Bloomberg Professional Services

This article was written by Murat Bozdemir, ESG Data Solutions Product Manager, Nadia Humphreys, Head of Sustainable Finance Data Solutions, and Frances Shi, Data Science Product Specialist at Bloomberg.

The latest ESMA guidelines for using sustainability-related terms in fund names could force a significant amount of rebranding in the market. The new guidelines are designed to protect retail investors and apply to any product marketed to them as having sustainable terms.

The scope of products impacted are not isolated to SFDR article 8 and 9 funds. In essence the ask is for funds with sustainability-related terms in their names to meet a baseline set of data-related exclusion rules.

New ESMA guidelines: What will change?

Under the new guidelines, funds with environmental, sustainability, impact, transition, social and governance related terms in their name should have a minimum of 80% of investments with environmental or social characteristics or sustainable investment objectives. They must also apply certain exclusions defined by the EU regulation for the Paris-aligned benchmarks (PAB).

These exclusions are less restrictive for funds using terms like ‘transition’, ‘social’ or ‘governance’ in their names, where exclusions related to tobacco, controversial weapons and UNGC & OECD violation of principles apply. On the contrary, funds using terms like ‘impact’, ‘sustainable’ and ‘environmental’ in their names have additional fossil fuel related exclusions.

A Bloomberg analysis of the impact of this new guidance on a sample of 2,770 European funds shows that a large number of funds will either have to change name or divest from certain holdings.

