The niche, not-so-niche sustainable debt market

This article was written by Bradley Foster, Maia Godemer, and Enrique Neves Martin at Bloomberg.

In the first half of 2021, the issuance of sustainable debt reached $825 billion, which represents an 8% increase over the $759 billion issued through all of 2020. In June 2021, the sustainable debt market hit another milestone, reaching $3 trillion of issuance since its inception in 2007, when the European Investment Bank issued their first “Climate Awareness Bond.”

What is sustainable debt?

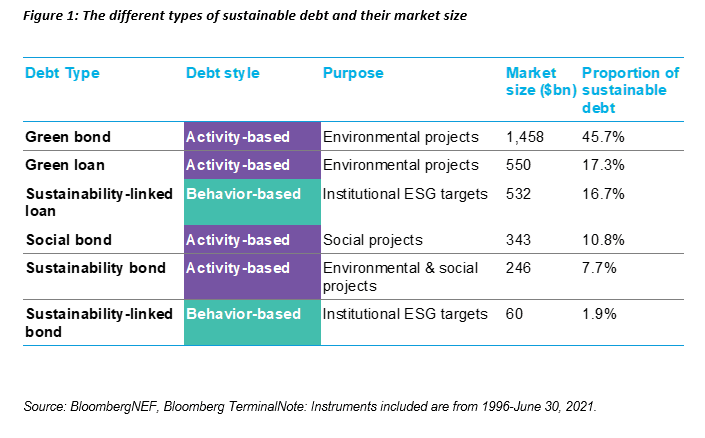

Sustainable debt has traditionally been defined as fixed income instruments raised with environmental and social purposes in mind. However, since its inception, the sustainable debt market has kept on growing and innovating with new type of securities being created. At present, Bloomberg records two main types of sustainable debt: activity-based and behavioral-based debt instruments.

- Activity-based products gather any instrument finance projects and/or activities that have a social or environmental benefit, and sometimes both. Social projects could be investments in social activities such as affordable housing or employment generation, while environmental projects can be investments to install additional renewable energy capacity, for instance. They are social, green, and sustainability bonds and loans. They can be used to finance new projects or refinance existing ones.

- Behavior-based products tie a financial characteristic of the debt instrument, like its coupon or the loan interest rate, to a sustainability target. They gather both sustainability-linked bonds and loans. Contrary to activity-based debt, the activities performed with the raised money are not what earns behavior-based debt types their “sustainability” label. The sustainability target can be an environmental objective like greenhouse gas emissions reduction or a social objective, like a decrease in the number of worker accidents.

What are transition bonds?

In recent times, the market has seen the creation of transition bonds. These debt instruments were initially created to allow heavy-emitting issuers, which had a difficult time coming to market with green bonds, to raise an alternative form of sustainable debt. They do not bring any pricing benefits to issuers, but instead simply allow them to signal to their investors that they are allocating some funds to their low-carbon transition, in turn taking advantage of the sustainable investment trend. Transition bonds can also be issued to finance projects that are allowing issuers to go from a heavy-emitting activity to an alternative that has a lower impact, but cannot yet be considered as green. We saw some instance of transition bonds being issued to finance gas-powered assets in countries currently reliant on coal. This is a typical example of projects that have a decarbonization potential, but could not be considered as “green” due to the polluting nature of natural gas.

The existence of transition bonds is still very much debated in the market, further fuelled by the fact they lack a clear definition. In December 2020, the International Capital Market Association (ICMA) released a Climate Transition Finance Handbook that provides guidance to issuers about how to communicate their transition strategy when issuing sustainable debt. This is not a transition bond framework, but it does offer broader recommendations on how to convey a credible transition strategy to investors.

The need for regulations

The market is still lacking a legislative framework that would define the conditions issuers must follow to issue sustainable debt. Until now, organizations were following voluntary guidelines issued by industry associations like the Green and Social Bond Principles from ICMA or the Green Loan Principles from the Loan Market Association. Those methodologies have helped to standardize and bring more transparency to the sustainable debt market. However, they still leave room for interpretation in their implementation, as eligible green and social projects and activities remain quite broad.

The European Union issued the first draft of its green bond standard at the beginning of July 2021. The EU intends for it to be a voluntary “gold standard” for green bonds and it will be open for EU and non-EU issuers to use. However, if issuers decide to call their bond a “European green bond” or “EUGBS” then they will have to abide by the European standard. The EUGBS mostly relies on the existing pillars of the green bond principles from the International Capital Market Association, adding the fact that the bond’s proceeds must be invested in economic activities that are aligned with the EU Taxonomy. The U.K. recently appointed its own technical expert group to work on its Taxonomy and develop a similar standard.

The care being taken to issue effective regulations and avoid greenwashing is just one piece of a larger effort to not only quantify sustainable investment, but ensure that the rapid growth and interest in this area is managed and harnessed to its full potential.

Learn more about BloombergNEF’s strategic research solutions.