This article was written by Nakul Nair, Data Science Specialist at Bloomberg.

The Sustainable Finance Disclosure Regulation (SFDR) mandates that investment funds in the European Union disclose the extent of their focus on sustainability initiatives. SFDR, which was entered into force in March 2021, has had a significant impact on funds capital allocation decisions. While SFDR is a regulatory obligation, in this blog, we show that data from SFDR reporting can also be used to inform investment decisions, by backtesting different strategies.

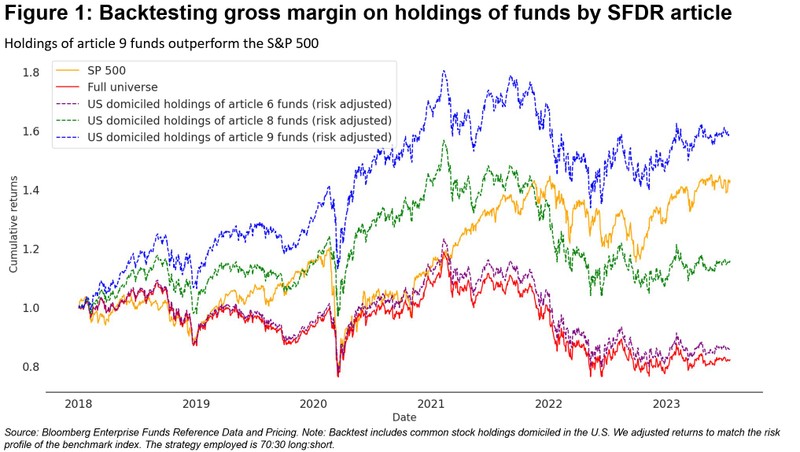

We took the universe of funds disclosing under SFDR Article 9, 8 and 6 and extracted the US equity holdings in these funds. We then devised a backtest to compare the returns from investing in these equity holdings when their gross margins were in the top 15% of our universe with returns from shorting the holdings with margins in the bottom 15%, applying quarterly rebalancings between 2018 and 2023.

As shown in figure 1, the backtest shows that holdings of Article 9 funds out-performed relative to the S&P 500, which we use as the benchmark as the test focuses on US equity holdings.

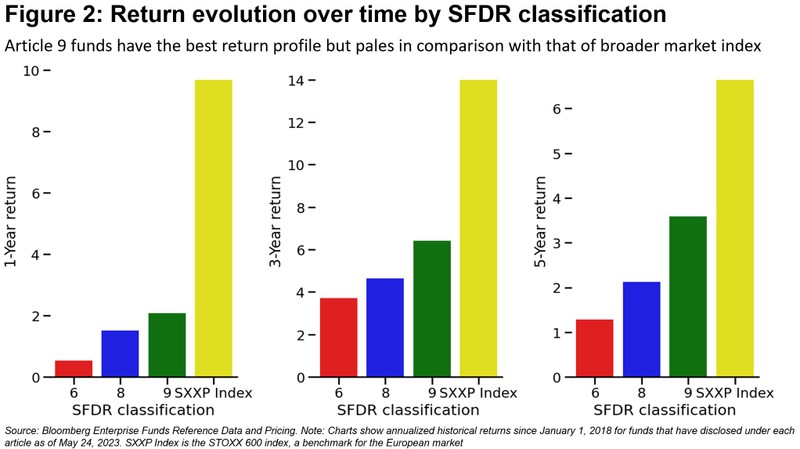

To arrive at this result, we began the analysis by looking at average 1, 3 and 5-year returns for funds grouped by SFDR category. Figure 2 shows how these returns compare to the STOXX 600 since the funds are domiciled in the EU. While Article 9 funds have the best returns here as well, they fall short of the benchmark index over all the time periods we examined.

