Bloomberg Professional Services

Geopolitics and trade policy are no longer background noise. Tariffs, industrial policy, and currency pressures are reshaping supply chains, balance sheets, and cross-border capital flows, especially across Asia. Investors need risk capabilities that can keep pace: tools that connect macro shocks to portfolio outcomes, and frameworks that make those linkages explainable.

Drawing on recent insights from Bloomberg Intelligence and Bloomberg’s risk and performance specialists, this article looks at how investors can upgrade their approach to risk in this new environment.

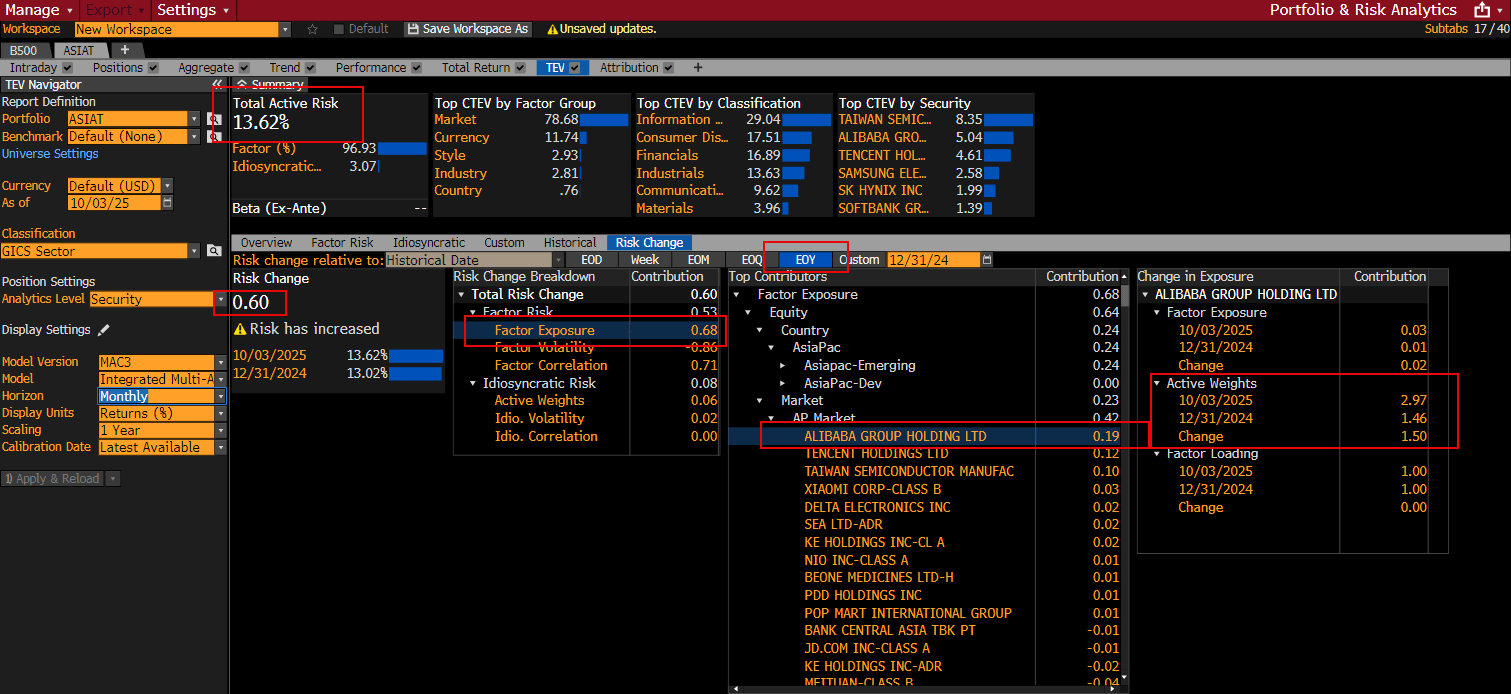

Tariffs redraw trade

U.S. tariffs are accelerating a structural reconfiguration of global trade. For Asia, the question is not simply who gains from supply chains shifting out of China, but how enduring those shifts will be and where the next bottlenecks may emerge.

Analysis of port operators across major ASEAN economies shows a pattern that many infrastructure investors will recognize: an initial surge in shipments as exporters rush to beat tariff deadlines, followed by a period of weaker volumes as elevated inventories are worked down. That whiplash can obscure longer-term trends.

Two dynamics stand out:

- Many ASEAN exporters face U.S. tariffs in the 19–20% range, materially below those imposed on China or India. That pricing differential continues to support the relocation of supply chains into Southeast Asia.

