Global wind energy midyear outlook

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Analyst Rob Barnett, with contributing analysis by Alessio Mastrandrea. It appeared first on the Bloomberg Terminal.

Global wind installations are poised to set a record in 2024, at about 125 gigawatts for the first time vs. about 117 GW in 2023, and we believe a double-digit growth pace is achievable in 2025-26. More than half of this year’s capacity additions are likely to be in China, with the country’s largest turbine manufacturer, Goldwind, set to boost top-line expansion 10%, based on consensus. Growth expectations are a tad higher for European manufacturer Vestas, and we see potential upside to analysts’ 2025-26 numbers for most equipment suppliers. The peer group’s profit, led by Vestas, could rebound significantly amid lower steel prices and higher turbine prices.

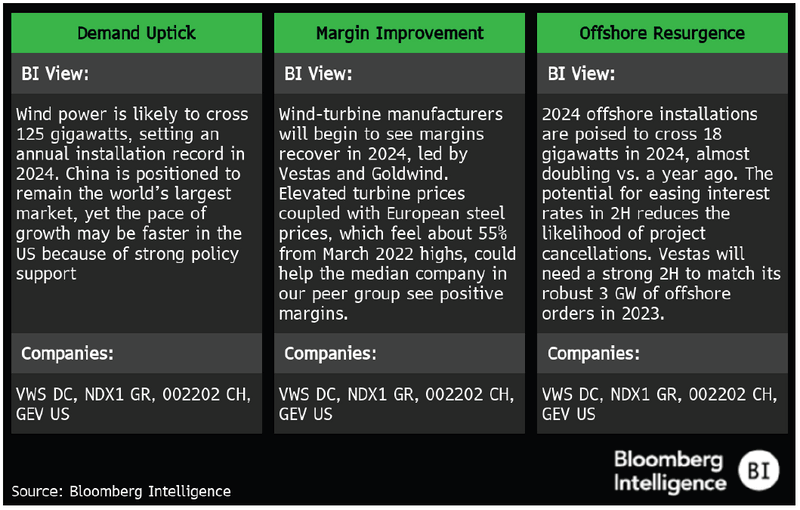

Three keys for 2H: Global solar energy

Key Drivers

Wind stocks trail broader market, energy peers on elections hit

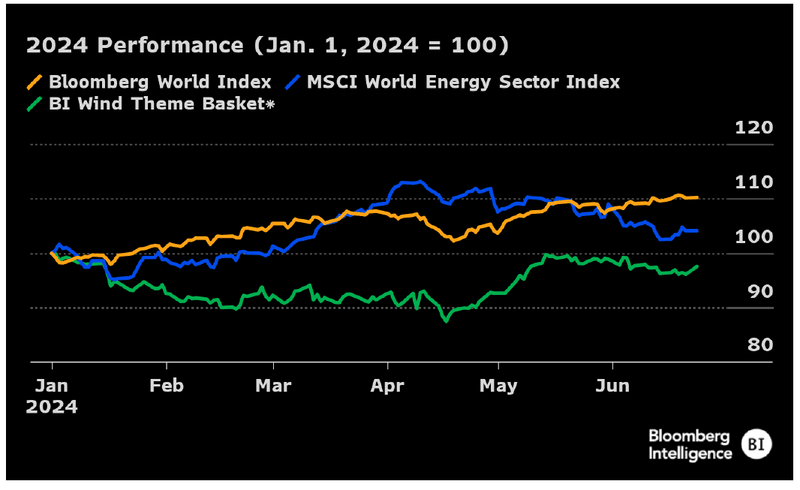

Wind-energy shares fell about 3% in 2024, based on the median company in BI’s wind-theme basket, against a 6% uptick for the MSCI World Energy Index and 10% for Bloomberg’s World Index. Wind-valuation metrics trail the broader market amid a pullback in share prices and muted profit expectations for some companies.

Tepid sales pace likely held back shares

Underperformance of wind-energy shares so far in 2024 vs. the Bloomberg World Large & Mid Cap Index can probably be attributed to concerns over elections in Europe and the US. Orders are nevertheless off to a strong start in 1H amid expectations for rapid growth in 2024, with policy support likely to buoy wind-turbine demand. These drivers may help boost the fairly tepid consensus sales growth for most manufacturers in 2024-26, despite efforts to reduce demand for coal and other fossil fuels as part of governments’ net-zero ambitions.

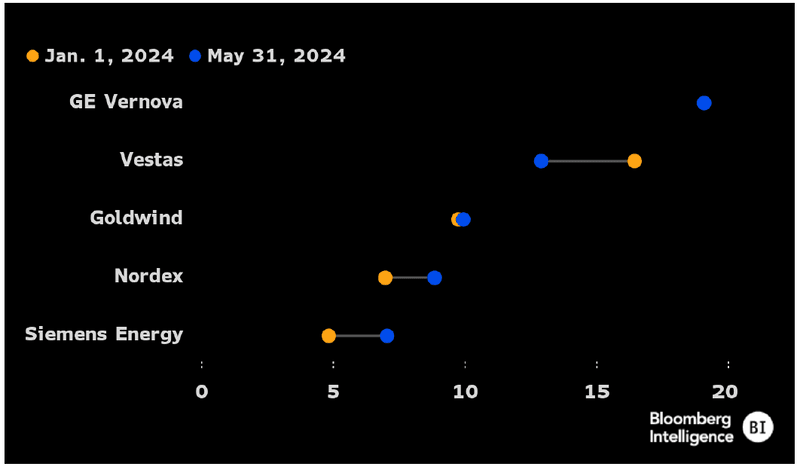

Since its IPO, GE Vernova’s shares modestly outperformed the median company in BI’s wind theme basket so far in 2024, possibly due to the expectations of rising profitability this year.

