US fintech midyear policy outlook

Bloomberg Intelligence

This analysis is by Bloomberg Senior Intelligence Analyst Nathan Dean. It appeared first on the Bloomberg Terminal.

Fast-expanding regulatory scrutiny of the financial-technology sector has the potential to create short-term compliance headaches for companies like Apple, Meta, Google and PayPal. One proposal from the Consumer Financial Protection Bureau, expected to be finalized in 2H, could bring those companies and others trying to operate in consumer payments under the bureau’s jurisdiction and examination authority. Longer term, it’s feasible that CFPB oversight could bring process changes if regulators think current operations run afoul of US laws. Fintechs may also see increased competition as a new real-time payment system, FedNow, which went live in 2023, enables banks to compete on faster processing times. Overall, however, the threat of a major policy action that materially changes business practices remains low.

Meta, Google, fintechs could face more scrutiny in CFPB proposal

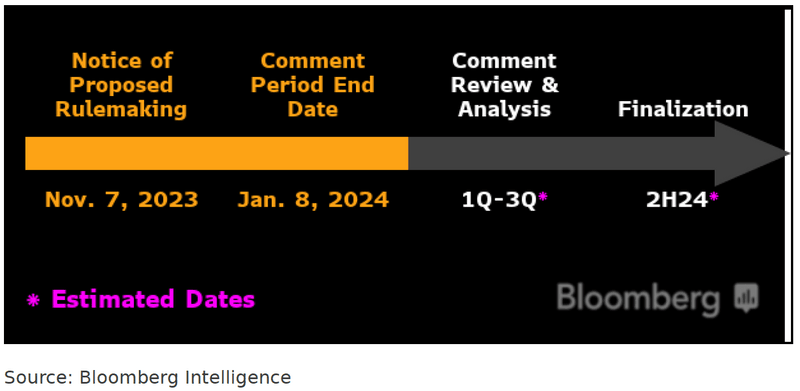

With the comment period closed and the CFPB’s constitutionality status secured, the bureau will likely finalize its fintech rule in 2H, with minimal changes to the proposal. Comments from the financial services industry were broadly supportive while the technology industry warned of overreach and harm to consumers. Some potential tweaks — like the definition of a large participant — may stave off concerns for smaller companies.

Our thesis: Meta, Google and other companies offering digital wallets and payment apps may come under CFPB supervision, increasing compliance costs and demands, if a 2023 proposal proceeds. Though the plan appears manageable for the industry, it might open the way for a debate on whether large fintech firms are a systemic risk, that designation could bring capital requirements and other hurdles.

What’s at stake?

Compliance headaches, for now.

CFPB scrutiny over technology companies involved with consumer payments may ratchet up regulatory demands in the short term. The first step if the 2023 proposal is finalized would likely be to answer inquiries from the agency and to host examiners on site. Compliance spending is likely to increase as a result. We believe the CFPB is most interested in determining whether these companies are adhering to US law in areas such as data collection and customer finances. Many of these operations — such as Meta, Google and Apple — would have the financial resources to make any needed changes. But it’s also possible that the CFPB, upon seeing areas that it thinks need correction, could push for changes to business processes, demand customer restitution or take enforcement actions.

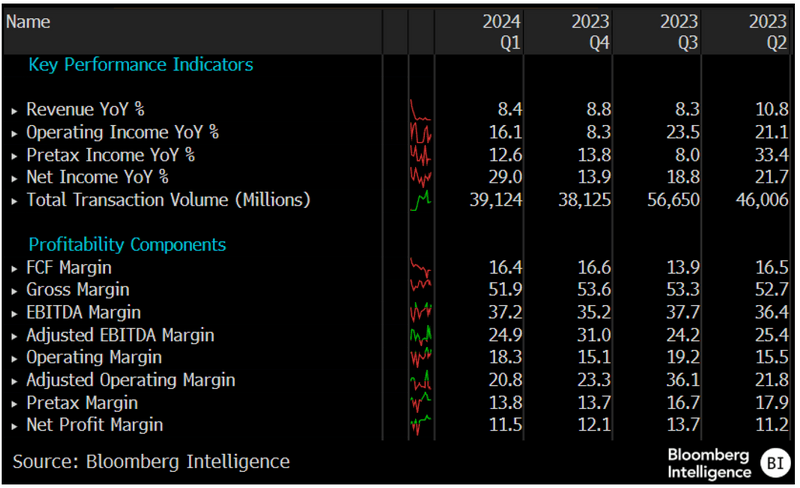

Key Performance Indicators 2Q23 – 1Q24

But… Systemic-risk threats are brewing.

