Nuance is critical in balancing the E the S and the G in ESG

This analysis is by Bloomberg Intelligence ESG Analyst Gail Glazerman. It appeared first on the Bloomberg Terminal.

Corporate exposure to environmental, social and governance factors can differ greatly and equal weighting could skew ESG analysis, a shortcoming addressed in Bloomberg’s new proprietary headline ESG score. Oil & Gas faces much more financial risk associated with the environment, while social factors are a bigger driver for tobacco; accounting for this enhances our analysis.

Not all E, S and G exposure is equal

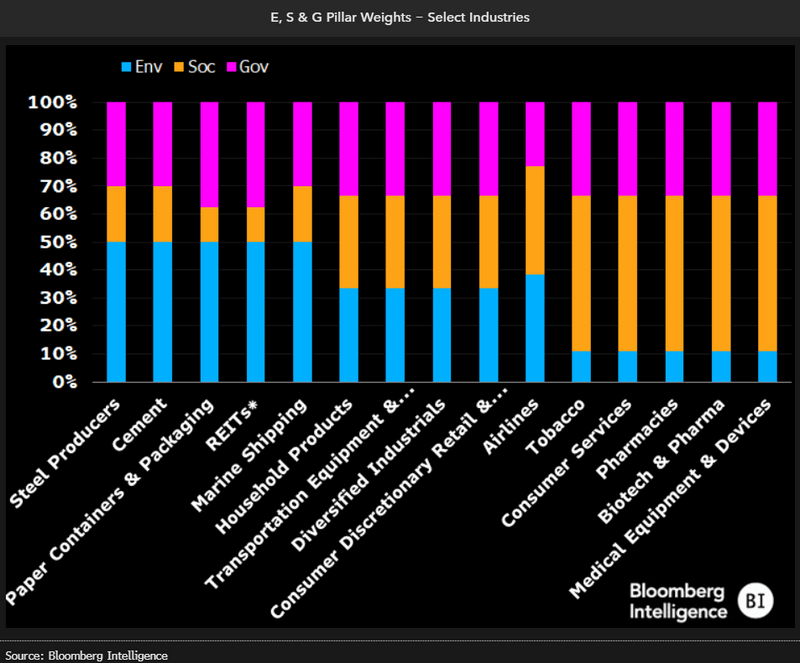

Industries aren’t equally exposed to environmental, social and governance issues and failing to address variations could prove misleading. An NYU meta study found “business strategy focused on material ESG issues is synonymous with … improved returns,” stressing the importance of focusing on the right issues. Our ESG score assesses each industry’s relative financial exposure to environmental, social and governance factors and applies these weights to E, S and G pillar scores.

Bloomberg’s E&S scores reflect performance on industry-specific issues. Governance is treated as sector-agnostic and was assigned the same point value for all industries. E and S points were assigned based on an assessment of the timing, magnitude and probability of financial impact. Each pillar’s points were divided by the total to derive weights.

