This article was written by Adam Peralta, Global Head of Product Rates e-Trading and Adam Lister IRS e-Trading Product Manager at Bloomberg.

As January comes to a close, the overriding message from the market is that SOFR swap trading is here to stay, supported by a strong first month of trading in 2022. The trend is apparent and further evidenced by analyzing the trading activity related to both SOFR and LIBOR swaps on Bloomberg. Overall volume on Bloomberg’s Global Trading Venues; Bloomberg’s US swap execution facility (“BSEF”), Bloomberg’s EU multilateral trading facility (“BTFE”) and Bloomberg’s UK multilateral trading facility (“BMTF”) (“Venues”) is up approximately 31% compared to January 2021, and 73% of the USD swaps market on Bloomberg is now SOFR swaps. As the market continues to move forward into a world of “no new LIBOR risk,” two important themes have emerged: (1) SOFR Liquidity is stronger than ever, mirroring that of LIBOR; and (2) the subset of SOFR products available to trade on Venues has replaced that of LIBOR. Below, are some important market observations related to the transition, where we analyzed the following metrics to use as a litmus test for SOFR adoption: bid-offer spreads, participating dealers in SOFR swaps on Bloomberg Venues and the overall market volumes of SOFR trading compared to LIBOR.

Bid-offer spreads and improved SOFR liquidity

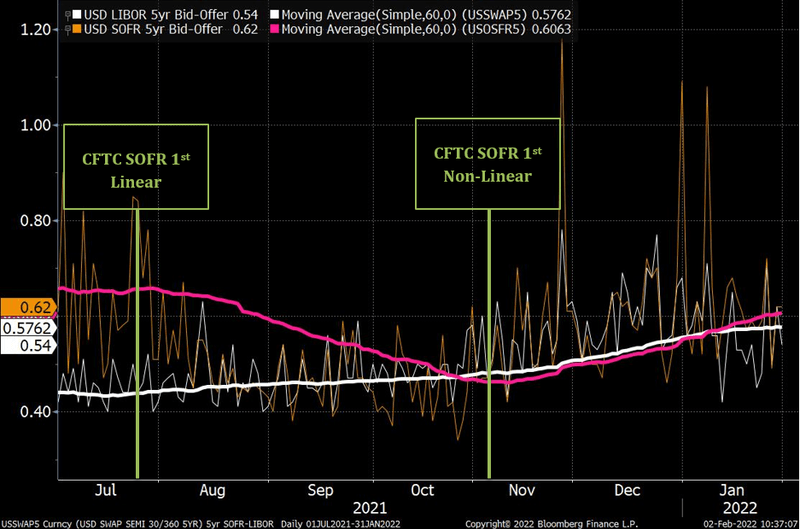

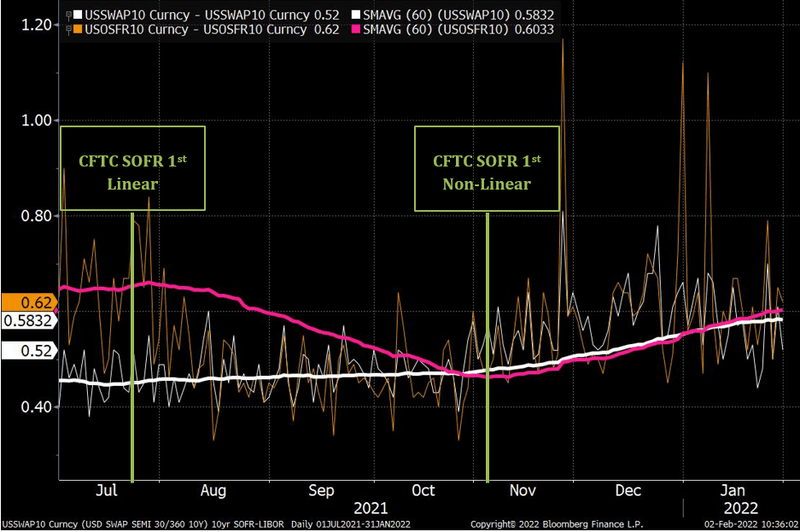

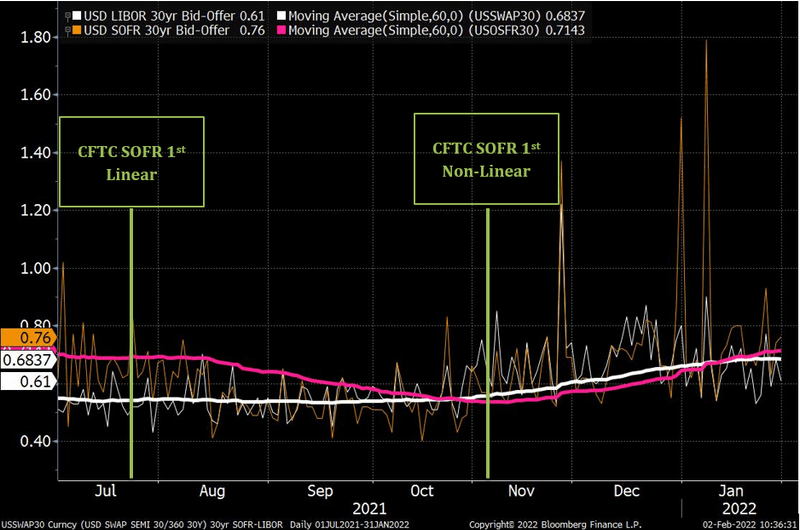

Composite pricing data (CBBT) on Bloomberg shows that SOFR liquidity improved significantly over the course of 2021 as evidenced by SOFR bid-offer spreads tightening and crossing below the equivalent LIBOR spread this past October. Measuring the width of a bid-offer spread is often a good indicator of liquidity as wider spreads typically signal less liquidity in a given instrument, and tighter spreads typically signal an instrument is liquid. Measuring the trend shows how liquidity changes over time. Applying these concepts, it’s clear that SOFR Swaps liquidity has improved when analyzing the 60 day simple moving average of bid-offer spreads