Shining a light into the dark: What pre-trade and post-trade data will MiFID II make public?

MiFID II’s transparency regime is an essential component to achieving the regulation’s goals: strengthen investor protection and ensure fairer, safer and more efficient markets. The new regime will also support financial crisis reforms leveraging the power of data – in the form of observable actionable quotes and trades – to perform risk reducing activities. In particular, the assessments required by the Fundamental Review of the Trading Book (FRTB), liquidity assessments, ratio calculations, price fairness compliance checks and collateral quality assessments will benefit from the new rules.

1. What quote and trade information will become available on 3 January 2018?

The pre-trade firm prices (quotes) and post-trade prices for non-equity and equity-like instruments from trading venues, and the actionable indications of interest (AIOIs) from systematic internalisers will become freely available to the public after 15 minutes. However, the providers of real-time information, i.e. trading venues (exchanges, MTFs or OTFs) or Approved Publication Arrangements (APAs), can offer more timely information on a commercially reasonable basis.

2. Will all firm quotes and post-trade prices be disseminated?

MiFIR introduces pre-trade transparency waivers and post-trade transparency deferrals to balance the goals of the regime with the potential (adverse) impact of transparency on a market maker’s ability or willingness to provide liquidity. Under certain conditions, pre-trade price transparency can be waived and post-trade details deferred, depending upon an instrument’s liquidity or quote/trade size.

3. What are the thresholds?

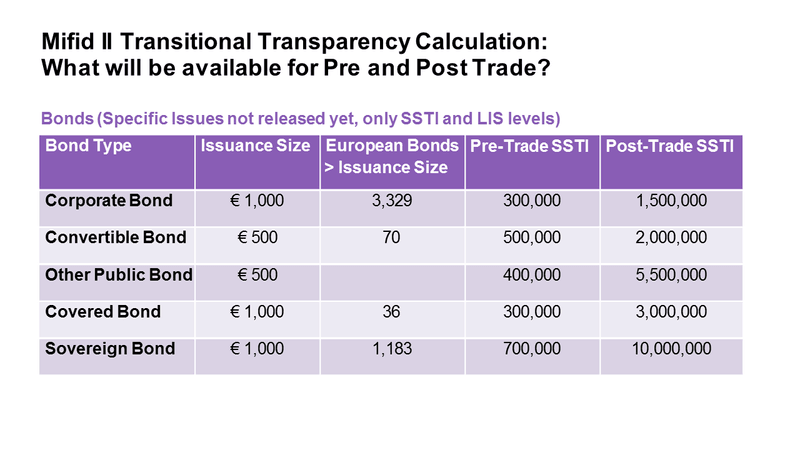

Transparency is determined by a two-part test. If an instrument is liquid and the size of the quote/trade is below the size-specific to the instrument (SSTI) threshold, it needs to be reported in real-time. Otherwise, pre-trade reporting will be waived and post-trade reporting will be deferred.

Trading activity was chosen as the basis for the liquidity designation. ESMA initially set 15 or more “average daily number of trades” as the benchmark and threshold to designate bonds as liquid or illiquid.

4. Will waivers and deferrals be uniform?

Although EMSA sets financial instrument liquidity designations, and initial waiver and deferral thresholds for when quotes and trades are published to the market, waivers and deferrals may not be uniform across the EU. MiFIR enables NCAs to re-designate instruments in a manner that allows for greater transparency.

Markets and their participants differ across the EU. An NCA’s approach to transparency may be governed by its particular stance on investor protection. For example, in markets with significant retail participation, NCAs may consider a financial instrument to be liquid and raise the large in scale threshold in order to make more prices subject to real-time public dissemination. On the other hand, NCAs in markets with comparatively more institutional participation may decide to petition ESMA to grant an exception, so that quote and trade information dissemination is more conservative. Transparency is just one of a few areas where we may see different “flavors” or combinations of MiFID II.