- Intra-Asia trade is becoming a more important growth engine, as regional consumption rises and regional supply chains deepen.

For risk managers, the implication is that tariff shocks should not be modeled as one-off events. They are catalysts for gradual, path-dependent shifts in trade flows, capacity deployment, and local demand – all of which can be incorporated into regional and sector factor exposures.

Banks build resilience

Trade dislocation and tariff uncertainty flow through to the financial system via asset quality, funding costs, and capital buffers. Across Southeast Asia, lenders have spent years tightening risk controls, boosting provisioning, and strengthening capital positions. That investment is now being tested.

In general, larger banks in Singapore, such as DBS, OCBC, and UOB, appear better positioned than many regional peers to absorb tariff-related pressures. Expected credit costs may rise modestly as banks make provisions for both direct and indirect exposures, and net interest margins may narrow as rates fall, but overall asset quality may remain resilient.

The picture is more nuanced elsewhere. Relative to regional peers, Thai banks face more pronounced asset-quality headwinds in a challenging macro environment that has already led major rating agencies to place the sovereign outlook on negative. Yet even here, provisioning and capital buffers provide adequate shock absorbers.

India’s Tariff Shock

In India, the impact of U.S. tariff measures is more targeted. A surprise 50% tariff creates near-term pressure, but key sectors such as pharmaceuticals and electronics – representing roughly 30% of India’s exports to the U.S. by value – remain exempt. Combined with domestic stimulus, that helps support demand. Indian banks’ direct loan exposure to the most affected export sectors is relatively limited, and larger institutions such as ICICI, SBI, and HDFC benefit from diversification and stronger balance sheets.

For investors, these differences underline the need for granular credit and country risk modeling. “Banks in Southeast Asia” is not a single risk factor; it is a set of distinct stories about capital strength, exposure concentration, and policy sensitivity.

Indonesia policy and currency

Indonesia illustrates how policy innovation can create both opportunity and new forms of risk. The creation of the sovereign wealth fund Danantara, tasked with overseeing state-owned enterprises, is intended to improve efficiency and attract investment in strategic sectors ranging from food security to digital infrastructure.

Alongside that ambition, investors must account for execution and governance risk. State-owned enterprises face pressure to raise dividends to fund investment plans and debt service. A 10% increase in state revenues targeted for the 2026 budget has fuelled uncertainty for the mining sector, which faces the possibility of new export levies on top of royalty hikes.

On the currency side, rupiah depreciation remains a watchpoint, but Indonesian banks have kept net open foreign exchange positions below 3%, and foreign currency loans are broadly matched to deposits. Direct currency risk appears manageable, although borrower strain could manifest indirectly.

Here again, risk teams benefit from frameworks that can separate policy, credit, and currency channels, and test them via targeted scenarios rather than treating “Indonesia risk” as a single, opaque bucket.

Reimagining risk models

These regional case studies highlight a broader shift: risk is moving from a back-office control to a front-office decision tool. That shift requires both richer models and more intuitive interfaces.

Multi-asset risk models such as Bloomberg’s MAC3 (Multi-Asset Class Version 3) illustrate what “next level” looks like in practice. MAC3 combines:

- Factor-based models that decompose securities into market, sector, style, and currency drivers.

- Full-revaluation approaches that directly reprice instruments, especially derivatives, under different scenarios.

- Dedicated single-country models with local style and industry factors to better reflect domestic market dynamics.

By incorporating more than 2,000 factors across equities, fixed income, and alternatives, such models allow investors to see how a policy shock propagates through an entire portfolio.

