This analysis is by Bloomberg Intelligence ESG Trade Analyst Clelia Imperiali. It appeared first on the Bloomberg Terminal.

First-ever transnational carbon tax to hit EU suppliers’ exports

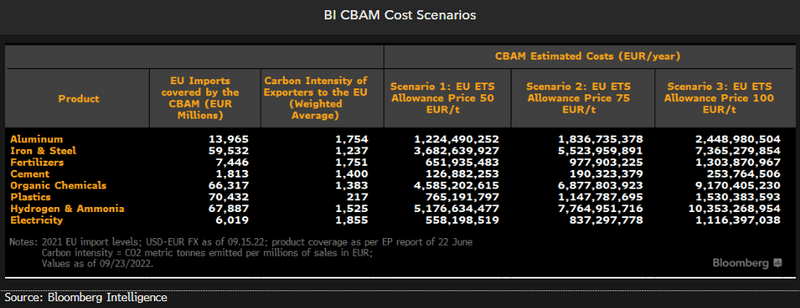

The Carbon Border Adjustment Mechanism (CBAM) would be the first-ever transnational carbon tax, charging EU companies for the emissions embedded in the products they import. Our calculations estimate the current proposal (10 commodities) means EU importers may pay more than €33 billion a year for their non-European inputs, in a maximum scenario of the EU carbon price at €100 a metric ton. The tax could help level the playing field for domestic producers, which are subject to rising EU carbon prices and prompt non-EU companies to reduce emissions to remain competitive in the bloc.

EU and US carbon taxes, trade and protectionism: BI webinar

The economic, trade and tax ramifications of two carbon levies that would apply to foreign companies in the EU and US, with potential to reshape global supply-chains along carbon-reduction patterns, were discussed by Bloomberg Intelligence and ING on Sept. 29. The EU measure — the Carbon Border Adjustment Mechanism — is in the final stages of adoption and applies to a narrow range of products. The US proposal has a broader coverage, but remains on the drawing board, and could get a boost when the EU tax is applied to US companies.

EU import costs set for $24 billion hit on expanded carbon tax

The expanded scope of the Carbon Border Adjustment Mechanism (CBAM) could add 25 billion euros a year to import prices in covered industries under our core EU carbon-price scenario of 75 euros a metric ton. Though the broader coverage would still affect only 10 commodities (less than 2% of total imports in value from outside the bloc in 2021), the CBAM is likely to extend to trade with larger partners after its full launch.

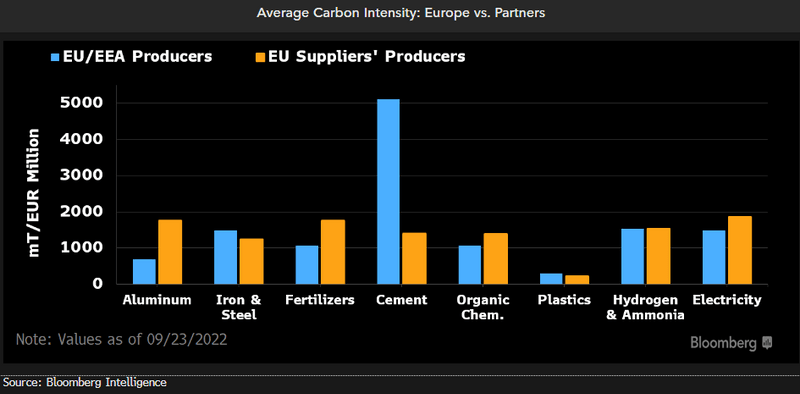

CBAM increases import costs based on embedded emissions

The CBAM could increase the cost of imports by between 1% (scenario 1, plastics) and 19% (scenario 3, electricity) — depending on embedded carbon emissions — in the 10 sectors analyzed (cement, fertilizers, iron and steel, aluminum, hydrogen and ammonia, plastics, chemicals and electricity). Our calculations use 2021 import values and the weighted-average carbon intensity of companies with a market capitalization of more than 100 million euros, in countries that account for more than 5% of EU imports in their respective sectors.

We consider three carbon-price scenarios — 50, 75 and 100 euros a ton — and assume that no other carbon tax is paid in the country of origin. We also exclude free allowances, which are due to be phased out by 2032 at the earliest.

EU importers should factor in CBAM red tape, levy costs

Energy, construction and agribusiness companies — among the primary users of the emissions-intensive materials targeted by the CBAM — face increased red tape for their non-EU production input from 2023, and higher costs from 2026, if the CBAM is approved by year end. As emissions caps and free allowances stand to be progressively reduced under the EU Emissions Trading System (ETS), the CBAM will introduce a tax on imports to level off the price differentiation stemming from less-restrictive environmental rules outside the EU.

This will also discourage the relocation of EU plants outside the bloc, to bypass the ETS (so-called “carbon leakage”). EU imports of the 10 products included were worth over 290 billion euros in 2021.

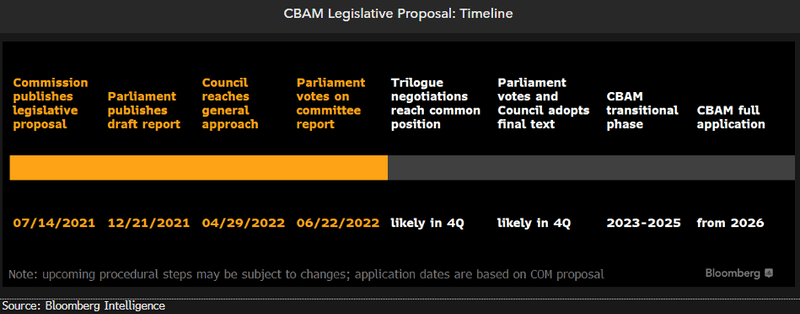

Green-ambition, ETS compromises needed for 2H adoption

The CBAM legislative proposal adopted by the European Parliament on June 22 may delay negotiations with EU member states, making 2H approval challenging. The suggested carbon tax expands the mechanism’s sectoral scope and shortens implementation times amid the reduction of free allowances under the EU Emissions Trading System. The inclusion of export rebates, however, could favor a compromise with the less ambitious, moderately green negotiating position agreed to by EU members.

A 2H approval of the legislative proposal also depends on the parallel revision of the ETS, which the CBAM complements. That’s needed to begin the initial application in 2023, as originally planned, with a transitional phase leading to full implementation and costs in 2026. The product coverage could also be expanded during later reviews.