Oil and gas business model transition scores methodology

This analysis is from BloombergNEF. It appeared first on the Bloomberg Terminal.

Companies in heavy-emitting industries face substantial risk from a world that transitions toward a low-carbon economy in alignment with the Paris Agreement, in order to mitigate the worst effects of climate change. This is ‘transition risk’, and oil and gas companies in particular have their work cut out for them, as such a world is likely to consume far less fossil fuel. The BNEF business model transition scores described here assess 39 major oil and gas companies on their business model preparedness for a low carbon world and make up half of the Bloomberg climate transition scores.

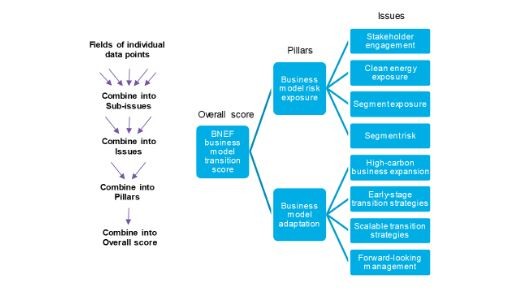

- These scores were calculated for 39 companies and based on approximately 40 individual metrics across two pillars, assessing the current business model risk and future direction. These include topics such as whether or not the company has undertaken efforts to develop alternative, clean revenue streams like electric vehicle charging, how at risk the current upstream business is, if the company is actively expanding fossil operations and whether or not the company is based in a region with a government-set, net-zero goal.

- The scores are industry-specific, data-driven and transparent, relative to peers, and forward-looking. This allows companies to contrast their transition preparedness using industry-relevant comparable data, and investors to assess and understand companies’ risks based on both their current activities and their plans.

- Some 23 of the target companies are integrated oil and gas groups, with the remaining 16 evenly split between exploration and production, and refining and marketing organizations. The scores are dynamic, in that they weight specific metrics more or less heavily, based on the particular company’s upstream or downstream emphasis. This document is a user guide and detailed methodology; results analysis will be published separately.

BloombergNEF (BNEF), Bloomberg’s primary research service, covers clean energy, advanced transport, digital industry, innovative materials and commodities. BNEF helps corporate strategy, finance and policy professionals navigate change and generate opportunities. Explore more content on the BNEF blog.