LIBOR fallback spread to SOFR could stabilize in months ahead

This analysis is by Bloomberg Intelligence analysts Ira F Jersey and Angelo Manolatos. It appeared first on the Bloomberg Terminal.

The implied LIBOR fallback spread used for derivatives once the ubiquitous benchmark is no longer published could stabilize over coming months. We see the median spread using ISDA’s calculation remaining below 30 bps. Such a move could mirror the 2012 experience. We also review the available fallback data on the terminal.

LIBOR/SOFR spread adjustment could stabilize

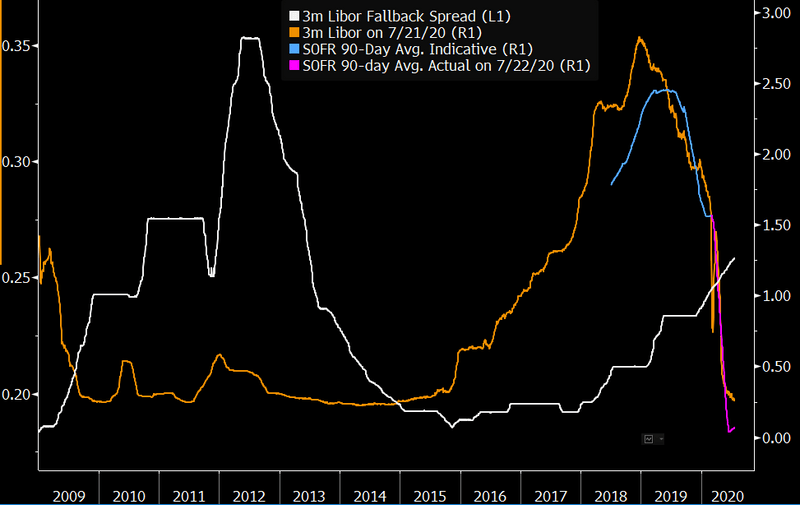

As the initial LIBOR spread widening from the COVID-19 crisis subsides, it’s likely the ISDA LIBOR fallback spread will continue to stabilize. Below, we include information on ISDA fallback information that’s available on the Bloomberg terminal. The indicative data show how the stability of the fallback spread can change over time. However, it has tended to remain in a 20-bp range over the past 11 years. Following the financial crisis that began in 2007, the fallback spread widened to as much as 35 bps on the heels of the European currency crisis, but subsequently fell as low as 19 bps in 2015.

Since early 2018, the spread has climbed to almost 26 bps today, with the last two steps wider coming as the Federal Reserve cut rates in 2019 and earlier this year. Yet as in 2012, the spread may widen the next month then stabilize.

ISDA LIBOR/SOFR fallback spread climbing in crisis

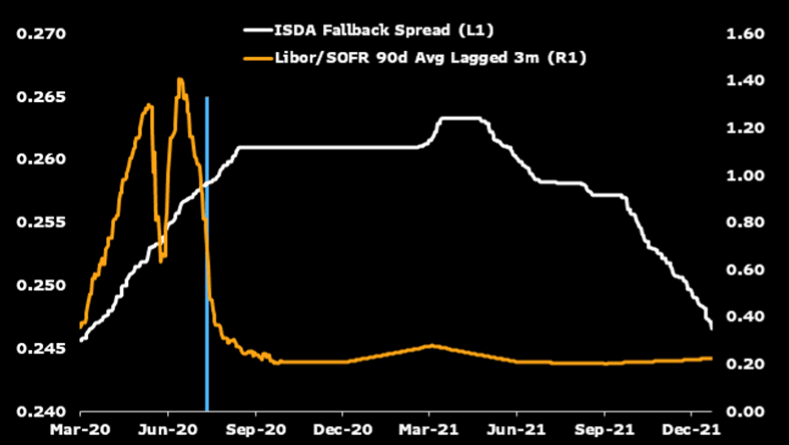

LIBOR/SOFR spread adjustment could wind up at pre-COVID-19 Level

The three-month LIBOR/SOFR five-year median spread adjustment, as recommended by ISDA, could revert to pre-coronavirus-crisis levels, assuming rates implied by futures are realized. The LIBOR spread above the secured overnight financing rate (SOFR) should peak below 27 bps, reflecting the LIBOR/SOFR spread tightening following the March-April blowout. Assuming spreads remain tight, the median could decline toward 24 bps as we approach the 2021 LIBOR-end date.

The fallback spread is important as trillions of dollars of notional value in cash and derivative instruments are tied to LIBOR, and will be reset to the rate on the date the fallback is triggered. Therefore billions of dollars may be transferred in mark-to-market derivatives, and cash securities may reprice in a brief period.

