Climate activists continue to target financial institutions

This article was written by Bloomberg Intelligence Senior ESG Analyst Rob Du Boff and Bloomberg Intelligence Senior ESG Climate Analyst Andrew John Stevenson.

To meet net-zero commitments, markets are looking more to banks and insurers to reduce funding and/or underwriting of fossil fuels in favor of renewables. Yet while shareholders support climate initiatives, they appear to be more hesitant to push financials to take drastic action needed to achieve the goal of limiting global warming to 1.5 degrees Celsius.

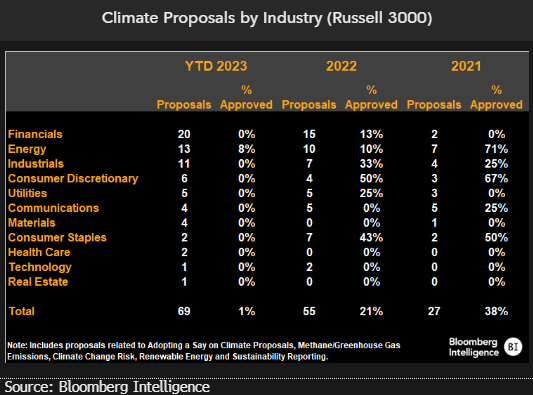

Climate pressure on financials grows

The financials sector was again the largest sector for climate-related proposals in the 2023 proxy season, with 20 year to date, up 33% from 2022. The recent focus on financials compares with just four similar proposals in the prior three years combined, aided in part by less-restrictive SEC rules. Though none were approved, a campaign from “As You Sow” targeting several large banks (JPMorgan, Goldman Sachs, Bank of America, Wells Fargo) all received relatively high investor support of about 30%.

The resolutions requested that each bank issue a report “disclosing a transition plan” that described how it would align financing activies with 2030 greenhouse-gas emission-reduction targets.

Limiting financed emissions less popular in 2023

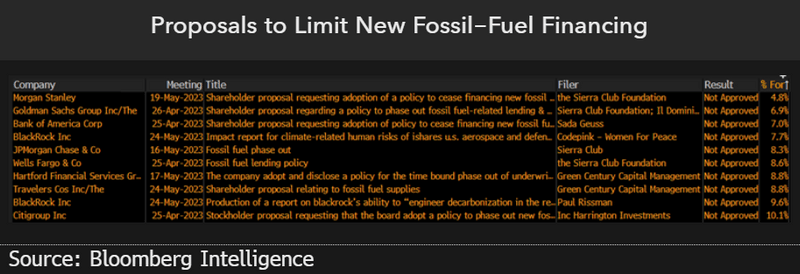

Though many banks have committed to aligning lending and investments with net-zero emissions by 2050, in accordance with IEA recommendations, some investors have pushed for a more aggressive approach of immediately ending all lending for new fossil-fuel development. These resolutions failed to gain traction, with most receiving less than 10% of the vote as shareholders found them too prescriptive.

Support for proposals to stop lending and underwriting new fossil-fuel projects fell in 2023, including at Morgan Stanley (4.8% this year, down from 8.5% in 2022), Goldman Sachs (6.9% vs. 11.3%), Bank of America (7% from 11%) and JP Morgan (8.3% vs. 10.1%). The 2022 energy crisis and recent ESG backlash may have contributed to the fewer votes.

Insurers’ climate support wilts amid political pressure

Shareholder support fell significantly for insurers Chubb and Travelers “to measure, disclose, and reduce the (greenhouse-gas emissions) associated with … underwriting, insuring, and investment activities.” The proposals garnered majority approval from investors in 2022 (72% and 56%, respectively). However, neither company issued a report, and more than half of investors who voted in favor withdrew support this year.

Both insurers pointed to the difficulty of Scope 3 targets, and noted that the proposal could run afoul of existing or proposed anti-ESG laws in multiple US states. This mirrors several major European insurers, including Allianz, Axa, Zurich and Swiss Re, exiting the Net Zero Insurance Alliance after receiving a letter from 23 state attorneys general questioning the legality of such commitments.

