Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Analyst Rob Barnett and Bloomberg Intelligence Senior Associate Analyst Alessio Mastrandrea. It appeared first on the Bloomberg Terminal.

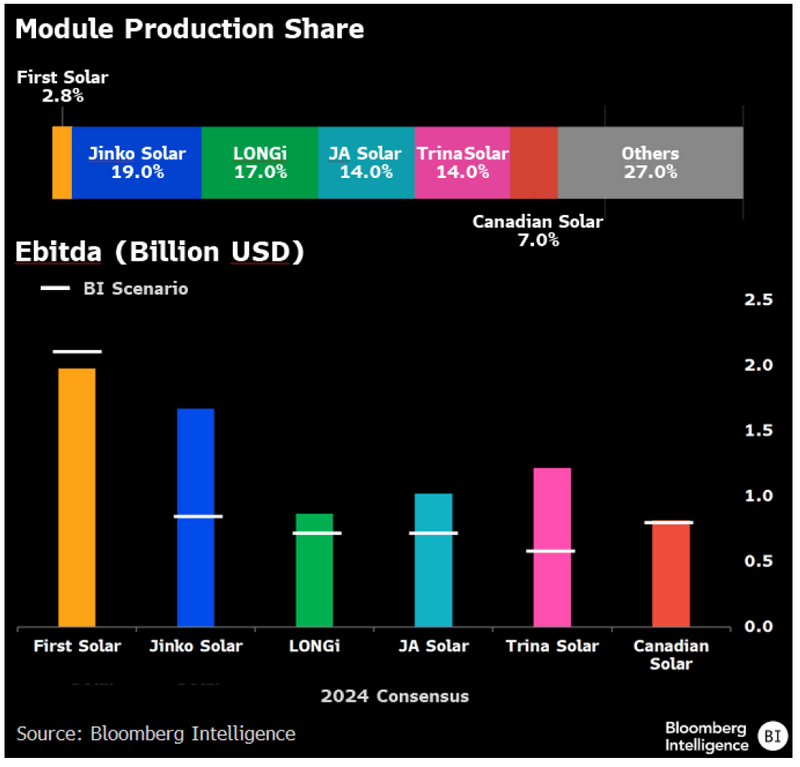

First Solar’s Ebitda could exceed $2 billion in 2024, which may surpass most rivals by more than 2x, based on our scenario analysis. Though dominant in the US and protected by trade barriers, First Solar holds less than 3% market share globally based on annual module production. This contrasts with peers Jinko Solar (about 19% global module share), Longi Green Energy (17%), JA Solar (14%), Trina Solar (14%) and Canadian Solar (7%). Such companies do most of their manufacturing in China and Southeast Asia and are likely to see margins dented in 2024-25 as an oversupplied module market has caused prices to drop more than 60% over the last two years.

Production Share and Ebitda Outlook

First Solar profit may be resilient as peers falter

We believe these catalysts could act as important triggers for this idea in coming months.

Timeline of catalysts:

- Aug. 14: Rival Jinko Solar 2Q results, followed later in August by Longi Green Energy, JA Solar, Trina Solar and Canadian Solar, which are likely to show continued deterioration in margins

- Oct. 31: First Solar 3Q results likely to show fast top-line growth with an Ebitda margin exceeding nearly all peers

- Nov. 5: US Presidential and Congressional elections could reshape energy and trade policies

- Feb. 27, 2025 (Expected): First Solar’s 2024 results are likely to show continued revenue and profit momentum outpacing nearly all peers

Module prices outside US poised to drop on surplus

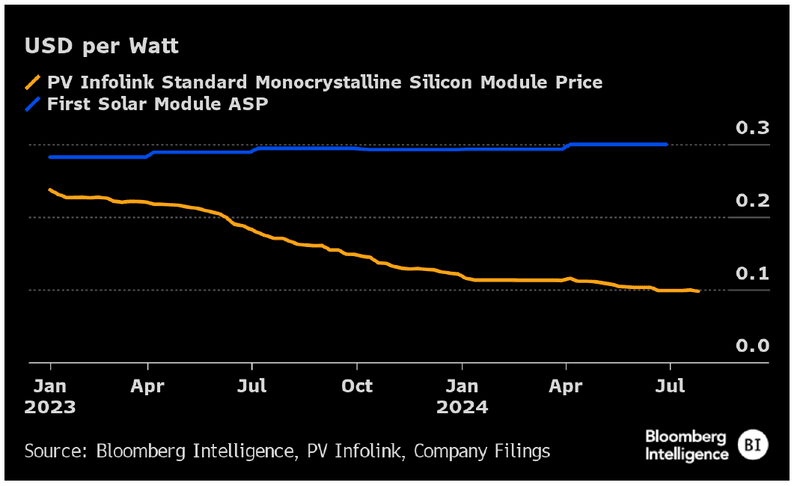

The average price for monocrystalline solar panels has fallen 60% to about 10 cents a watt vs. around 26 cents two years ago. The decrease is primarily driven by a massive oversupply of module manufacturing capacity, which stands at nearly 1,200 gigawatts, while global demand is likely to be closer to 600 GW this year. So far, First Solar has been immune to falling module prices, recording an average selling price of about 30 cents a watt in 2Q. Furthermore, the company is completely sold out through 2026, with its backlog at a reported average price of about 30 cents a watt.