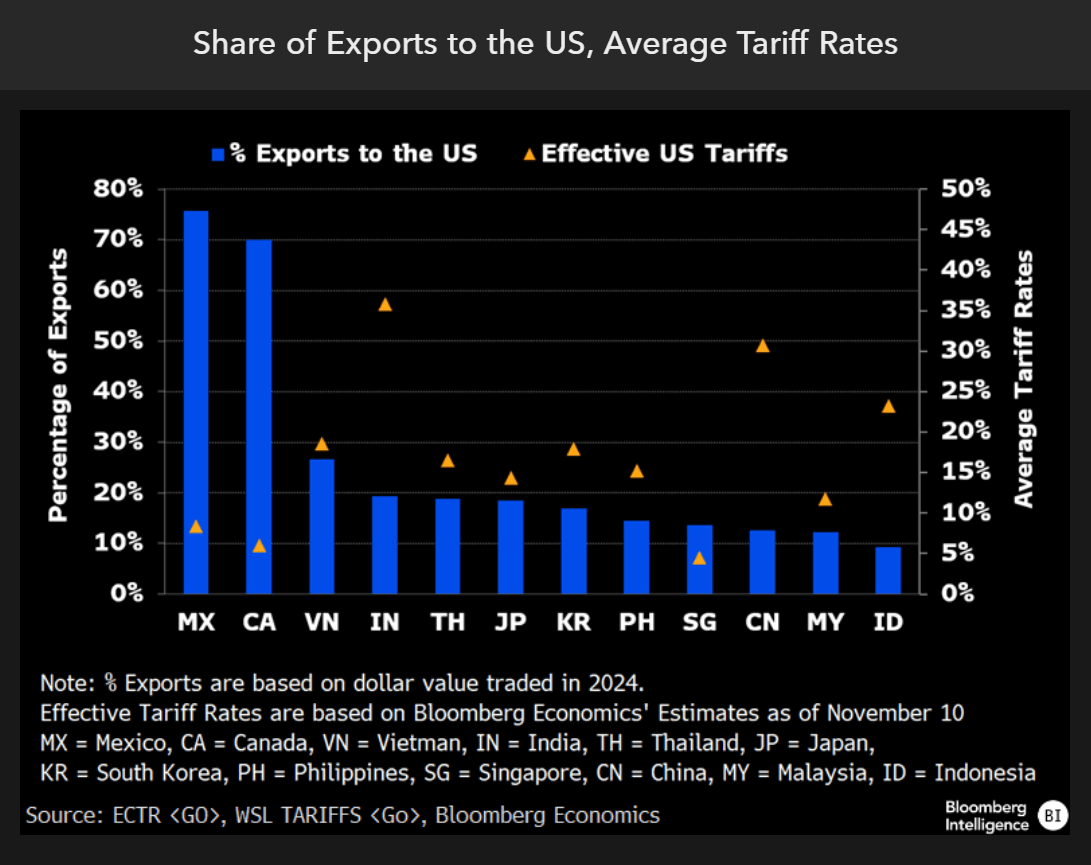

Image 1: Factor-Based Scenario Definition by shocking the US Semiconductor FactorIllustrative factor-based scenario: defining a semiconductor tariff shock in a U.S. equity index.

Consider a tariff-driven semiconductor shock. Applying a 15% negative move to a U.S. semiconductor factor within an index resembling the S&P 500 can yield an estimated 2.3% decline in the overall index value. The same analysis can be replicated across any sector, region, or custom portfolio, using the cross-asset and cross-country correlations embedded in the model.

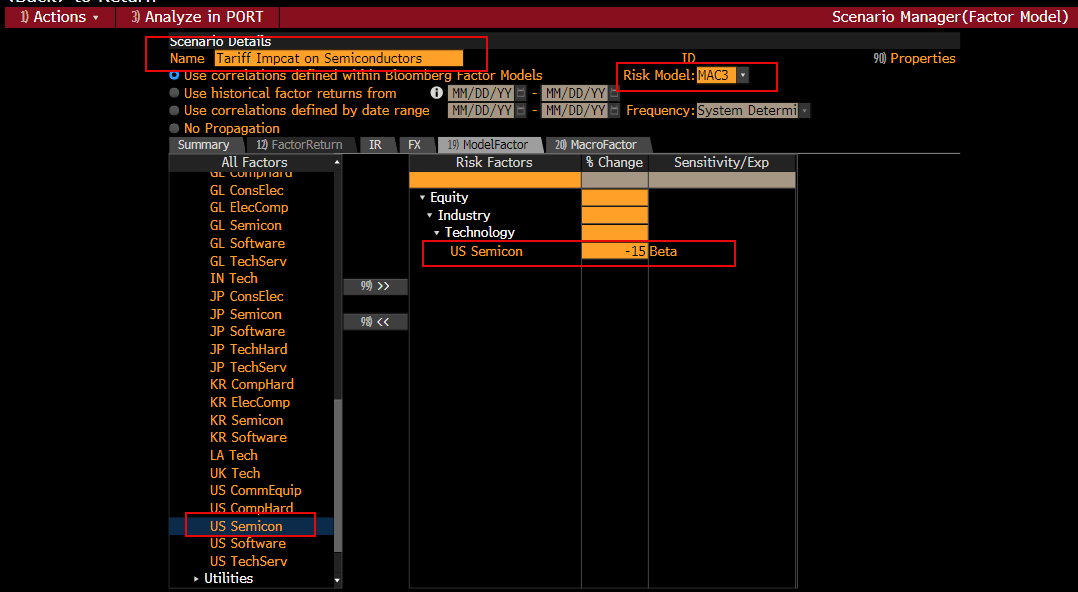

Image 2: PORT WS showing the analysis of the Semiconductor shock on US Market Index B500Portfolio-level view of an illustrative semiconductor shock, showing index and sector impacts.