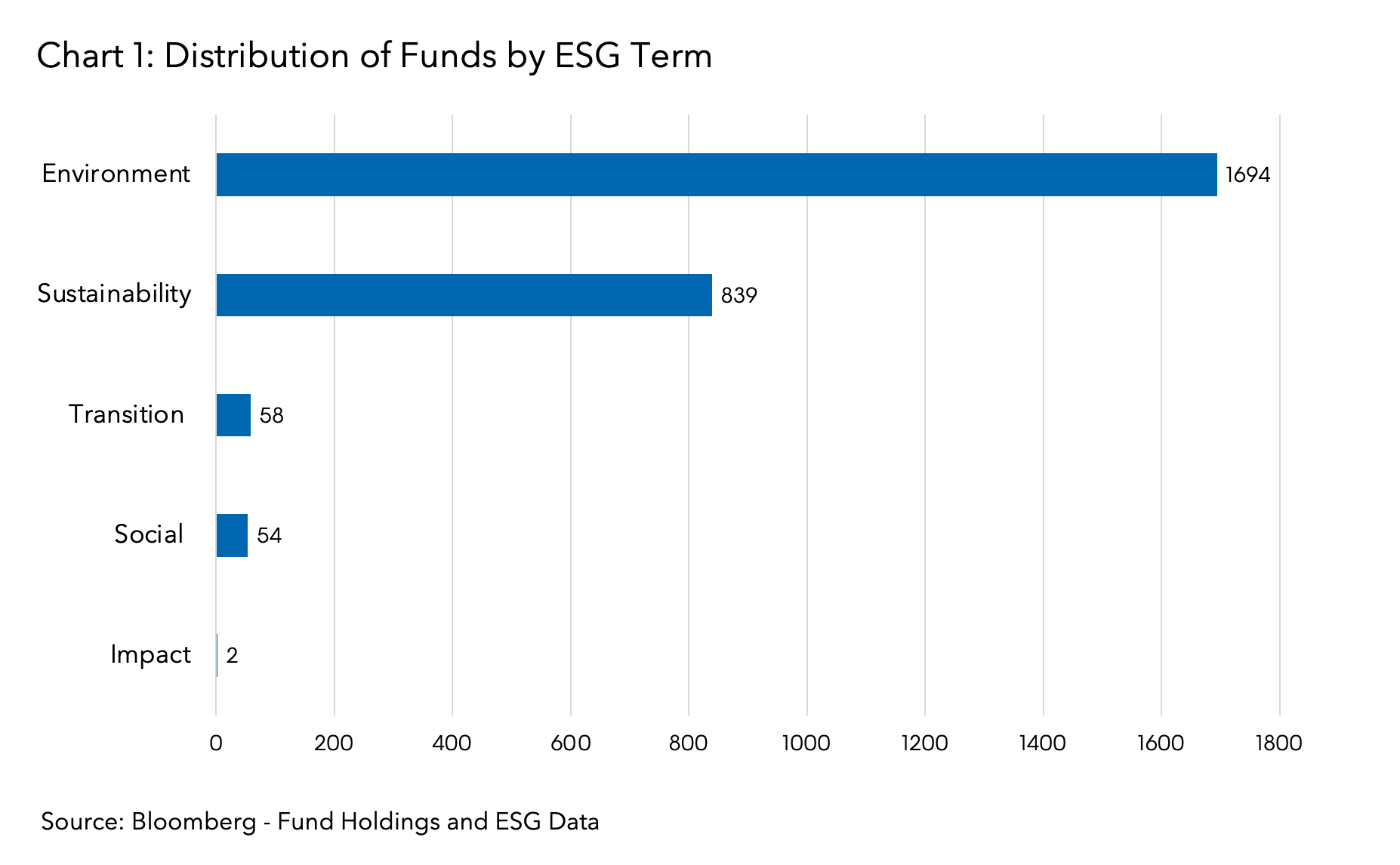

Products selected included UCITS and AIF funds with equity and fixed income holdings and ESG-related terms in their name. The chart below (Chart 1) displays the distribution of funds sampled by the names used to describe them. Note, Bloomberg is using ESG Book UNGC violations and underlying transparency data.

Out of the funds with ‘sustainability’, ‘environment’ and ‘impact’ related terms, 1,620 funds (58%) are exposed to at least one company that could violate exclusion rules related to fossil fuel activities. Including the other exclusions such as the UNGC & OECD Guidelines violation, increases the number to 2,290 funds (82.7%). This potentially means that impacted funds would need to remove ‘sustainability’, ‘environment’ and ‘impact’ related terms from the fund’s description or divest from companies who do not meet the exclusion rules.

