberg Terminal.

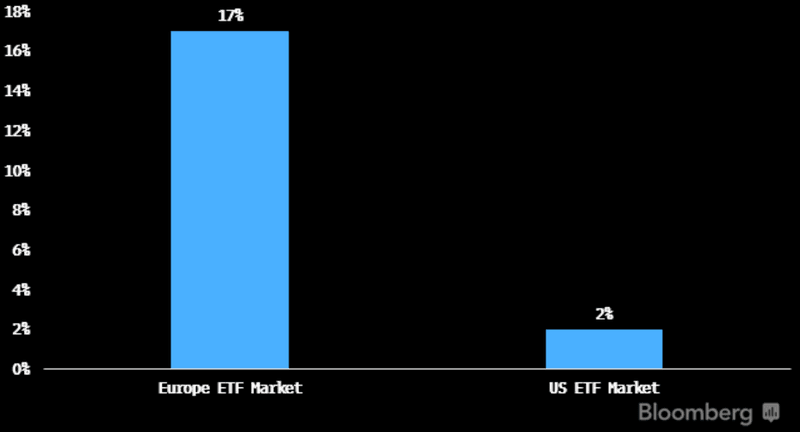

The SEC’s proposed ESG disclosure mandates could lead to a regulatory framework that looks like Europe’s, requiring more details about investing strategies and helping to boost the sector’s share of US ETF assets from 2%. Some issuers, likely anticipating the new rules, have already launched US-listed ETFs that would rank highly under the potential taxonomy.

Taxonomy for US ESG echoes Europe’s SFDR

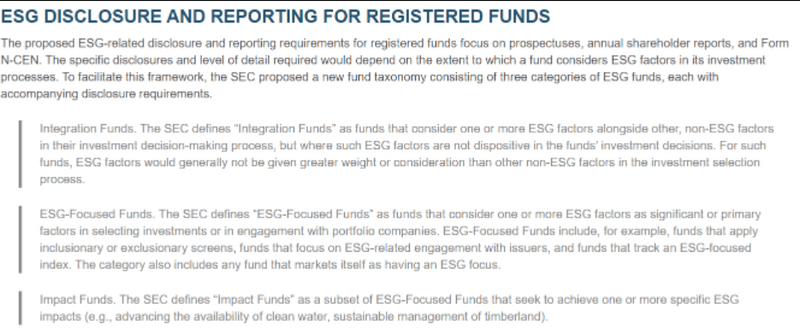

Europe has led the way in defining ESG investing and could provide a regulatory road map for the US. The SEC’s new proposal to improve disclosures by investment funds that purport to take Environmental, Social and Governance (ESG) factors into consideration could look like the EU’s existing Sustainable Finance Disclosure Regulation (SFDR). Under SFDR, funds are grouped into three categories based on their ESG integration levels — Article 6, 8 or 9. The SEC proposal also has a three-label taxonomy.

Proposed US ESG fund disclosures

Forced feeding of ESG ETFs could increase

US-listed ESG ETFs could get an asset boost under proposed SEC guidelines, both from new flows and the rebranding of existing funds as ESG strategies. A much larger share of ETF assets are in ESG products in Europe (17%) vs. the US (2%), driven partly by mandated disclosures that provide more details about funds’ investing strategies. Monthly flows into Europe’s ESG ETFs are averaging 30-40% of the regional total.

European ETFs have 14% of assets in Article 8 funds and 3% in higher-rated Article 9 products.

% Of industry assets in ESG ETFs

Rebrands and Paris-Aligned ETFs likely on the way

In Europe, the highest-ranked ESG ETFs — Article 9 funds — are aligned with the climate goals of the Paris Agreement. More than 150 such ETFs in the region hold $52 billion in assets. Some US issuers have followed suit with recent launches, likely anticipating similar disclosure rules from the SEC. As in Europe, we also expect some issuers to rebrand existing ETFs as more ESG friendly by switching indexes or adding ESG screens to current benchmarks.