Assuming President Joe Biden wins re-election in 2024, there’s a risk that over the next few years a debate will ensue over whether large fintech firms pose a systemic risk to the US financial system. CFPB Director Rohit Chopra hinted as much in an October 2023 speech. A systemic-risk designation — also known as being a nonbank SIFI — could result in regulatory measures such as capital requirements to safeguard companies against failure. Yet this plan would likely take years to implement, and need extensive study before a decision is made. A victory by former President Donald Trump could negate this risk.

What’s the outlook?

70% chance of finalization in 2024.

Though a proposal released late in a president’s administration usually means finalization will come after the November elections, we think the CFPB sees the plan as high priority and may wrap up earlier. The comment period was short — signaling the bureau is aiming to move quickly — and it doesn’t appear that comments from the technology industry about overreach and compliance burdens will stop the CFPB from moving forward. Banking industry comments were broadly supportive and tweaks to the proposal are feasible.

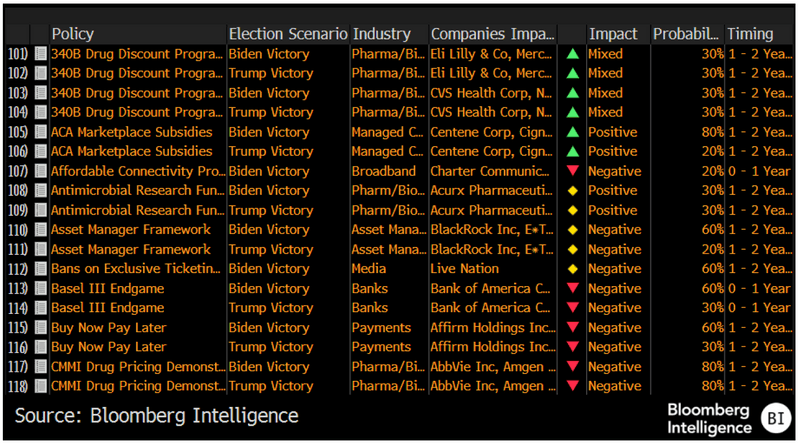

BI Election Matrix

What’s the timeline?

Anticipated Rulemaking Timeline

What’s the issue?

Payments, fintech scrutiny.

The CFPB proposal would expand the definition of “large participants” under the bureau’s examination authority to include tech firms involved with consumer payments, as an initial step toward increasing scrutiny of certain technology companies, we believe. The CFPB in 2021 sought information from Apple, Amazon, Meta, Google, PayPal and Square to learn more about how firms are handling customer financial data. The CFPB has concerns that tech companies entering the payments business — and their ability to collect and monetize personal data — may be straying from US consumer laws. The proposal is only applicable to companies with more than 5 million transactions per year.

Policy Action:

- CFPB Proposes New Federal Oversight of Big Tech Companies and Other Providers of Digital Wallets and Payment Apps, Nov. 7, 2023

- “CFPB Orders Tech Giants to Turn Over Information on their Payment System Plans”, Oct. 21, 2021

Impacted Firms:

- Fintech including Amazon, Apple, Meta, Google, PayPal, and Square.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2024 Bloomberg.

Bloomberg Intelligence is a service provided by Bloomberg Finance L.P. and its affiliates. Bloomberg Intelligence likewise shall not constitute, nor be construed as, investment advice or investment recommendations, or as information sufficient upon which to base an investment decision. The Bloomberg Intelligence function, and the information provided by Bloomberg Intelligence, is impersonal and is not based on the consideration of any customer’s individual circumstances. You should determine on your own whether you agree with Bloomberg Intelligence. Bloomberg Intelligence Credit and Company research is offered only in certain jurisdictions. Bloomberg Intelligence should not be construed as tax or accounting advice or as a service designed to facilitate any Bloomberg Intelligence subscriber’s compliance with its tax, accounting, or other legal obligations. Employees involved in Bloomberg Intelligence may hold positions in the securities analyzed or discussed on Bloomberg Intelligence.