in 5-year (Figure 1), 10-year (Figure 2) and 30-year (Figure 3) swaps shown in the charts below. In addition to improved SOFR liquidity, indicated by tighter SOFR bid-offer spreads, there is a clear convergence of SOFR, LIBOR Bid-Offer spreads across all tenors indicating liquidity in SOFR swaps is now comparable to that of LIBOR. In all of the charts below, the SOFR moving average is in magenta and the LIBOR moving average is in white.

Looking at the 60 day simple moving average, it’s clear that spreads have narrowed on 5 year SOFR swaps indicating that SOFR Liquidity is now comparable to that of 5 year LIBOR swaps.

Looking at the 60 day simple moving average, it’s clear that spreads have narrowed on 10 year SOFR swaps indicating that SOFR Liquidity is now comparable to that of 10 year LIBOR swaps.

In keeping with other tenors, we see the same observable trend that spreads have narrowed on 30 year SOFR swaps indicating that SOFR Liquidity is now comparable to that of 30 year LIBOR swaps.

Some key takeaways:

- There are two important regulatory dates noted on all three charts: (1) The CFTC SOFR First Linear Rates initiative; and (2) The CFTC SOFR First Non-Linear Rates initiative. In both instances, the CFTC recommended that the dealer markets prioritize and trade SOFR swaps in place of LIBOR swaps in light of US banking supervisory guidance that such activity should cease as soon as practicable and in any event by December 31, 2021 (see Further Reading below). As evidenced by all three charts above, a clear pattern of improved liquidity emerges immediately following July 2021 (CFTC SOFR First), where SOFR bid-offer begins to tighten.

- In October 2021, coinciding with the upcoming November 2021 CFTC SOFR First date for non-linear swaps, there was a convergence of SOFR and LIBOR Bid-Offer spreads across all tenors, indicating SOFR swap liquidity was equivalent to that of LIBOR swaps.

- From October 2021 onward, SOFR Bid-Offer spreads mirrored those of LIBOR, overlapping and in some instances crossing below the LIBOR spread indicating a sustained trend that liquidity in SOFR swaps is now comparable to that of LIBOR.

