Sustainable bond issuers score, perform better in most sectors

This analysis is by Bloomberg Intelligence Senior ESG Analyst Christopher Ratti. It appeared first on the Bloomberg Terminal.

The Bloomberg ESG score for companies that issued sustainable bonds was higher on average than non-issuers, based on our analysis of the Bloomberg US Corporate Bond Index. The total return of sustainable-debt issuers year-to-date was also better for most sectors than conventional bonds — a trend we anticipate to continue. Further analysis of the individual pillars resulted in better environmental and social pillar scores.

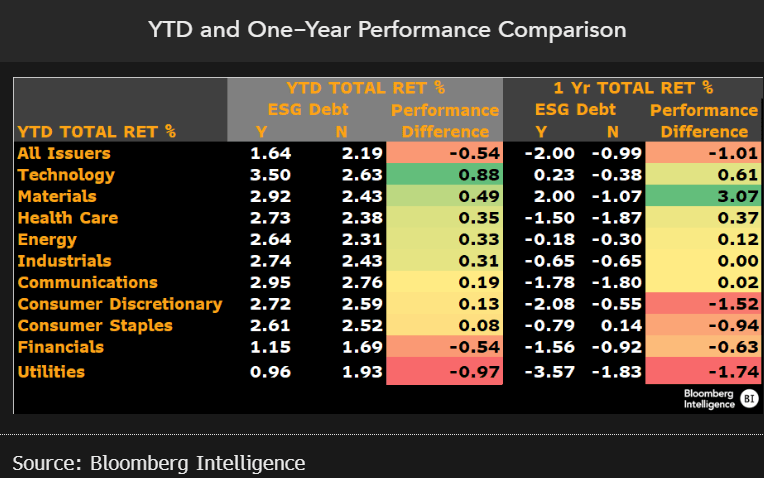

Sustainable bonds performed better in eight sectors

We look for continued strong performance of sustainable debt as robust demand — especially for new issuers — and stickier money should support the market. The technology and materials sectors led sustainable debt, as eight of 10 sectors that issue such bonds saw stronger average performance than conventional bonds. Year to date, the performance of all sustainable bonds trailed non-sustainable debt issuers, mostly due to weaker performance of utilities and financials, which have more sustainable issuance than other sectors and underperformed. Over the past 12 months, we find six of 10 sectors with higher or equal performance for issuers of sustainable bonds. The materials sector fared best and utilities worst.

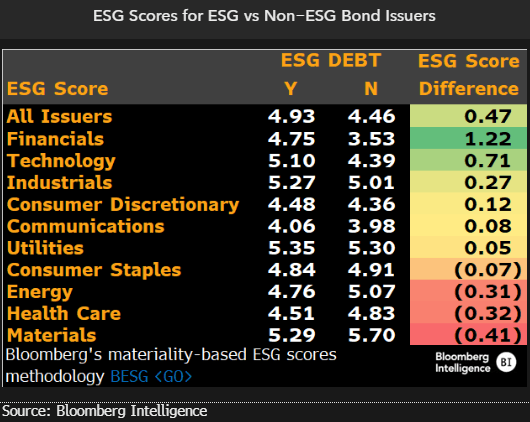

Financials, tech bond issuers show better ESG scores

ESG scores for sustainable bond issuers were higher on average than for companies that didn’t sell that type of debt. The average ESG score was nearly 0.5 of a point higher for issuers of sustainable bonds at 4.93 vs. 4.46 for conventional issuers, based on analysis of the Bloomberg US Corporate Bond Index. We also found six of 10 sectors reflecting this relationship, with financials more than 1 point higher and technology at 0.7 point higher. Of the four sectors that didn’t have higher scores for sustainable bond issuers, materials was the lowest, with an ESG score 0.4 point lower than conventional issuers.

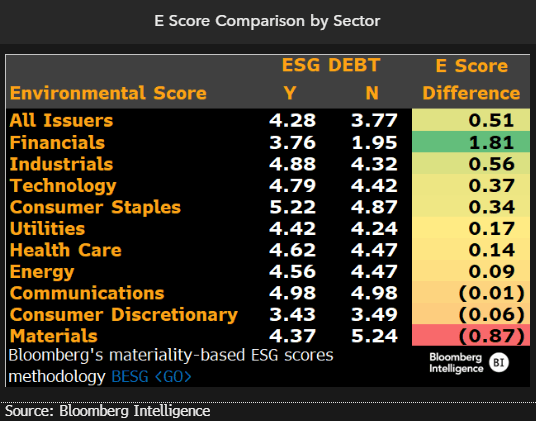

Stronger E scores for ESG bond issuers

Financials and industrials top the list of sectors with better environmental pillar scores for sustainable-bond issuers. Seven of 10 sectors show higher average E scores for issuers of sustainable bonds than for non-issuers. Sustainable-bond companies in the financial sector have an average E score almost 2 points higher than conventional issuers. The materials sector shows the weakest comparative average E score of sustainable-bond issuers to non-issuers, at 0.87 point lower.

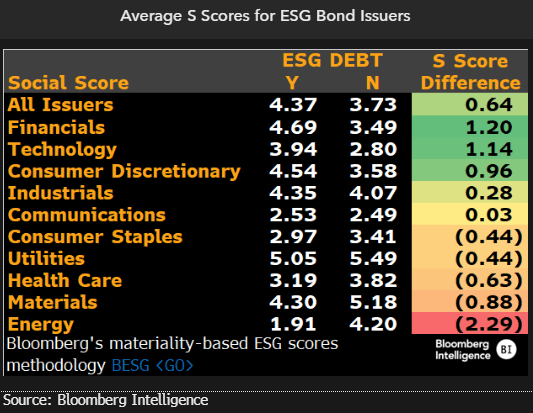

Sustainable bond issuers have higher average S score

The average social-pillar score for sustainable debt issuers is 0.64 point higher than for conventional issuers from the Bloomberg US Corporate Bond Index. As we break down further by sectors, there’s an even split, with five sectors that have higher S scores and five sectors with lower S scores for ESG bond issuers. The sustainable-bond issuers from the financial sector are a strong performer, with a social score 1.2 points better than non-issuers.

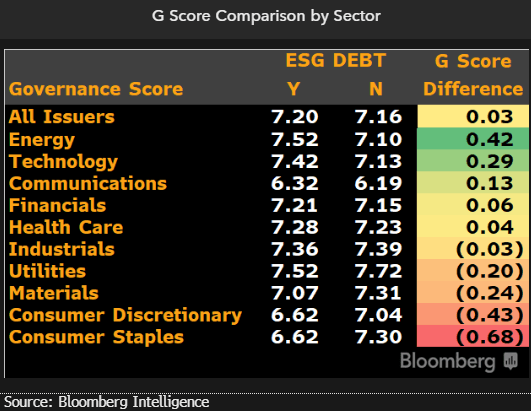

G scores stronger for ESG bond issuers in five sectors

Stronger governance-pillar scores were reflected by issuers of sustainable bonds across five sectors, though the range was tighter for governance than the other pillars. For all issuers, the G scores were almost the same, with an average of 7.2 for sustainable bond issuers and 7.16 for conventional issuers. Energy, technology and communications represented the top three sectors in which sustainable-bond issuers had higher G scores than non-sustainable bond issuers. Consumer staples had the largest difference in average G score, with conventional issuers showing the higher score, on average.