As we’ve stated before, MiFID II is more a journey than an event, and trade reporting is another example of that, particularly for the buy side. Data gaps, in particular SI determination, are expected to be filled in 2018, and in conjunction with more regulatory guidance, this should help firms implement the regulation in a robust, systematic manner.

Amid this uncertainty, what’s a buy-side firm to do? And can it get help from brokers? Below we outline how firms can use Bloomberg’s solutions to trade report.

1. What are the obligations of buy-side firms?

The buy side needs to submit and verify that the report was submitted in a timely manner and without errors. For reports submitted to the Bloomberg Approved Publication Arrangement (APA), which has been approved by the UK FCA, Bloomberg has created a blotter for verification purposes. We have also created several solutions to help buy-side firms submit trade reports so they can:

- Get their counterparty to “assist them” by submitting a trade report on their behalf for publication; or

- Submit the trade report themselves.

2. How can firms determine if they have an obligation?

If the trade is completed on an EU trading venue, or the counterparty is an SI, the buy side does not have a trade reporting obligation.

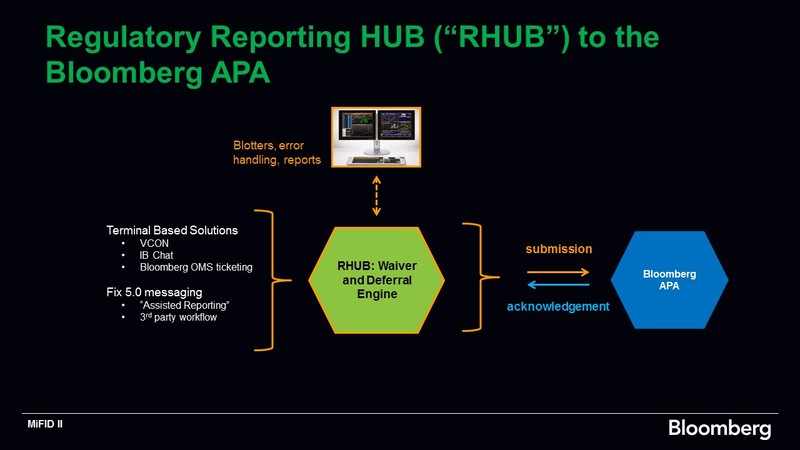

In all other situations however, there may be a trade reporting obligation. Bloomberg’s Regulatory Reporting Hub (RHUB, Figure 1) will take the guess-work out of what has to be reported.

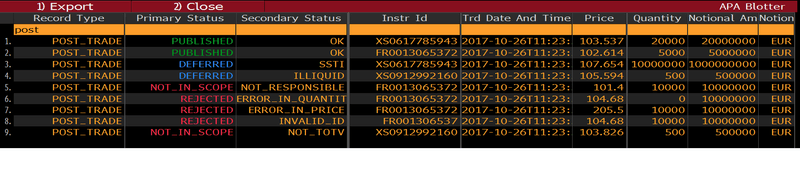

RHUB is a regulatory compliance engine “brain”. After receiving a submission, RHUB first validates whether the instrument is traded on a trading venue (TOTV) and subject to the trade reporting obligation. It then determines if the size of the trade requires immediate transparency, or makes it eligible for time-deferral. RHUB also runs data quality checks on the submission before it sends the trade to Bloomberg’s APA for publication (Figure 2). The RHUB blotter displays the APA publication status so the buy-side firm can verify that the trade was submitted and published in a timely manner without errors

3. How can firms submit trade details for publication?

Bloomberg offers multiple solutions:

- VCON, Bloomberg’s voice trade confirmation system

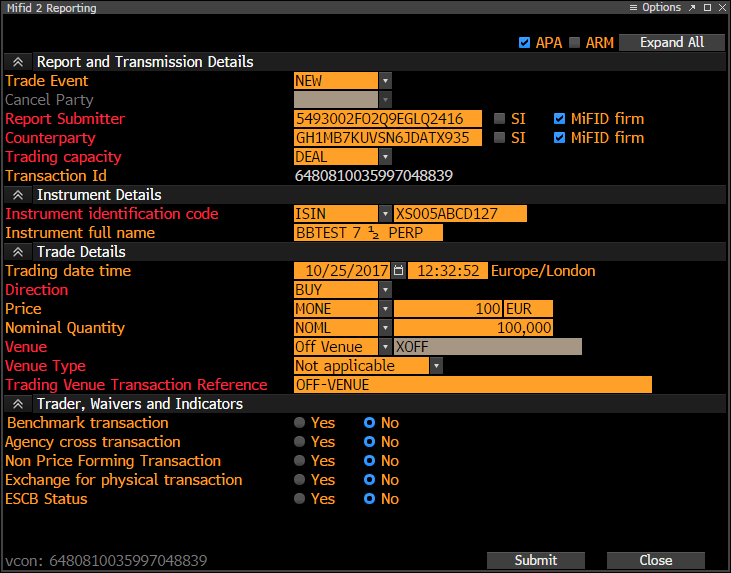

At the final stage of the voice-trading process, the sell side may confirm trade details with the buy side through VCON ticketing. Either party, after the trade is confirmed, can click “Report to RHUB” from VCON <GO> to submit the trade details to RHUB for validation and the Bloomberg APA for publication (Figure 3). Of course, in this scenario the buy side only needs to trade report if it is the seller and the counterparty is not an SI.

- FIX

If a buy-side firm determines that it has a frequent obligation, it can use FIX 5.0 or FIXML via MQ connectivity to integrate its OMS ticketing workflow with RHUB. If the OMS does not support FIX 5.0, Bloomberg’s Connectivity Integration Solutions can leverage custom tags and “map” messages to the FIX 5.0 format for RHUB consumption. Bloomberg’s buy side order management system, AIM, is integrated with RHUB in this manner. Bloomberg’s sell side Trade Order Management System (TOMS) is integrated with RHUB as well.

- Assisted Reporting

According to the FCA’s Final MiFID II Policy Statement in July 2017, the regulator will allow brokers, as part of their execution services, to “assist” their buy side customers by submitting a trade report for publication on their behalf, without it being deemed an inducement.

The sell side can leverage FIX 5.0 or FIXML via MQ connectivity from their OMS ticketing workflow to submit their own trade reports, or assist buy-side customers in sending trades to RHUB for publication by the Bloomberg APA.

4. How does assisted reporting work?

The buy-side firm has to become a member of the Bloomberg APA since the report will be made on its behalf. The broker submits the trade details to RHUB, which first determines if the instrument is TOTV. If it is, then RHUB determines who the responsible reporting party is. Brokers can enable their buy-side counterparty (LEI) for assisted reporting in RHUB. If the EU broker has enabled the customer and the buy side is the seller, then the reporting is “assisted”. If the broker is not an EU MiFID II investment firm, then regardless of the side of the trade, the buy-side firm is responsible for reporting and the submission will be treated as assisted.

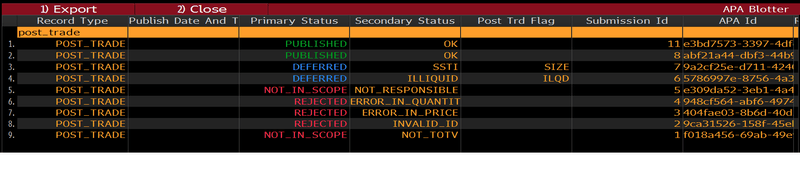

RHUB then finishes its data integrity checks, and depending upon the size of the trade, eligibility for a time-deferral is determined. RHUB will either immediately submit the report or wait for the deferral period to expire before submitting the details to the Bloomberg APA for publication. The RHUB blotter enables the buy side to confirm the status of the trades submitted “on their behalf”. This enables compliance departments to verify that the trade-transparency obligation was met and that the report was published in a timely manner without errors (Figure 4).