Host of COP28, UAE ramps up record issuance of sustainable debt

This analysis is by Bloomberg Intelligence Senior Analyst Christopher Ratti. It appeared first on the Bloomberg Terminal.

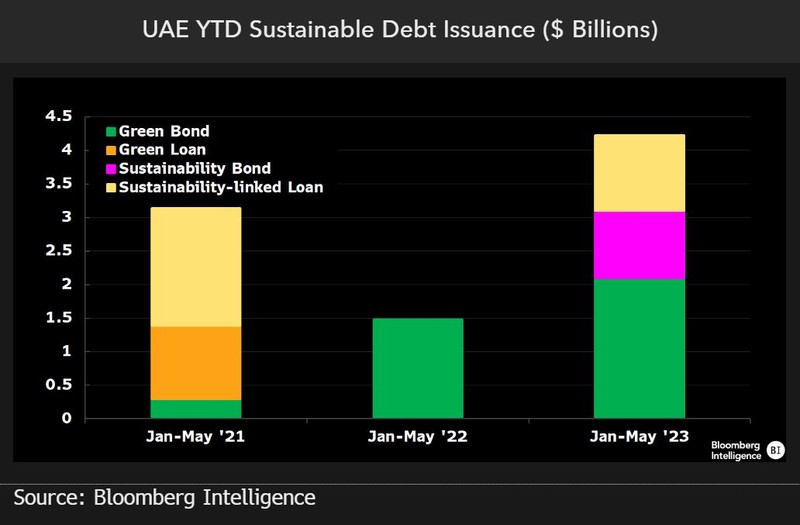

UAE sustainable debt issuance is off to the strongest start on record ahead of Dubai’s hosting the COP 28 global climate conference this November. The spread vs. Treasuries has tightened on bonds issued this year, with the dollar as the favored currency dispersed across green and sustainability bonds. The total issuance of these securities through the first five months is only $100 million behind 2022 full-year issuance.

UAE Is encouraging sustainable debt issuance

Sustainable debt issuance from UAE issuers is off to its best start on record, with $4.7 billion issued through May, a level approaching 2022 total issuance of $4.8 billion. UAE has encouraged sustainable debt prior to hosting COP28 in Dubai in November, and its Securities and Commodities Authority has informed companies that they would be exempt from listing fees this year for green or sustainability-linked bonds. We expect this to push issuance past record 2021 levels of $6.45 billion, while continued government support of sustainable debt should help global issuance.

Spreads of UAE sustainable bonds keep moving tighter

All five of the UAE’s bond issuers so far this year have seen strong demand, with the deals 2-3x over-subscribed, resulting in better pricing. Spreads vs. Treasuries launched at 25-35 bps lower levels than the initial price talk, and the spreads on four of these issues have also tightened from the issue date. First Abu Dhabi has seen the smallest move, as it’s 5 bps tighter, and Sharjah Finance Department had the largest move, showing 33 bps of additional spread tightening. Commercial Bank of Dubai priced on June 7 and could follow spread moves for similar securities.

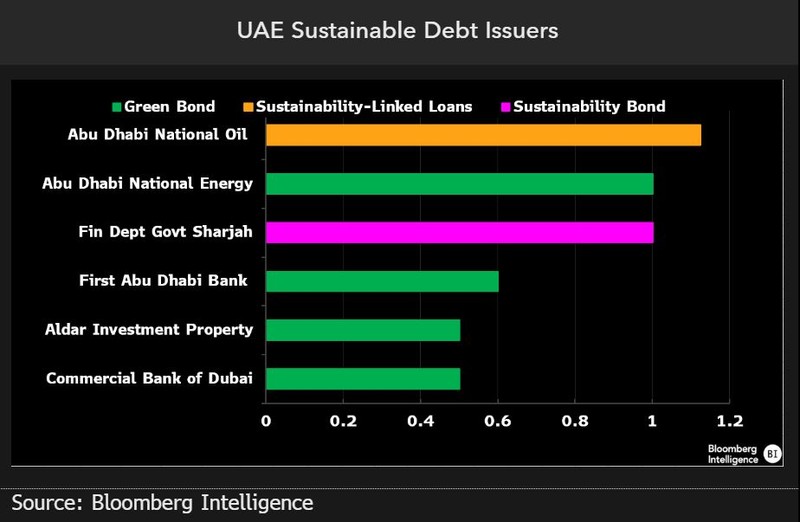

Commercial Bank of Dubai is the UAE’s latest issuer of ESG debt

Six issuers from the UAE have issued sustainable debt so far this year. Half of them are first time issuers of such debt, with Commercial Bank of Dubai being the most recent to market with a $500 million green bond. Abu Dhabi National Oil is the largest issuer, with a sustainability-linked loan that surpassed $1.1 billion, followed by the Finance Department of Sharjah’s $1 billion sustainability bond. We expect more issuance of these ESG labeled securities and more first-time issuers leading up to COP28.

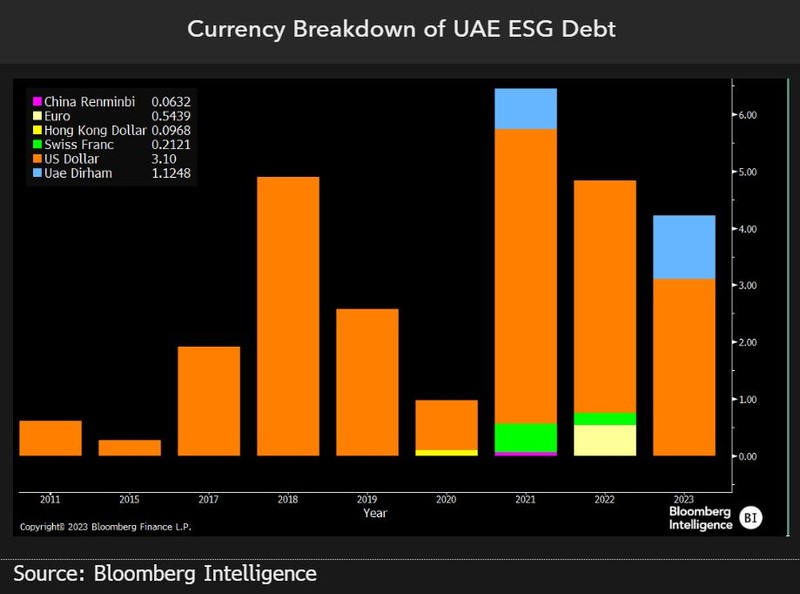

Dollars dominate UAE’s ESG debt

The preferred currency for sustainable debt issues from UAE companies remains the US dollar, which accounts for $3.6 billion so far this year of the $4.7 billion issued. This has historically been the case, as the dollar had dominated conventional issuance from UAE companies, and while this is still a growing market for ESG debt issuance in other currencies, we expect dollar dominance to continue.