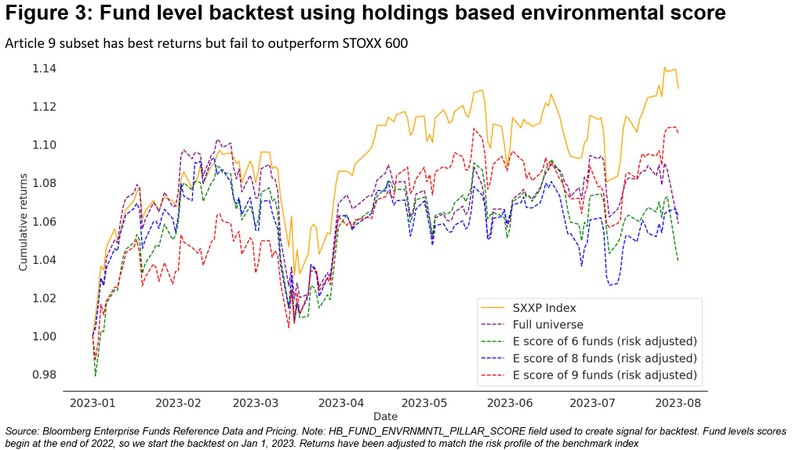

Since the funds on their own performed worse than a market index, we decided that a financial backtest was necessary. For this backtest we used Bloomberg’s environmental scores for each fund category to compare the returns from investing in the funds with ‘E’ scores in the top 15% of our universe with selling funds in the bottom 15%, rebalancing daily. Figure 3 shows that the performance of SFDR Article 9, 8 or 6 funds is better than seen in figure 2 but is still not as good as the STOXX 600.

We therefore decided to go one layer deeper and test against funds based on their holdings. As stated in figure 1, for this test we used common financial ratios (such as earnings-per-share, inventory turnover etc.) to create a signal for the US-based equity holdings of funds belonging to each SFDR article. The results of the backtest reveal out-performance for equities holdings of Article 9 funds against the S&P 500 benchmark.

We used several Bloomberg datasets for these backtests including Fund Reference and Pricing data to identify SFDR disclosures for all European funds, Fund Holdings to isolate the US-domiciled holdings and the Company Fundamentals product to access the financial ratios we used to create a trading signal.

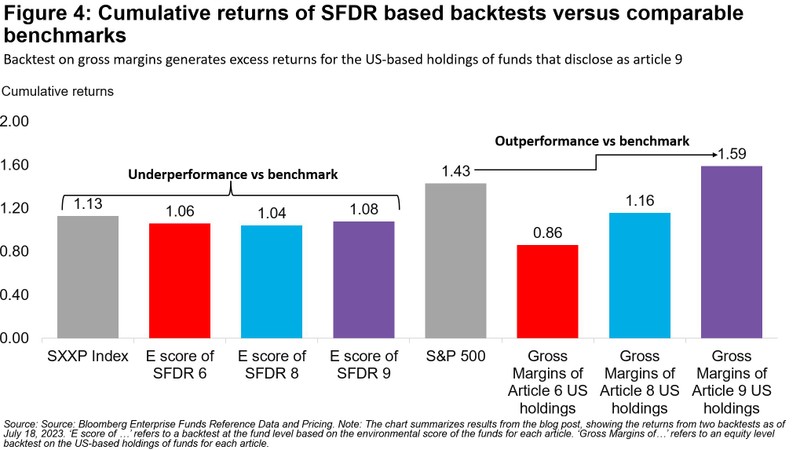

To recap, the research set out to use SFDR disclosures as a means to find differentiated performance in an investment strategy. This is not possible by simply investing in funds based on their SFDR article (figure 2). Running a backtest using the funds environmental score improves performance, but not enough to beat a comparable benchmark (figure 3). We were able to observe differentiated performance, however, for the US-based holdings of SFDR Article 9 funds when backtesting using gross margins (figure 1). The results of both backtests are summarized in figure 4.

While this research was done relatively quickly, we were able to observe clear gains in our investment strategy by incorporating and combining Bloomberg’s ESG data with more traditional fundamental datasets. By digging into the data of these disclosures one can uncover trading signals and help realize unique investment opporuntities.

To learn more about Bloomberg’s Funds Data Solution used in this analysis, please visit our website here. To learn more about Bloomberg’s Company Fundamentals Product, please visit our website here. To learn more about Bloomberg’s Sustainable Finance Solutions, visit our website here.