How does clock synch really work? An update.

We originally discussed how clock synchronization works on the Bloomberg Terminal in September 2016. At that time, we had solutions in place for U.S. broker compliance with FINRA Rule 7430. These required brokers to synchronize their business clocks to the National Institute of Standards and Technology (NIST) atomic clock, and we were planning on using a similar solution for MiFID II.

According to RTS 25, clock synchronization enables market participants, trading venue operators and regulators to reconstruct events. It is essential “for conducting cross-venue monitoring of orders and detecting instances of market abuse, and allows for a clearer comparison between the transaction and the market conditions prevailing at the time of their execution.”

The regulation instructs market participants performing certain activities to synchronize their business clocks in order to record the date and time of any reportable event with the Coordinated Universal Time (UTC). This is issued and maintained by the timing centres listed in the latest Annual Report on Time Activities from the Bureau International des Poids et Mesures. The Annex to RTS 25 prescribes a maximum divergence/drift that is acceptable for the type of trading activity that is being undertaken.

1. How is clock synch practically implemented?

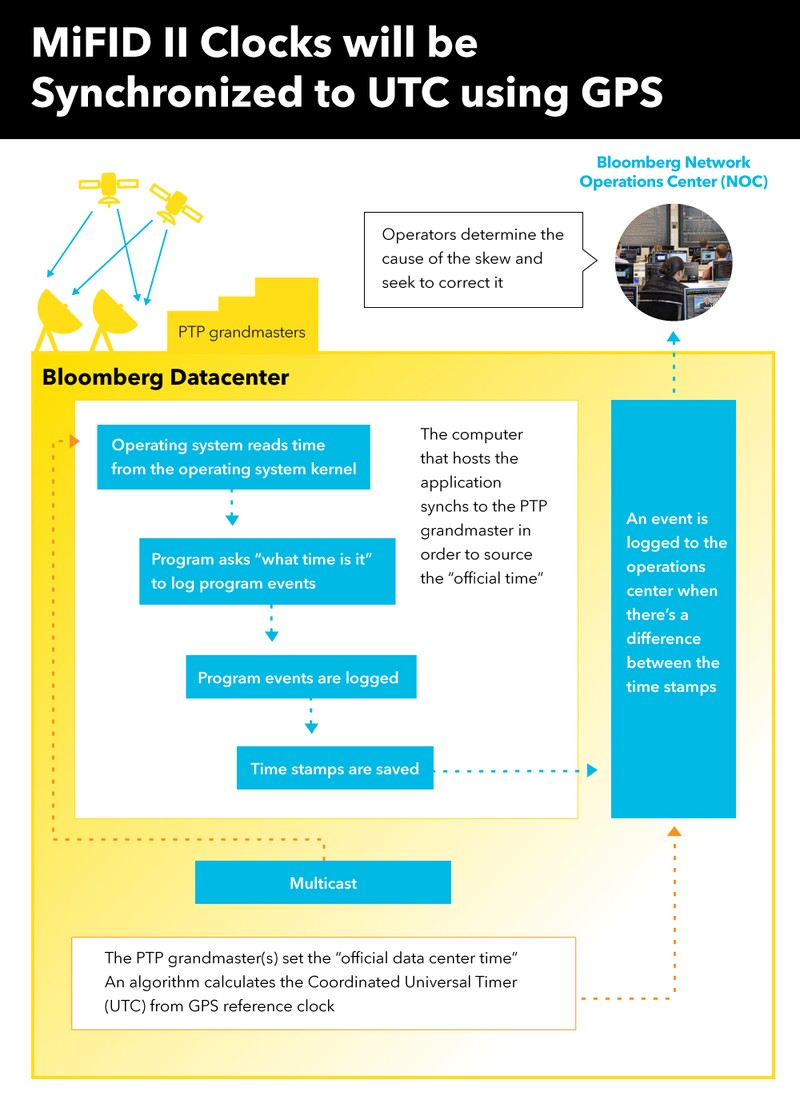

Consistent with the instructions of the Bureau International des Poids et Mesures, Bloomberg uses Global Positioning System (GPS) satellites to source UTC time.

Global positioning satellites each have multiple atomic clocks that are coordinated to transmit the “official” time. At each Bloomberg data center, there are multiple antennas and GPS time receivers with high quality hardware clocks, or Precision Time Protocol (PTP) grandmasters, synchronized against a constellation of GPS satellites (Figure 1). Each PTP grandmaster contains an atomic clock receiving its own GPS signals. The PTP grandmaster transmits the time into the data center using the precision time protocol. The grandmaster sets the official “datacenter network time.” Bloomberg has redundancy built in each data center.

2. How does the time get to the applications where the time-stamping occurs?

Platforms such as Bloomberg’s Order Management Systems, fixed income trading applications, order routing etc. are “hosted” on computers in the data center. The computers’ operating systems kernel receive time updates every 2 seconds and update their clocks appropriately to maintain synchronization within the MiFiD II requirements.

3. How is drift monitored?

An independent feedback loop monitors whether the time is referenced correctly. If the difference between the application’s operating system, and the PTP grandmaster’s time stamps drift past the MiFID II designated threshold for the activity, a notification is sent to the operations center to investigate what is causing the drift.