This analysis is by Bloomberg Intelligence ESG Analyst Michelle Leung and Bloomberg Intelligence Credit Analyst Rena Kwok. It appeared first on the Bloomberg Terminal.

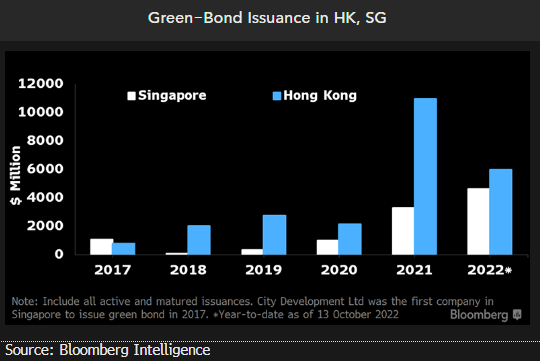

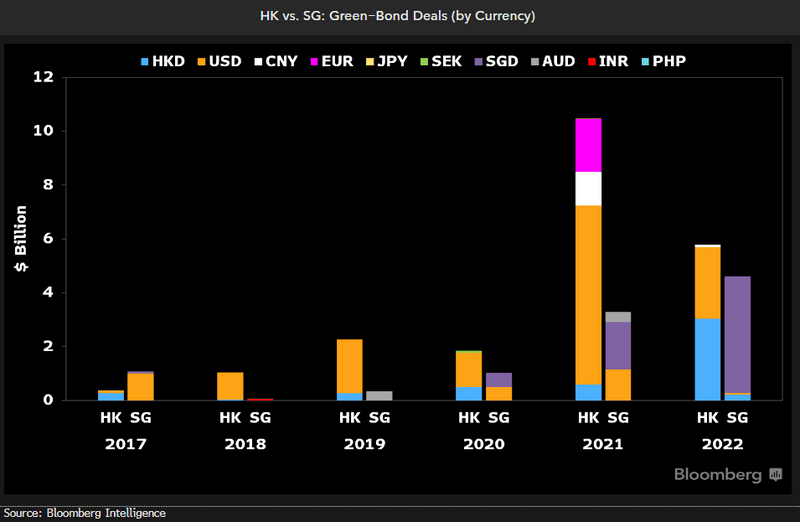

The Hong Kong and Singapore governments are seeking to promote green and sustainable financing in the long term, as they set clear bond-issuance targets. Hong Kong leads in issuing notes in different currencies and offshore yuan bonds. Its green-debt growth outpaced Singapore’s in 2017-21, which might have partly contributed to its faster CO2 emissions cut too.

Clear sovereign green-bond targets up to 2030

The Hong Kong and Singapore governments envision issuing more sovereign green bonds in the coming years to fund public green projects. While the HK government’s plan underscores its HK$175.5 billion ($22.4 billion) green-bond commitments through 2027, Singapore strives to raise S$35 billion ($24.3 billion) by 2030, based on the Singapore Green Plan 2030. That implies an average of $4.5 billion of annual sovereign issuance by Hong Kong and $3 billion by Singapore, not a small amount compared to their respective $11 billion and $3 billion total green-bond issuance in 2021. Singapore issued its first 50-year S$2.4 billion sovereign green bond in August at 3.04%, giving a big boost to the nation’s green-bond market this year. The setting up of the Green Bond Framework also lays the foundation for more issuance to come.

String of landmark deals prove HK’s strength

A string of landmark green deals in different currencies has reaffirmed HK’s position as Asia’s green financial hub. The city has $20 billion in outstanding green bonds denominated in the dollar, euro and yuan as of September, more than $17.4 billion in 2021 and Singapore’s $2.6 billion. In February 2021, it issued the world’s largest dollar government green bond worth $2.5 billion. In November 2021, the government completed a green-debt offering comprising eurobonds and dollar bonds, with the total size of the three tranches three times that of its first $1 billion green bond sold in 2019. In the same month, HK also issued its inaugural yuan green bond worth 5 billion yuan ($783 million). It is well prepared for more green-bond issuance after doubling the green-bond program’s borrowing ceiling to HK$200 billion in 2021.

Demand for China’s offshore yuan bonds

China’s efforts to promote an offshore yuan bond market, which helps the currency’s internationalization, could offer a unique role for Hong Kong and cement its status as the leading global financial center. This year, 23 billion yuan of offshore yuan sovereign-bond issuance is planned in HK. More municipal governments might offer green bonds in HK after the success of Shenzhen Municipal Government’s 5 billion-yuan (including 3.9 billion yuan or $542 million in green bonds) offshore-bond debut in the city in October 2021. China may need at least $17 trillion in green investments over the next 30 years to hit its climate goal, the World Bank estimates. That implies at least $567 billion in annual green spending, equivalent to about 17% of China’s 2021 infrastructure outlay, based on Bloomberg Economics forecasts.