US issuers follow Europe with Paris-Aligned ETFs

ETF market in U.S. may look more like Europe’s with new rules

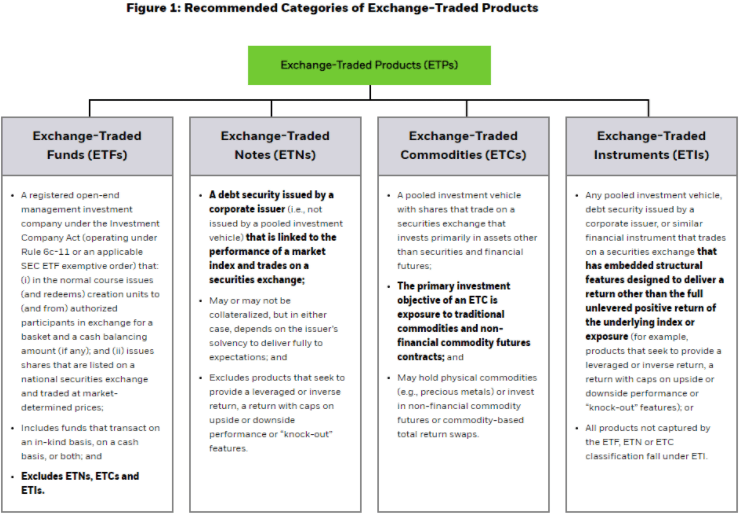

Regulations proposed by the industry could align the U.S. ETF market more with Europe’s, which already has many such rules in place. Key areas include product nomenclature, cryptocurrency funds, benchmark regulation, ESG disclosures and market-maker payments.

Nomenclature proposal mimics Europe’s breakdown

Industry participants in the U.S. have proposed a framework for cleaner identification of funds, adding differentiations between structures such as exchange-traded notes (ETNs) and exchange-traded commodities (ETCs). If adopted by the SEC, the classification system will mirror the one that already exists in Europe, which has adopted exchange-traded products, or ETPs, as the blanket industry term for ETFs, ETCs and ETNs.

Proposed ETP Classification System (iShares)

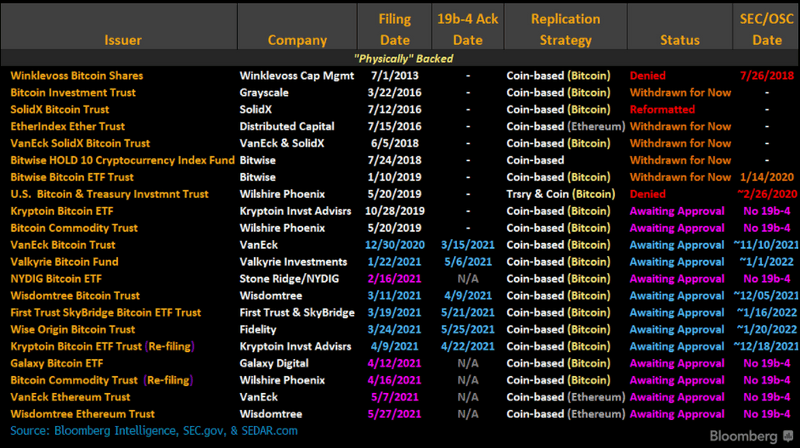

Europe shows Bitcoin ETPs can operate efficiently

The SEC has yet to approve a cryptocurrency ETF, with 13 active filings in registration. Europe already has more than 30 exchange-traded products on the market, but they aren’t UCITs-compliant, so aren’t technically ETFs. Though that makes access for individual investors more difficult, the products still demonstrate that crypto funds can operate and trade efficiently. In the U.S., an ETF would likely find an immediate retail audience, which may be giving the SEC pause.

Crypto funds aren’t universally welcomed by European regulators. The U.K.’s FCA, for example, has banned the sale of crypto-linked ETPs to retail investors.

Pending crypto ETF filings (U.S.)