This analysis is by Bloomberg Intelligence analysts Ira F Jersey and Angelo Manolatos. It appeared first on the Bloomberg Terminal.

This year will be the important transition period away from LIBOR to SOFR, which affects almost $200 trillion of financial products. The Alternative Reference Rates Committee’s (ARRC) updated implementation plan reflects passing milestones, such as trading in SOFR-based futures and over-the-counter derivatives.

Progressing toward a SOFR world

One year in, the transition toward SOFR has seen several milestones crossed, and while full-scale adoption has been modest at best, we think 2019 could see an acceleration in SOFR usage. Federal Reserve Chairman Jerome Powell said that SOFR was the best rate available, giving it a top regulator’s stamp of approval. The introduction of futures and the first $50 billion of cash securities issuance have been steps toward wider adoption.

The transition toward SOFR has progressed somewhat faster than the ARRC’s phased transition plan originally envisioned. In our view, the next major mile marker will be for central counterparties to allow a choice between using the current swap discounting or SOFR discounting.

Statement

“Transition will be a complicated task. … ARRC members have become more comfortable with the idea that a transition is feasible. … In our view, the ARRC has chosen the most robust rate available.”

Jerome Powell, Federal Reserve introductory remarks, roundtable of the Alternative Reference Rates Committee

Nov. 2 2017

SOFR: The chosen reference benchmark

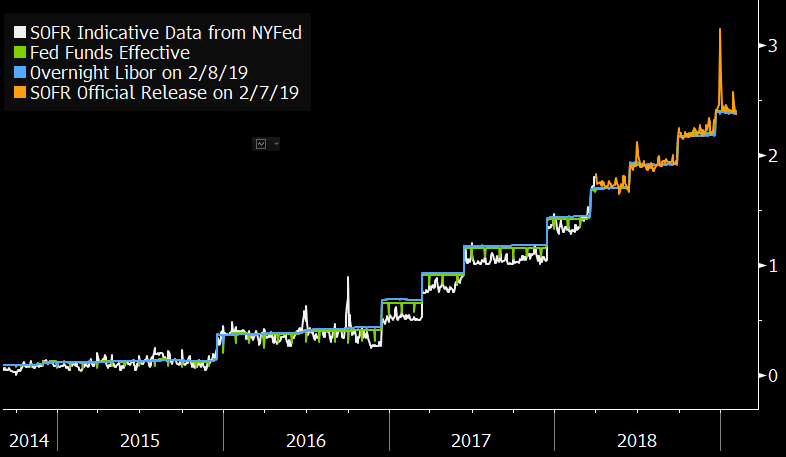

SOFR was chosen by the ARRC on June 22, 2017 as the alternative reference benchmark. SOFR is derived from transactions in the overnight Treasury repurchase agreement market. The Fed began to publish data as of March 2, 2018. Similar to the New York Fed’s previously released indicative data, the SOFR has been much more volatile than other overnight rates such as overnight LIBOR and the federal funds effective rate.

One interesting aspect is that SOFR has been wide vs. the other rates, while the indicative data showed it had been primarily below those rates. Given that SOFR should theoretically have lower credit risk than the alternatives, this fact is somewhat surprising and may revert over time.

SOFR vs. LIBOR and Fed Funds

Summary of paced transition plan

Significant progress was made in 2018 in the transition to the SOFR. In October, the Chicago Mercantile Exchange began clearing SOFR swaps using SOFR price alignment interest (PAI) discounting; this was originally planned to occur in 1Q19. We believe the plan is likely to be fulfilled faster than envisioned. Additionally, futures on SOFR began trading well before the timeline suggested. It’s possible that a liquid term derivative market allowing for a term benchmark may occur well before 2021, as contemplated by the transition plan.

As soon as a liquid term derivatives market is established, the rate is likely to be used more regularly in cash and derivatives transactions. In fact, we’re not sure term rates based on SOFR are necessary, if current compounding conventions become the market standard.

Trillions of notional value to transition

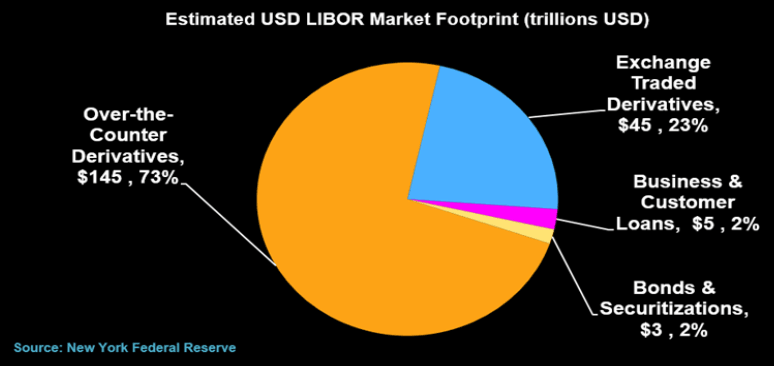

U.S. rate markets predominantly use LIBOR and fed funds as reference rates in derivative contracts. Overnight index swaps and fed funds futures reference the fed funds effective rate calculated by the New York Fed. Most other U.S. dollar swaps reference the London interbank offered rate (LIBOR). Large money-center banks, such as JPMorgan, Citigroup, Deutsche Bank and Goldman Sachs, are major swap counterparties.

There’s about $200 trillion in notional value of securities, over-the-counter (OTC) derivatives and listed U.S. interest-rate derivatives tied to these two benchmarks. Fallback language in ISDA documentation will be a major discussion point during the transition. The goal would be to clarify what new rate applies should a reference rate become less viable over time.

About $200 trillion of securities and derivatives

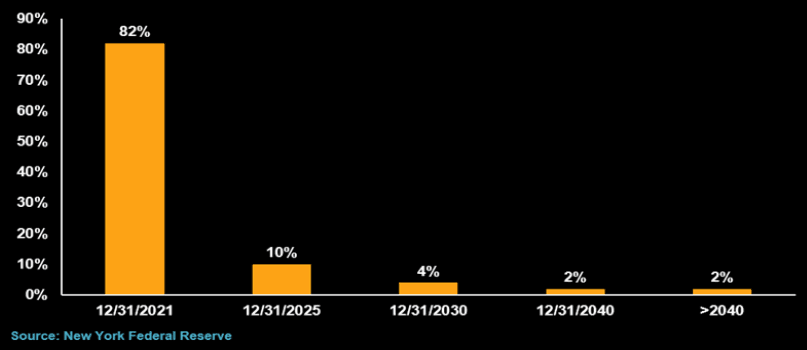

Most LIBOR instruments mature by 2021

According to the ARRC’s maturity waterfall, the majority of LIBO-referenced financial instruments will come due by the end of 2021. This includes over-the-counter and exchange-traded derivatives, loans, bonds and other securitizations. Even for those instruments that mature further out, amending the prospectus or agreement to reflect SOFR instead of LIBOR would likely be a straightforward task for many counterparties.

Estimated LIBOR-based instrument maturities

The syndicated-loan market may experience greater friction in switching to SOFR, however — the current language in many credit agreements only defines a fallback rate that’s similar to LIBOR if the reference rate is unavailable. SOFR-related language may start to appear in credit agreements once the new rate has proven to be robust.