The key is not just to quantify the impact, but to make those results usable by portfolio managers, risk committees, and clients.

Understanding risk change

One persistent question for risk teams is simple to ask and difficult to answer: why did our risk change?

Traditional reports often show that Value-at-Risk or tracking error moved higher, but not whether the driver was a shift in positions, market volatility, or correlations. Newer tools, such as Bloomberg’s Risk Change Attribution, focus directly on this problem.

By comparing two points in time and sequentially repricing the portfolio, the method decomposes the change in risk into three main components:

- Exposure effects: how position changes altered risk.

- Volatility effects: how changes in factor or asset volatility contributed.

- Correlation effects: how relationships between factors evolved.

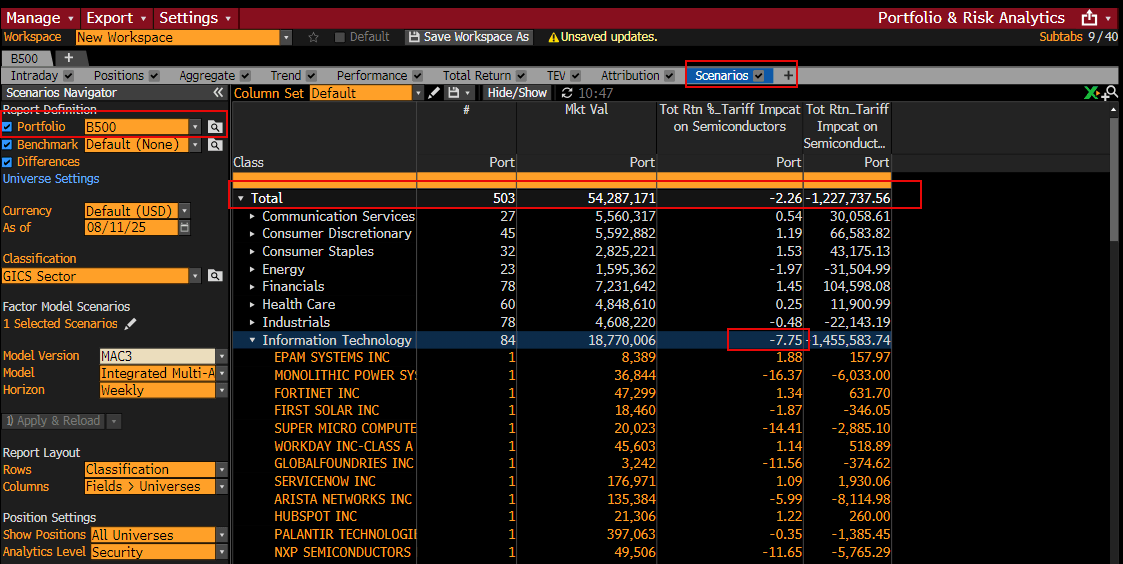

Image 3: PORT WS showing the Risk Change of a given portfolio over timeRisk change attribution view, decomposing portfolio risk shifts into exposure, volatility, and correlation effects.

In one example, a 60 basis point increase in an Asia equity index’s volatility was traced largely to a 1.5% increase in the portfolio weight of a single name, Alibaba. That level of transparency turns a generic risk metric into a concrete conversation: should that position be reduced, hedged, or justified based on conviction and expected return?

For boards, regulators, and asset owners, this type of attribution helps demonstrate that higher risk is understood, not accidental.