Solar Module Price (USD/Watt)

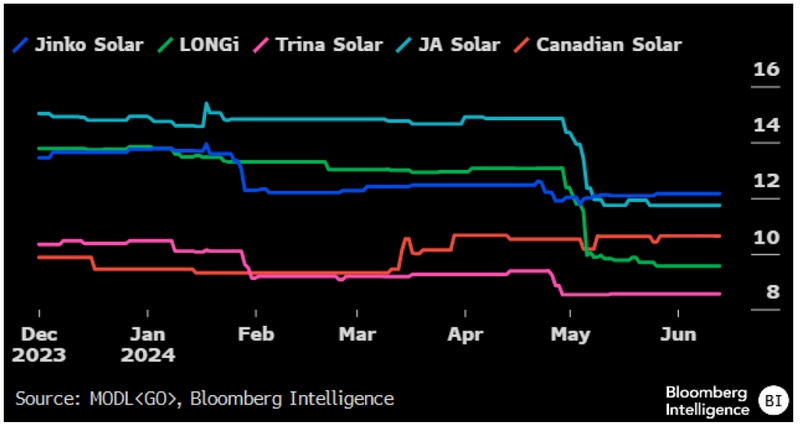

Consensus margins for Jinko Solar, China peers may decline

Since the start of the year, 2024 Ebitda margin consensus for Chinese module makers Jinko, Longi, Trina and JA Solar have fallen 200-700 bps. We think further revisions are likely following 2Q results, as it became apparent module manufacturers can’t squeeze costs enough to match the decline in prices. Despite robust demand growth, which may increase by more than 25% this year and approach 600 GW, according to our calculations, we believe the market will remain meaningfully oversupplied due to a significant overbuild in manufacturing capacity (about 1,200 GW).

Consensus 2024 Ebitda Margin Expectations

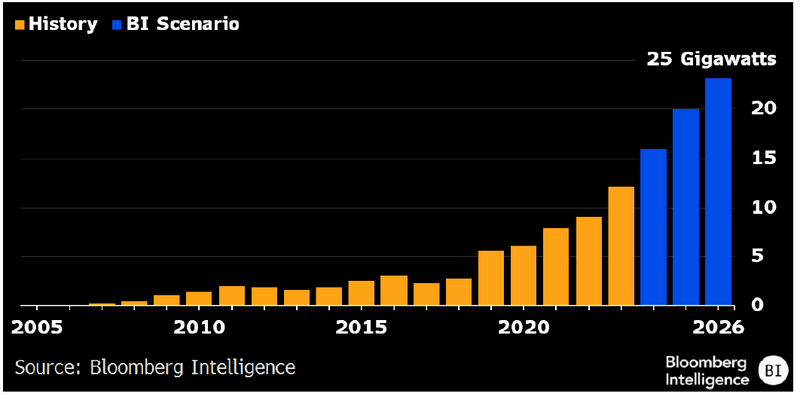

First Solar’s US expansion, margin growth backed by IRA

First Solar’s revenue could climb 35% to about $4.5 billion in 2024, in contrast to most module manufacturers where sales expectations have collapsed on a significant decline in module prices. The Inflation Reduction Act, which provides subsidies for US solar manufacturing, can bolster First Solar’s top line to over $7 billion by 2026, according to our scenario analysis. This above-consensus outlook is based on strong US demand amid output from new factories that will bring the company’s total production capacity to 25 gigawatts in 2026 vs. about 16.6 GW at the end of 2023.

First Solar Production (Click to Run Scenario)

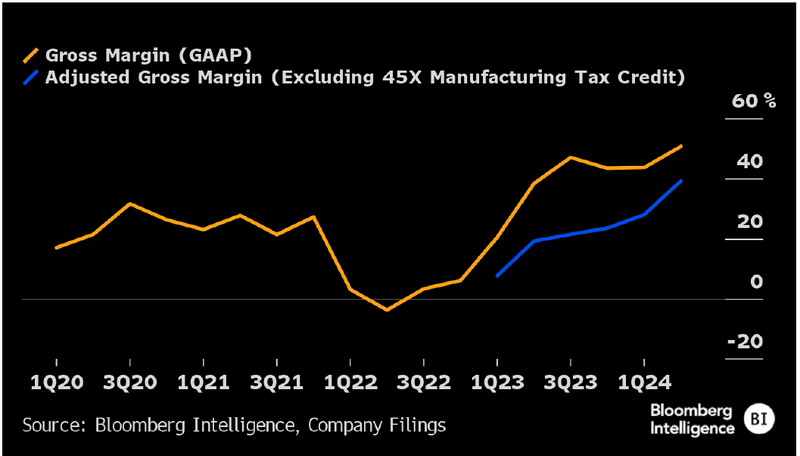

IRA repeal could upend our view on First Solar

Underpinned by the Inflation Reduction Act, one of the key risks to our outlook for First Solar is if former President Donald Trump wins in November and works with Congress to modify or repeal the act. Under a Trump presidency, we believe a repeal has only 10% odds, as the White House and Congress will probably have competing priorities. If the IRA is revoked or watered down, we calculate First Solar’s gross margin dropping to about 25% vs. 49% in 2Q.

First Solar: Gross Margin

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2024 Bloomberg.

Bloomberg Intelligence is a service provided by Bloomberg Finance L.P. and its affiliates. Bloomberg Intelligence likewise shall not constitute, nor be construed as, investment advice or investment recommendations, or as information sufficient upon which to base an investment decision. The Bloomberg Intelligence function, and the information provided by Bloomberg Intelligence, is impersonal and is not based on the consideration of any customer’s individual circumstances. You should determine on your own whether you agree with Bloomberg Intelligence. Bloomberg Intelligence Credit and Company research is offered only in certain jurisdictions. Bloomberg Intelligence should not be construed as tax or accounting advice or as a service designed to facilitate any Bloomberg Intelligence subscriber’s compliance with its tax, accounting, or other legal obligations. Employees involved in Bloomberg Intelligence may hold positions in the securities analyzed or discussed on Bloomberg Intelligence.