Impact on SFDR funds

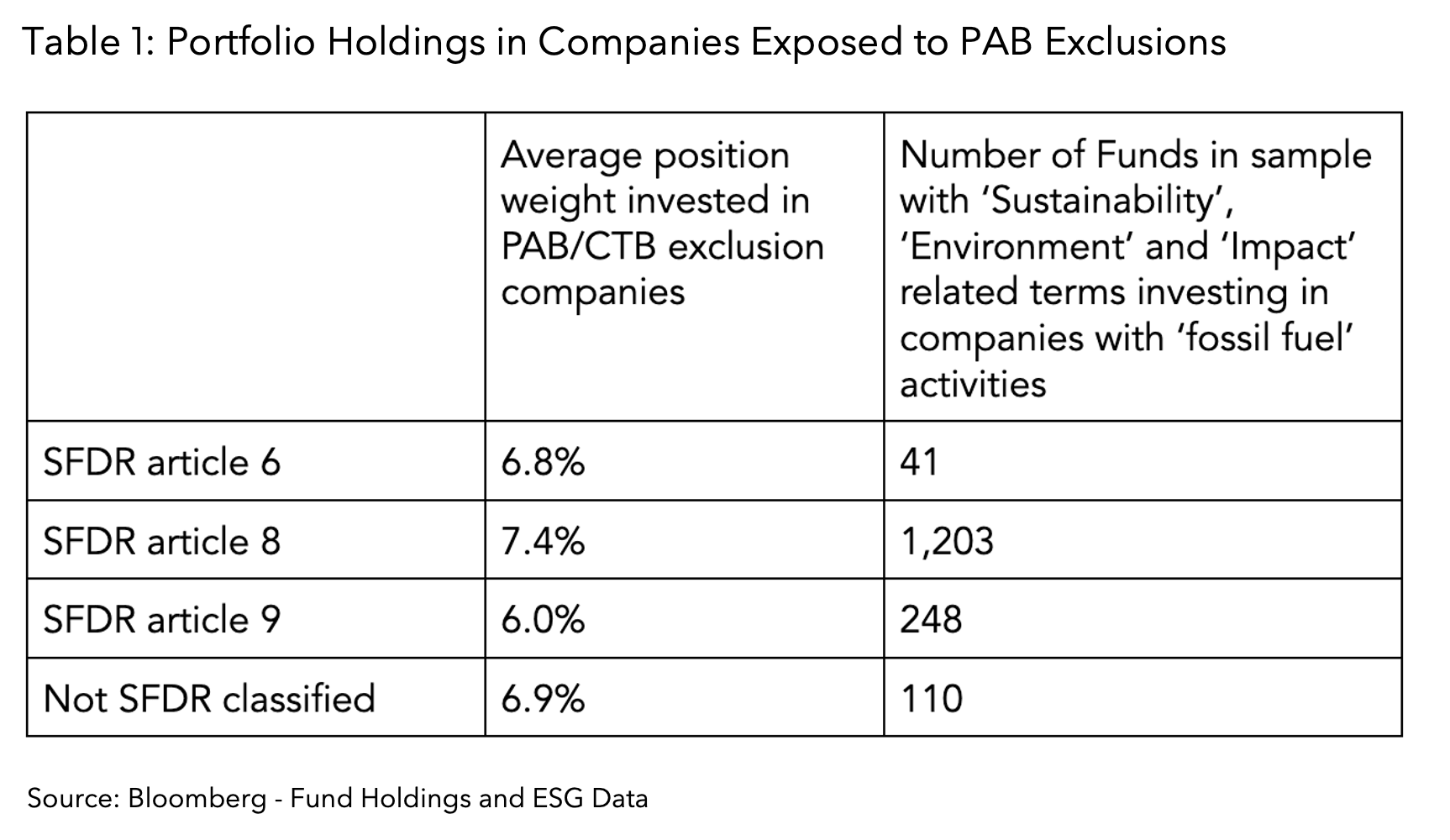

For SFDR funds, results summarized in the table below show that almost 75% (1,203 of 1,602) of the funds classified as SFDR article 8 (promoting environmental or social characteristics) are invested in companies potentially exposed to the fossil fuel exclusion criteria, compared to only 15% (248 /1,602) for SFDR article 9 products.

According to the latest research by Bloomberg Intelligence, article 8 ‘light green’ funds account for $8.0 trillion assets under management in Q2 2024. They also account for the largest proportion carrying names like ‘sustainability’, ‘environment’ or ‘impact’ in the analysis presented here.

One concern is that if these products need to remove environmental terms from their name, while still carrying article 8 or 9 disclosure obligations, the market is likely to revert back to SFDR articles as the equivalent of fund labels. Article 9 bond funds having to remove “environmental” from their names because the ultimate parent of a green bond does not meet one of the exclusions may be confusing for asset owners.

Every EU National Competent Authority has to endorse the guidelines and fund managers have until March 2025, taking into account the delays that apply after guidance publication, to implement procedures and become compliant with them.

Another question is if and when a potential new SFDR proposal will be published by the European Commission. Nevertheless, based on Bloomberg’s sample findings, a large number of funds will either have to update their name in accordance with these new rules or make divestments from companies who do not meet the exclusion requirements.

How to apply the PAB and CTB exclusions

Bloomberg recently introduced new data fields so investors can better understand the impact to their funds from the ESMA name rules, as applying the PAB and CTB exclusion criteria is technically challenging, even for seasoned sustainable investors. Managers need to scan their portfolio of investee companies for different fossil fuels and apply specific thresholds, e.g. scan for companies that derive 50% or more of their revenues from electricity generation with a GHG intensity of more than 100 grams carbon dioxide emissions per kilowatt hours (cO2e/kWh). They also need to exclude companies involved in controversial weapons, or having activities in the cultivation and production of tobacco.

To simplify this process for investors, Bloomberg offers a data solution that assesses companies against all the CTB and PAB exclusions. This helps users immediately understand whether a company is in violation of any of the exclusion criteria. The tool is based on Bloomberg’s revenue segmentation model, which considers up to 7 levels of company economic activities for exclusionary criteria defined by the regulator.

ESG solutions

Meeting evolving and complex regulatory requirements requires access to reliable ESG data, analytics and estimates. Bloomberg’s Sustainable Investment solution helps investors assess portfolios, funds and indices based on sustainability criteria and thresholds customized by the user.

The solution can be used by investors both for making investment decisions and to check, based on their own definitions, if funds align with regulatory obligations, including the Sustainable Finance Disclosure Regulation (SFDR), the UK Sustainability Disclosure Requirements, and future SEC guidance on ESG disclosures and fund labeling.

Clients can access the tool on the Bloomberg Terminal at {SUST <GO>}, and via Data License, for enterprise-wide access to the underlying data, for investors to use in their sustainable investment construction at data.Bloomberg.com.

The information included in these materials and all related information (whether oral or written) which may be provided in connection with these materials is for illustrative purposes only. Nothing in these materials or the services offered by Bloomberg is designed to be, or should be treated as, advice. If you are in any doubt as to your obligations or should you wish to seek advice, you should consult your own professional advisers.