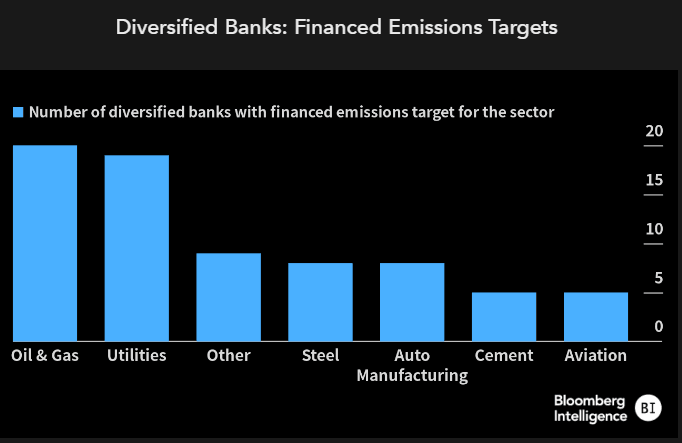

Financed emissions targets move beyond oil, gas, power

Of the 20 largest diversified banks, 16 set targets to reduce financed emissions in sectors beyond oil, gas and power generation. HSBC eyes a 66% cut to auto-manufacturing scope 1-3 intensity (tco2/vkm) from 2019-30, with targets for steel, cement and aviation. Expansion is indicative of banks’ efforts to address climate impact, yet differences in segmentation, emissions scope and metrics obscure comparison. Notably, 50% of diversified banks set intensity-based oil and gas targets over absolute, risking 1.5C being met if unchecked.

Proposed regulatory tightening from the SEC and ECB on banks’ emissions disclosures are key to the Net Zero Banking Alliance for members financing fossil fuels. It highlights the need for transparency, standardization and guidance.

Anti-woke states appear asleep to climate-related financial risk

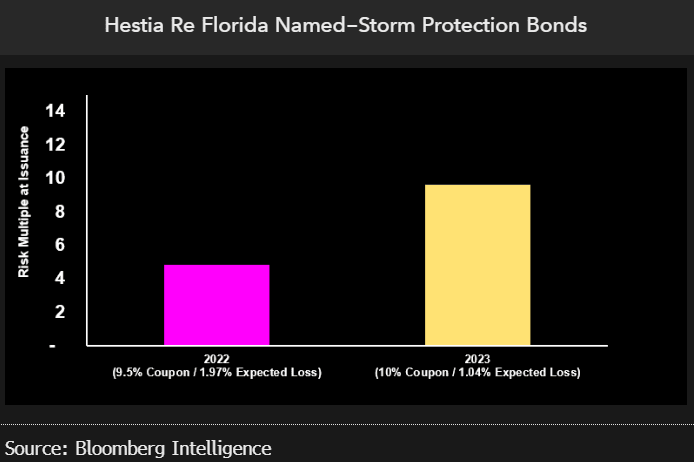

Soaring climate-related costs are exposing a gap between anti-ESG policies and the economic interests of states like Texas, Florida and Louisiana, our analysis shows. In Florida, investors are demanding double what they were paid last year to invest in hurricane-insurance bonds, though the state maintains that climate change doesn’t pose a financial risk.

State-sponsored insurers forced to fill gap

The risk-reward for investing in two Florida named-storm reinsurance protection bonds from Hestia Re is now 9.6x the expected loss — double the 4.8x that investors received last year, based on dividing each bond’s coupon by its expected liability. Meanwhile, the number of Florida residents insured by Citizens Property, the state-sponsored insurer of last resort, is expected to quadruple to 1.7 million by year-end from 420,000 in 2019 as the private sector continues to retreat due to rising climate costs.

Though such factors should spur Florida to pursue more transparency and climate data, it has resisted such efforts.