Active dealer participation in SOFR swaps

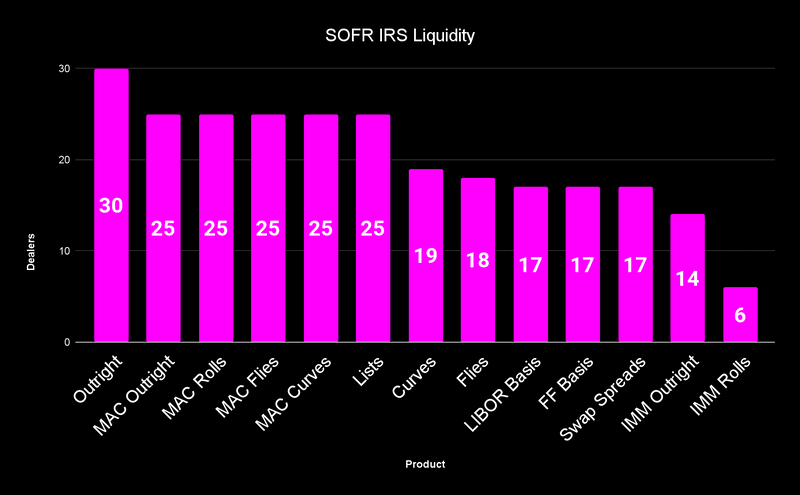

Over the last 12 months, the number of liquidity providers for SOFR swaps on Bloomberg Venues has grown significantly. The current SOFR liquidity profile is shown in Figure 4 below, where the depth of liquidity is measured by the number of liquidity providers by product. Clients now have access to pricing from 30 dealers (Figure 4) and an array of new tradable products to allow participants to efficiently transform their portfolios from LIBOR swaps to SOFR swaps.

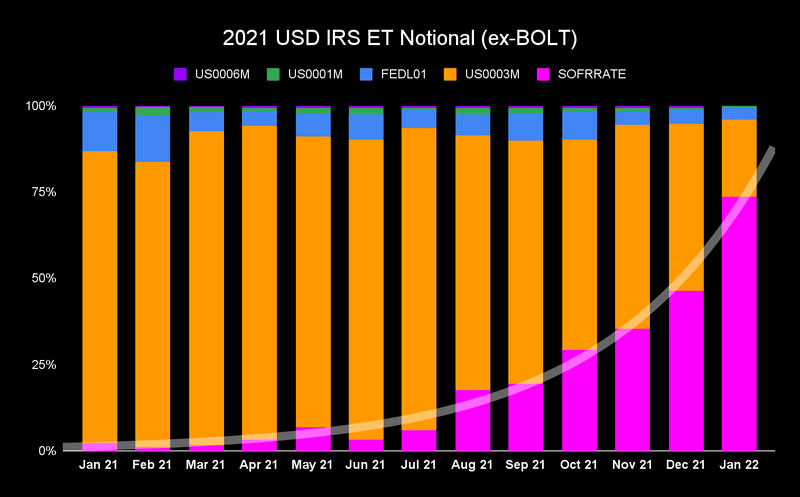

Growth in SOFR Swaps Volume

While the market generally observed slow growth and trading volumes through the first half of 2021, growth in SOFR grew exponentially from Q3 of 2021 into Q1 of 2022. As the data shows (Figure 5), SOFR’s share of USD IRS volume has risen markedly since the CFTC launched SOFR First in July 2021, alongside recommendations from global regulators to adopt SOFR, among other risk free rates. The sharp increase observed in SOFR trading as of January 2022 (Figure 5) falls in-line with the markets expectations as the industry crossed the January 1st deadline of “no new USD LIBOR risk.” As of the close of January 2022, and as the chart shows, 73% of the USD swaps market on Bloomberg is now SOFR.

As positive SOFR adoption continues, the discussion around SOFR swaps will continue as industry players contemplate different market issues such as: the optimal technical implementation of compounded in arrears versus forward looking term structures, risk-free versus credit-sensitive indices and changes to traditional pricing models as the market ultimately shifts away from Eurodollar futures and LIBOR hedges. However, what is clear, from the observable data on Bloomberg, is that SOFR appears set to supersede LIBOR as the primary USD derivative benchmark rate.

Further reading

Eurodollars in Stasis as LIBOR End Draws Near

FCA LIBOR Notice- Notice of prohibition on new use

Fed Supervisory Guidance – November 30, 2020