New guidance aims to clarify investment alignment with EU net zero goals

This article was written by Nadia Humphreys, Head of Climate Finance and Regulatory solutions at Bloomberg.

In the European Commission’s June package of regulatory proposals and guidance, a useful document was published on facilitating finance for the transition to a sustainable economy. These recommendations are designed to help Europe realise its ambition to be the first climate-neutral continent with a sustainable economy.

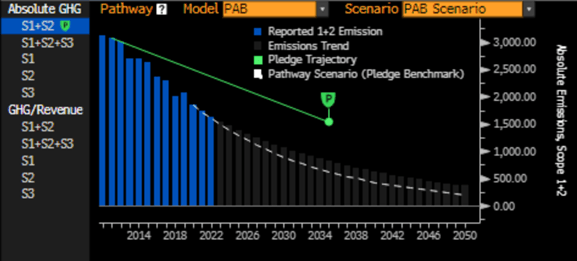

In order to achieve its goals, the Commission set out an ambition to reduce greenhouse gas emissions by 55% by 2030. It sized the investment needed to achieve those goals at around EUR 700bn more each year from 2021 to 2030 (relative to 2011 to 2020 investment). A flagship product in Europe’s armoury was legislation creating labels for Climate Transition (CTB) and Paris Aligned Benchmarks (PABs) in 2019. PABs require a 50% reduction in greenhouse gas emissions compared to the parent index in year one, and then a 7% year-on-year reduction of emissions.

Since their inception, funds tracking CTB/PABs have raised assets exceeding EUR 116bn according to the European Commission. However, according to Bloomberg’s funds data, a further EUR 275bn sits in European domiciled funds with ‘climate’ or ‘carbon’ in their description but not flagged as tracking/ CTB/PABs. Whilst these products have attracted impressive inflows since their launch, the total amount still falls short of the EUR 700bn target needed.

Concern has also emerged that ‘climate’ or ‘carbon’ related financial products may have differing ambition levels and that not all of them may be aligned with Europe’s net zero goals. In the recent ESA consultation on SFDR, regulators proposed that all funds pursuing a decarbonization strategy should be assessed against the 7% year-on-year carbon emission reduction pathway required for PABs. If this idea becomes reality, then companies whose carbon targets are within the 7% pathway will become attractive investment opportunities – as funds with decarbonization objectives will seek to hold qualifying securities.

For investors wanting greater clarity on whether a company’s carbon targets are within the PAB pathway, Bloomberg provides a new tool: ESG NETZ<GO>. The tool allows investors to visualize company-level pathways to a 7% year-on-year reduction, starting in 2020.

According to Dr Theodor Cojoianu, Member of the EU Platform on Sustainable Finance & Associate Professor in Sustainable Finance at the University of Edinburgh: “The Paris-Aligned Benchmarks allow for scientifically benchmarking the GHG-alignment to net-zero over time not only of portfolios, but also of individual companies. Delighted to see this tool which highlights that both the pathway to and the net-zero destination itself are important to take into account from an investment perspective”.

Find out more about PABs in this blog, and find out more about our sustainable finance solutions here. Bloomberg’s funds data is available on FRSC <GO> on the Terminal.