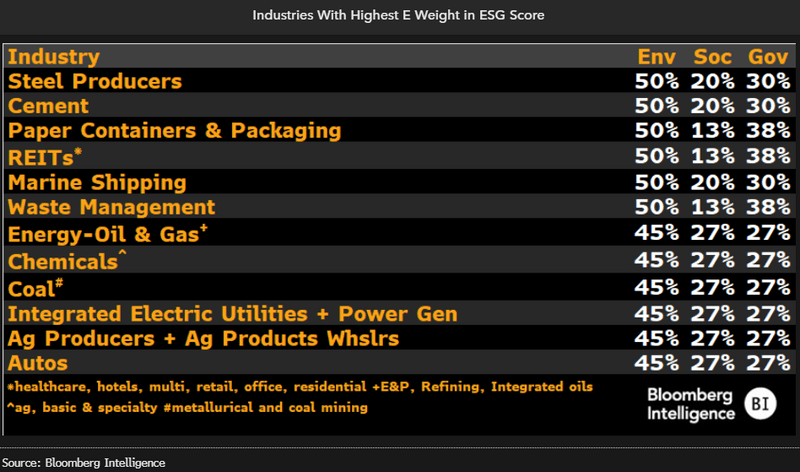

Environmental dominates materials, real estate, energy

Industries most exposed to environmental factors include steel, cement, paper packaging, real estate and energy, with environment accounting for 45-50% of the combined ESG score. Steel produces more CO2 than other heavy industries and is particularly exposed to energy and emissions management, eclipsing risks associated with social factors such as occupational health and safety and social supply chain. Decarbonizing steel will require billions of dollars in investment. In 2020, ArcelorMittal estimated deploying smart carbon and direct reduction of iron ore would cost over €45 billion. With customers increasingly focused on emissions in their supply chain, failing to do so could weigh on revenue. Oil & gas companies face a significant transition risk as alternatives become competitive, in part supported by government policy.

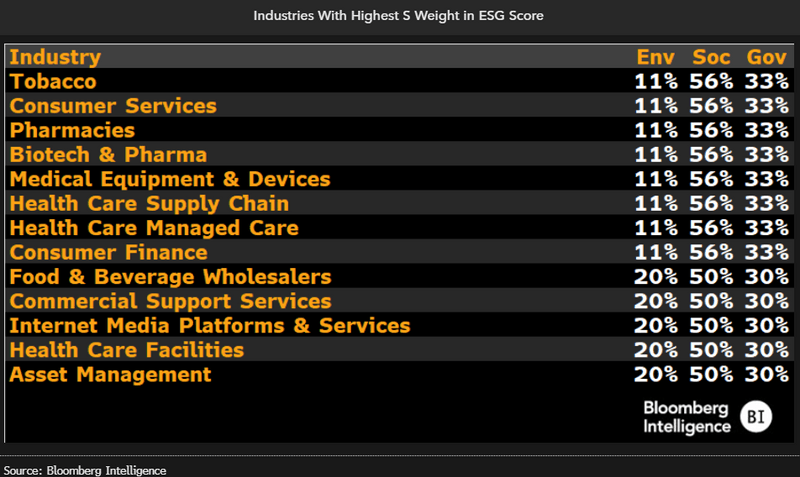

Social drives tobacco, health care, finance, internet

Among the 88 industry peer groups in Bloomberg’s ESG scoring universe, tobacco, select retail, health care, finance and Internet media industries are the most exposed to social factors, accounting for 50-56% of the combined ESG score. Though growing and processing of tobacco impacts the environment, in Bloomberg’s assessment of financial impact, this pales in comparison to the risks associated with customer welfare and related risk of government regulation.

Reflecting these factors, smoking has dropped to a more than 55-year low in the US and the industry continues to see new regulation of flavored tobacco and vaping products globally.

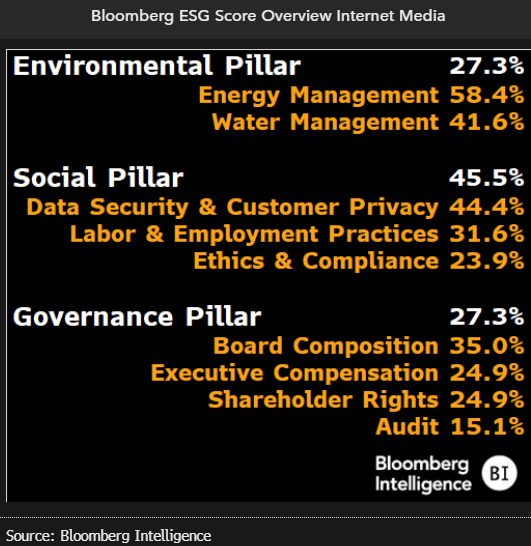

Privacy primary for internet media

Social factors are deemed most material for the internet media industry, representing 45% of the combined ESG score vs. 27% for environmental factors. The industry’s data centers are heavily dependent on energy and water for cooling. These resources are threatened as temperatures rise and droughts persist. But in our assessment, this is eclipsed by social factors, particularly the need to protect data privacy.

Developments involving Meta and TikTok demonstrate the importance of data privacy. The EU assessed a record €1.2 billion fine on Meta for privacy violations. In 2022, Meta estimated Apple’s introduction of privacy features could cost it $10 billion in revenue that year. Montana has banned downloads of TikTok and the US government has considered a broader ban, citing concerns about user data being misused.