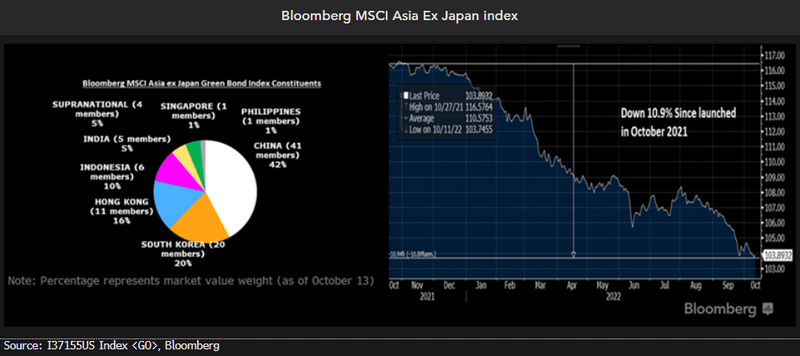

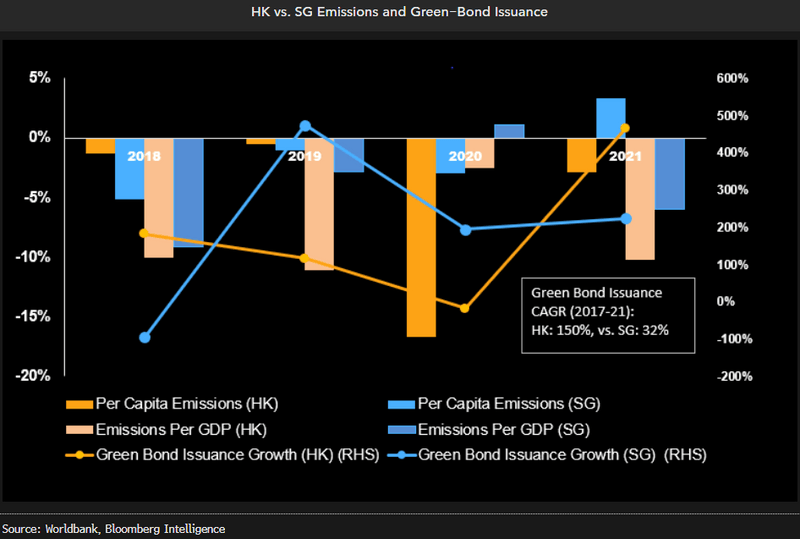

HK leads in CO2 reduction, green finance

Hong Kong improved its environmental efficiency faster than Singapore in 2017-21, as indicated by CO2 emissions per capita and per GDP, partly helped by its faster growth in green-bond issuance. HK’s CO2 emissions/GDP fell 9% CAGR from 2017-21 to 0.07 kg per $1,000 GDP, vs. Singapore’s 4% CAGR decline to 0.08 kg. CO2 emissions per capita too showed similar results, with HK’s 6% CAGR decrease to 4.4 tons vs. Singapore’s 2% CAGR dip to 9.7 tons. HK’s green-bond issuance jumped 150% CAGR vs. Singapore’s 32% CAGR. Both cities marked record green-bond issuance in 2021, demonstrating their ambitions in the segment. Meanwhile, HK firms constitute 11 out of 89 members in Bloomberg MSCI Asia ex Japan Green Bond Index and account for 16% of total market value vs. 1% from Singapore.

Sustainable finance continues to gain pace

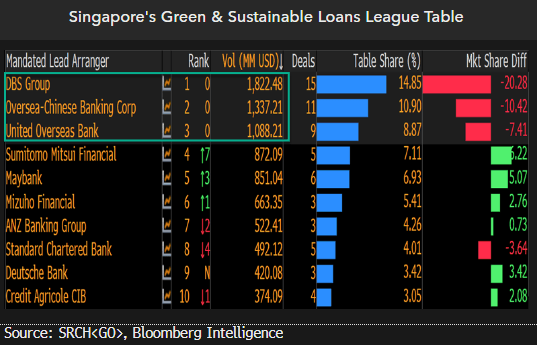

Singapore’s banks may leverage sustainable finance to drive loan growth in 2022 amid heightened efforts to combat climate change. Such loans could gain pace in the medium term, we think, as borrowers increasingly incorporate sustainability into their business models. The carbon tax announced in the budget effective 2024 might also offer an impetus for businesses and individuals to reduce their carbon footprint and align with national climate goals, leading to incremental green-financing loan growth for the banks. DBS topped the green and sustainable loans league table in Singapore for 2021.

DBS targets a $50 billion sustainable finance portfolio by 2024, comparable to OCBC’s $50 billion by 2025 and above UOB’s S$30 billion by 2024. UOB and OCBC had lifted their sustainable financing targets after exceeding them in 2021.