Three-month ISDA median spread, LIBOR/SOFR

FBAK <GO> function for ISDA fallback spread

Visit FBAK <GO> on the terminal for ISDA IBOR fallback rates. This function includes daily publication of the adjusted references rates (SOFR in US) and the official spread adjustment between adjusted reference rates and IBOR rates (USD LIBOR). Finally, the sum of the two is the official “all in” ISDA fallback rate.

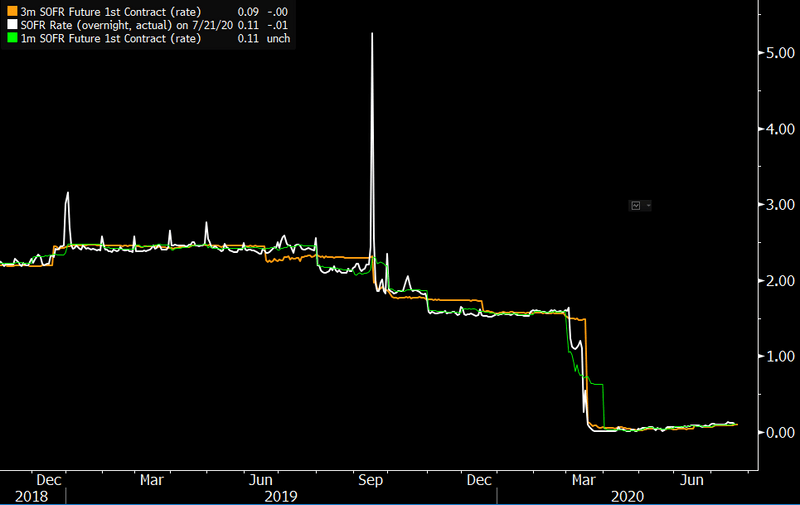

Overnight moves’ limited effect on term rates

Overnight lending rates occasionally have periods of significant volatility, but such moves usually have little impact on expected term rates unless the market anticipates the volatility will persist. The brief spikes in the overnight SOFR rate in September did little to the overall market expectation for the rate as priced by SOFR futures. The market appears to have anticipated the spikes wouldn’t become regular occurrences and that the higher SOFR rate wouldn’t last.

Some have suggested it was only the Federal Reserve’s intervention that averted persistently higher repo and SOFR rates. We don’t completely discount this, but we note that SOFR spiked by more than 60 bps at year-end 2018. This also didn’t affect the pricing of SOFR futures, as the market understood the spike higher was temporary.

September SOFR spike barely affected term futures

SOFR remains realistic LIBOR substitute

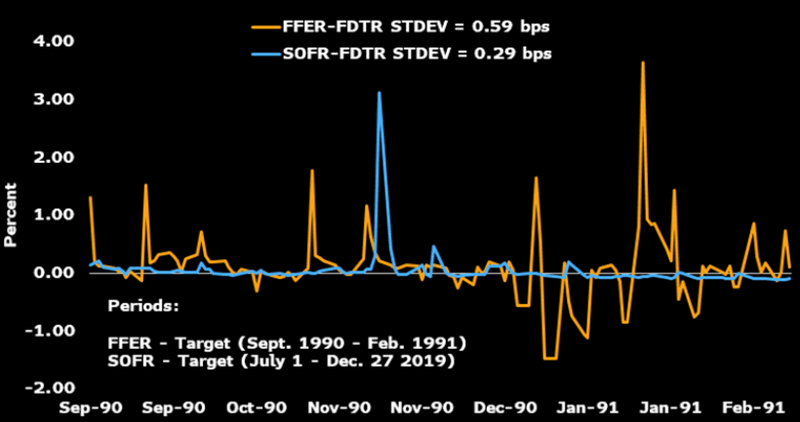

Criticism that SOFR may be too volatile to be a realistic benchmark misses the mark, in our view. Market-based benchmark rates tend to see brief but dramatic moves. While LIBOR isn’t volatile due to its trimmed mean and survey construction, other benchmarks such as the federal funds rate have tended to be quite volatile throughout their history before 2007. For example, from September 1990-February 1991, fed funds’ moves away from the target totaled almost 60 bps. For the past six months, SOFR’s moves away from target had a standard deviation less than half that magnitude.

We admit the rate level was much higher in the early 1990s compared with today, but this doesn’t detract from the point that regular moves of over 100 bps away from the target (both above and below) were commonplace. The same can’t yet be said for SOFR.

Standard deviation of Fed funds & SOFR from target