BI Wind Theme Basket vs. BI World Index

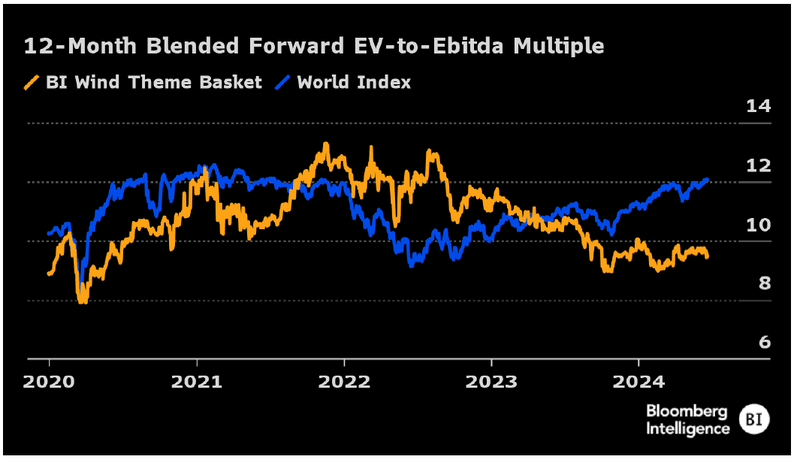

Wind valuations fall below broader market

Wind-valuation metrics have dipped below the broader market and the median company in our wind-theme basket has a forward 12-month EV-to-Ebitda multiple of 9.3x vs. 12x for Bloomberg’s World Index. While Vestas’ valuation appears high by comparison (EV-to-Ebitda multiple of about 12x), it has fallen to about one standard deviation below its five-year average and we believe this is primarily due to increased profit expectations following the easing of steel prices and supply chain disruption.

Steel prices are down about 50% compared with the March 2022 peak, and with manufacturers locking in decade-high turbine prices, 2024 Ebitda at some companies could surpass consensus expectations.

BI Wind Theme Basket: EV-to-Ebitda Multiples

Valuation metrics: Wind-turbine manufacturing peers

Blended 12-Month EV-to-Ebitda Multiples

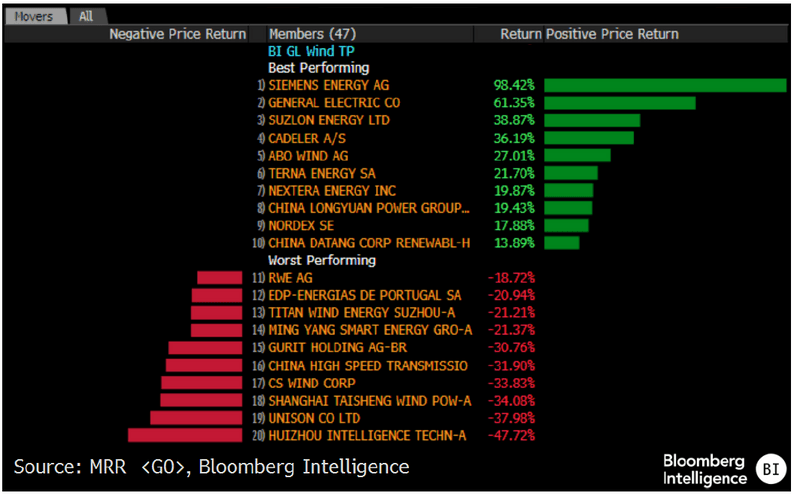

Top performers and laggards: BI wind-theme basket

YTD Performance as of May 31 Via MRR<GO>

Vestas, Goldwind, peers race to revitalize wind-market growth

Global wind additions could top 125 gigawatts (GW) in 2024 after rebounding to 117 GW last year, and there’s scope for that figure to soar to about 170 GW by 2028, with favorable policies including the Inflation Reduction Act and REPowerEU. Such a scenario could drive a significant surge in the orders of Vestas, Goldwind and peers.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2024 Bloomberg.

Bloomberg Intelligence is a service provided by Bloomberg Finance L.P. and its affiliates. Bloomberg Intelligence likewise shall not constitute, nor be construed as, investment advice or investment recommendations, or as information sufficient upon which to base an investment decision. The Bloomberg Intelligence function, and the information provided by Bloomberg Intelligence, is impersonal and is not based on the consideration of any customer’s individual circumstances. You should determine on your own whether you agree with Bloomberg Intelligence. Bloomberg Intelligence Credit and Company research is offered only in certain jurisdictions. Bloomberg Intelligence should not be construed as tax or accounting advice or as a service designed to facilitate any Bloomberg Intelligence subscriber’s compliance with its tax, accounting, or other legal obligations. Employees involved in Bloomberg Intelligence may hold positions in the securities analyzed or discussed on Bloomberg Intelligence.