This analysis is by Bloomberg Intelligence Senior Industry Analyst Will Hares and Bloomberg Intelligence Senior Industry Analyst Salih Yilmaz. It appeared first on the Bloomberg Terminal.

ADIPEC 2022: Energy security must come before sustainability

The challenge of threading the needle between energy security and sustainability was underscored during the 2022 Abu Dhabi International Petroleum Exhibition & Conference (ADIPEC), where global energy security featured prominently, and was deemed to have been sacrificed for sustainability by many industry leaders. The widespread consensus is that the sector faces gross underinvestment, given oil and gas will remain dominant sources of global energy for decades, requiring decarbonization to coexist with development. A sense of vindication was noticeable amid what’s seen by some as a reckless and premature energy transition, pushed too far and too fast by policymakers and public sentiment. Hydrogen’s profile continues to rise, as a favored long-term decarbonization lever for majors and national oil companies.

Industry leaders raise energy-security risks at ADIPEC 2022

Improving global energy security was the primary theme of the 2022 Abu Dhabi International Petroleum Exhibition Conference (ADIPEC), with industry leaders emphasizing that a premature energy transition and ESG pressures have contributed to upstream underinvestment. Climate-policy risk and emissions reduction featured more in the background than in prior years.

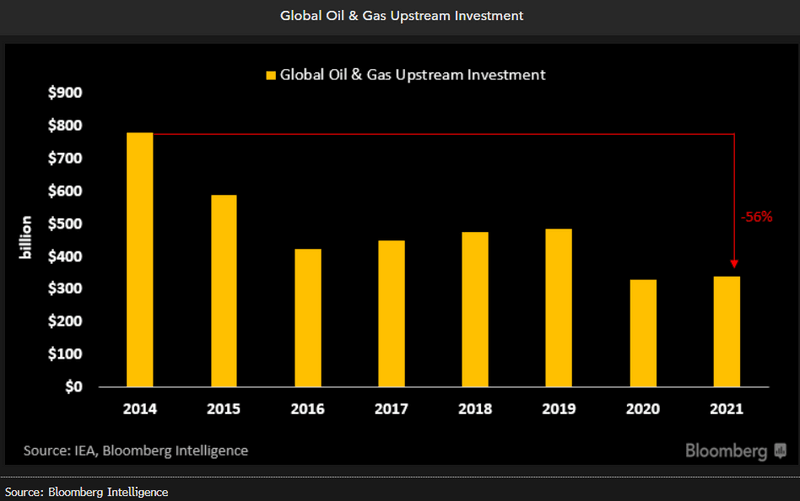

Chronic, gross underinvestment in global supply

The clearest message emerging from industry leaders at ADIPEC was that chronic, gross underinvestment in energy supply, encouraged by pressure from government, activists, investors and banks, has been a key driver of the energy crisis the world faces and represents the biggest risk to global energy security. Still, western energy majors’ annual investment plans remain roughly 15% below pre-pandemic levels, and the companies look steadfast in maintaining capital discipline in efforts to maximize free cash flow, which is being deployed into debt reduction, buyback programs and dividend recovery. Project delays and demand uncertainty are aggravating factors, contributing to constrained investment and oil-supply growth.

Middle East national oil companies are the industry exception and have begun to increase investment.

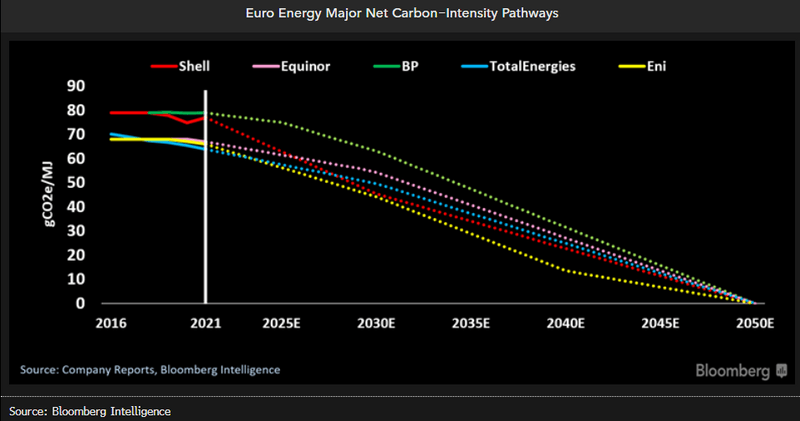

Amid crisis, climate objectives de-emphasized

Emissions-reduction objectives and climate-policy risk featured more in the background at ADIPEC than in previous years, underscoring that sustainability has been de-prioritized amid the more immediate issue of the global energy crisis. Though industry leaders flagged emissions reduction as a moral imperative, consensus is that energy security can’t be compromised as a result. European energy majors have announced net-zero emissions targets by 2050, but trajectories differ, with marginal progress made in the past five years. The world isn’t on a path that’s compatible with Paris Agreement goals, aimed at keeping global average temperatures from exceeding 2 degrees C above pre-industrial levels by 2050.

The world is roughly 1.2 degrees above pre-industrial average temperatures.

Sustainability sentiment pendulum swings

The global energy crisis has driven a reassessment of the application of ESG criteria to the oil and gas industry, amid an increasing acknowledgment of the pivotal role that global energy majors must play in an orderly energy transition. With all European majors aiming for net zero (Scope 1-3) emissions, and with the EU’s taxonomy to include gas as sustainable investments, we expect a continued gradual adjustment of ESG fund policies to include high-performing oil and gas companies.

This contrasts sharply with prior ADIPEC conferences, where we noted that pressure was rising on oil management teams to articulate and implement sustainable business strategies and provide enhanced depth, quality and industry specificity in ESG disclosures.

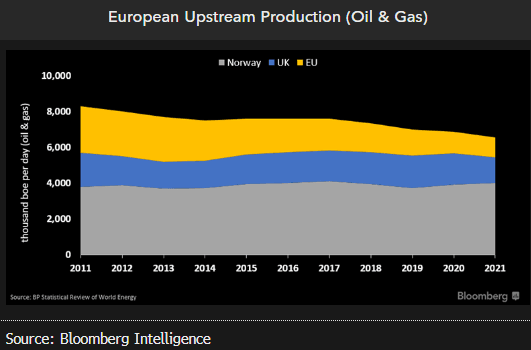

European energy development a missed opportunity

Europe’s failure to meaningfully invest in domestic oil and gas supply was a recurrent theme at ADIPEC. The region’s reliance on foreign supply has increased in the past decade, as indigenous production has fallen around 15%. The UK’s oil and gas production is likely now in terminal decline, while natural gas volume from the Netherlands’ largest field, Groningen, has been restricted due to induced seismic activity. Norway, Europe’s No. 1 energy supplier, has played a critical role in energy security and is on track to set a record for annual gas deliveries, at 118 billion cubic meters this year.

The UK’s windfall tax of 25% on domestic oil and gas production may increase to 30% and is almost certain to disincentivize investment, according to operators, citing instability in fiscal policies.