Connecting risk and return

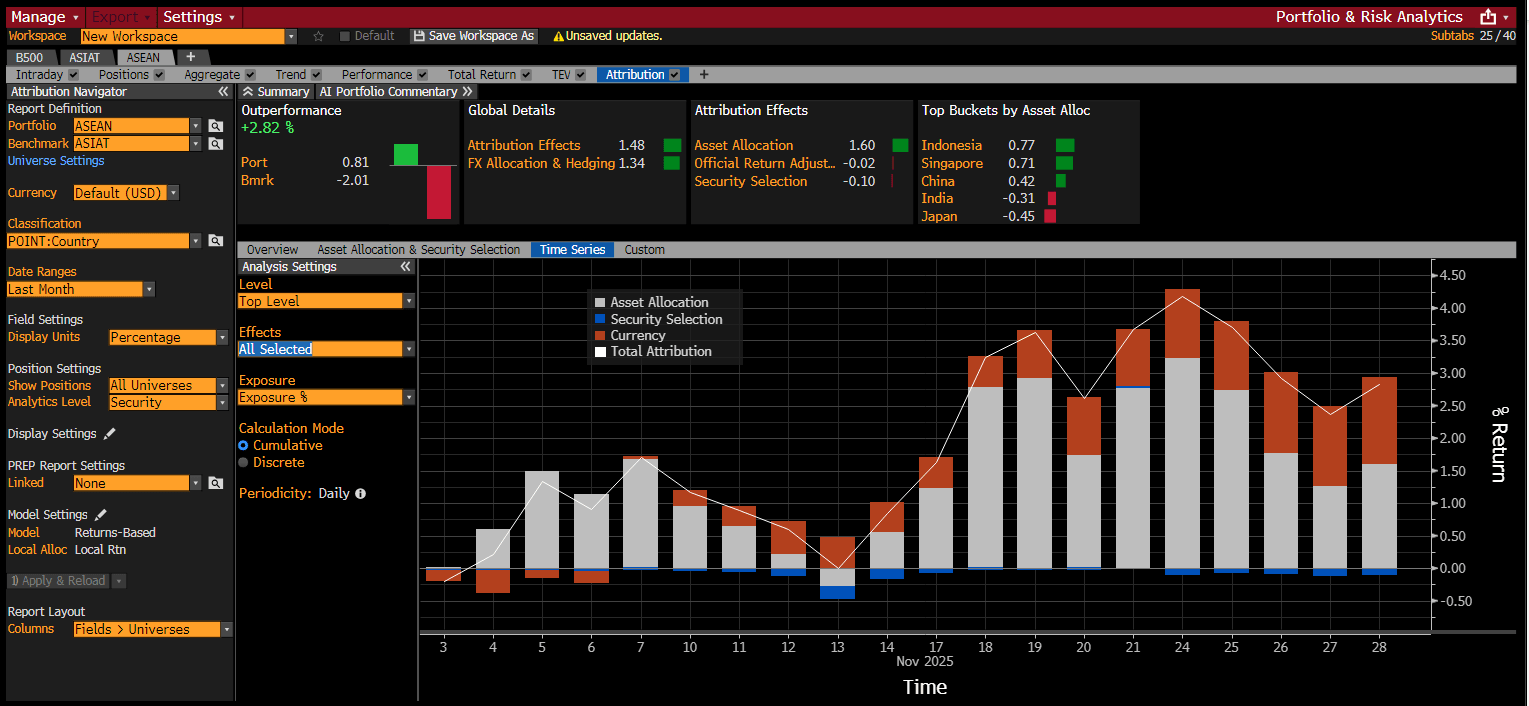

Ultimately, risk models must connect to performance. Factor-based performance attribution is a critical bridge, breaking down portfolio returns into contributions from market, style, industry, country, and currency exposures, and isolating security-specific effects that represent true stock-picking skill.

A complementary time-series view helps investors see whether performance was earned steadily or driven by a handful of outsized days or months. A portfolio whose excess returns arrive in a narrow window, tied to a single factor or event, may be very different from one that delivers smaller, more consistent gains across regimes.

Image 4: PORT WS showing the daily time Series of a fund performance relative to its benchmark along with the attribution effectsTime-series performance and attribution view, highlighting how excess returns build over time relative to a benchmark.

By integrating risk and performance attribution, investors can ask sharper questions:

- Are current factor bets aligned with the sources of historical outperformance?

- Is tracking error being used to express genuine insights, or is it an unintended byproduct of constraints and flows?

- How might a new policy or tariff regime affect both risk and expected return for key strategies?

Putting capabilities to work

Building next level risk capabilities is less about adding more numbers to reports and more about clarifying the story those numbers tell. In an environment defined by policy shocks and shifting trade flows, leading investors are:

- Embedding geopolitical and policy scenarios into multi-asset risk models, rather than treating them as qualitative overlays.

- Using country- and sector-specific analytics to distinguish between resilient and vulnerable balance sheets.

- Applying risk change attribution to explain shifts in risk to stakeholders in clear, concrete terms.

- Linking risk and performance attribution so that every unit of risk taken can be evaluated against realized and expected returns.

These practices allow risk to function as a strategic partner to investment teams, helping them navigate uncertainty with greater precision, speed, and transparency – and turning complex global disruptions into opportunities for better-informed decisions.

To learn more about the industry’s next-generation portfolio analytics solution, click here.

Insights in this article are based on breakout session discussions at the Bloomberg Investment Management Summit held in Singapore in October, 2025.