China decoupling curbs US EV supply as IRA boosts US industry

This analysis is by Bloomberg Intelligence Analyst Clelia Imperiali. It appeared first on the Bloomberg Terminal.

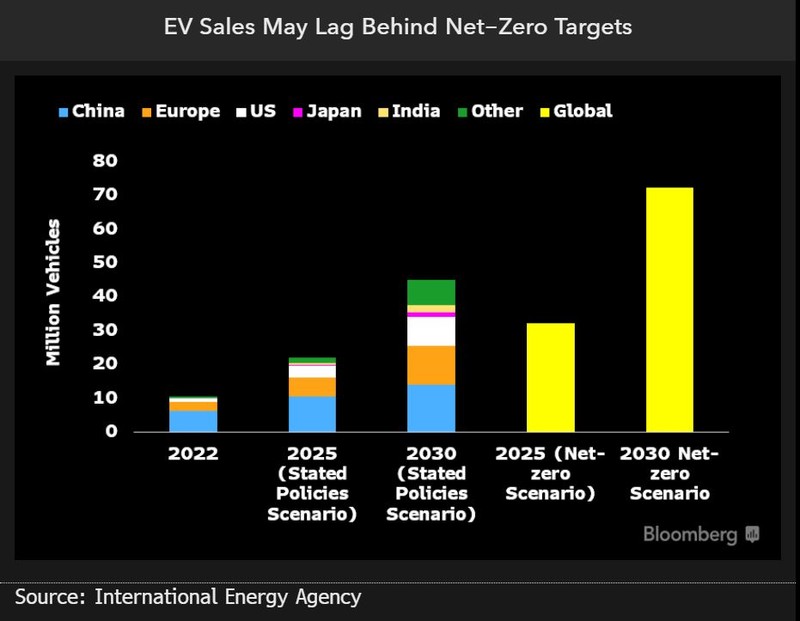

The outcome of the Section 301 review suggests policy will still weigh on US electronic-vehicle supply chains in 2H. Despite support to domestic production, tariffs of 7.5-25% in place since 2018 on critical components of EVs imported from China could slow progress on President Joe Biden’s target of 50% EV penetration by 2030.

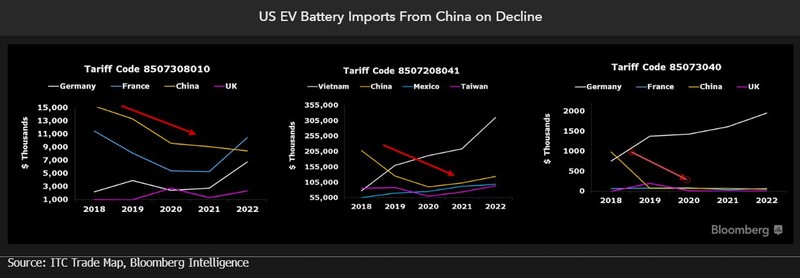

Many US imports of tariff-hit car and EV parts from Beijing had double-digit declines greater than 50% since tariffs took effect in 2018, with pandemic-related contractions only partially accountable. Between 2017, before the tariffs were adopted, and 2020, import substitutions that favored partners politically and strategically closer to the US, Germany in particular, were implemented. Tesla, General Motors and Ford are among the companies that have sought relief from the tariffs or welcomed specific automotive-related product exclusions.

Tariff relief effect could fade as China demand grows

The latest lifting of US Section 301 tariffs on Chinese EV and combustion car-part imports through September might be extended beyond 3Q, giving some breadth to US EV-component demand. For some products, the change in US imports might be minimal, since China’s booming domestic EV demand — lithium battery needs grew 7x from 2017-21 — can hardly be met by domestic production.

The exclusions concern products that already benefited from one- or two-year reprieves previously. Original tariffs as high as 25% were adopted by the US in 2018-19 on about $35 billion worth of Chinese imports related to the automotive sector.

IRA, USMCA North American content boost only partially helps

The 2022 Inflation Reduction Act and the US-Mexico-Canada Agreement in force since 2020 favor North American EV industry growth, yet diminishing dependence on Chinese parts won’t happen overnight and without costs. The USCMA now requires as much as 75% of North American content for core parts such as EV batteries to qualify for tariff reduction. The IRA EV tax credit hinges on increasing eligibility thresholds for domestic labor or assembly (100% by 2029) and critical material value (80% by 2027) of EV batteries.

Under the bipartisan Infrastructure Law, about $5 billion is devoted to building a national EV charging network. The US EV industry can count on more EV federal tax credits and new tax incentives included in the Build Back Better Act.