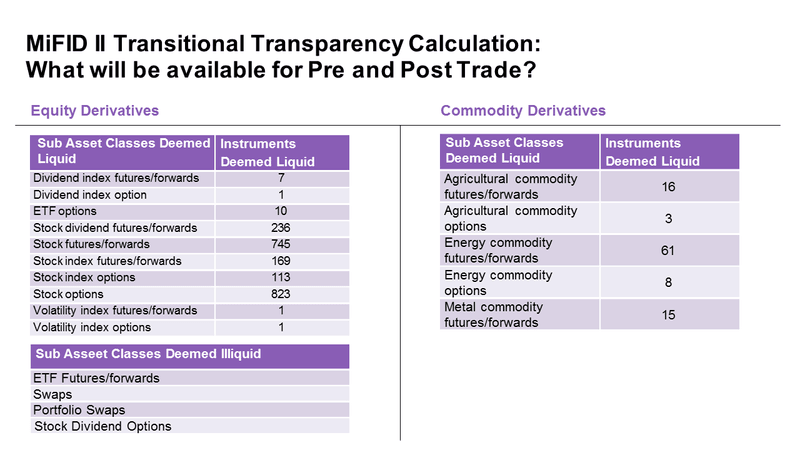

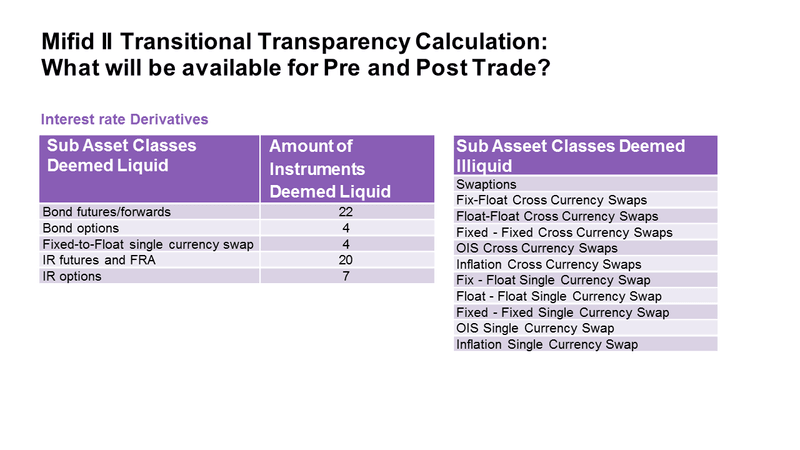

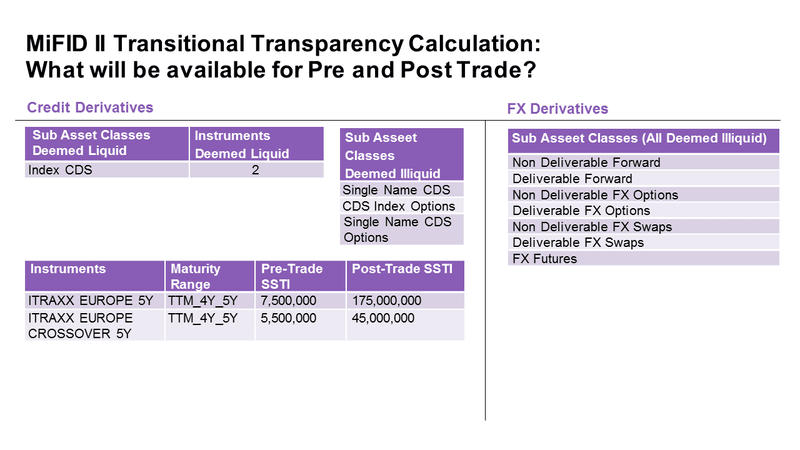

5. Will there be a lot of new information?

MiFID II data is like a box of chocolates – we don’t really know what we are going to get. Our best guess is that initially there will be a limited, but potentially valuable set. A few unknowns remain. For example, derivatives trade data may be published without identifiers. Without these, descriptive instrument information may not be sufficient to organize the data and map it to a ticker.

We also won’t know how much data will be released, and when, until the regime actually starts. There is definitely an estimation issue as many of these asset classes do not have any formal transparency mechanisms to provide a complete set of data to analyse. Based on the 15 average trades a day suggested in ESMA’s consultation paper, TRAX estimated that less than 300 corporate bonds would have a liquid market at the start of the transparency regime. According to ESMA’s initial analysis, as many as 1,100 bonds could be eligible for transparency. We will have more clarity in December, when ESMA releases information about which bonds are considered liquid at the instrument level.

6. Who will be offering real-time data feeds?

Market data providers, such as Bloomberg, are planning to aggregate quote and trade data by connecting to trading venues and Approved Publication Arrangements (APAs), such as the ones recently authorised by the FCA (which include Bloomberg’s APA).

Bloomberg plans to connect to multiple APA’s and trading venues to collect the data, categorize and identify trades, enrich the data, and disseminate it on a real time feed. The feeds will be available on terminal and off terminal through our real time delivery system, BPIPE. We will seek to organize the data to flow through the system much like we do with FINRA’s TRACE and other real-time data feed providers.

Is this consistent with your views? We are interested in your thoughts. Please emails us at bbg_mifid@bloomberg.net