This analysis is by Bloomberg Intelligence Senior Analyst Sarah Jane Mahmud. It appeared first on the Bloomberg Terminal.

Banks face their biggest regulatory challenge in decades as the world’s most widely used benchmark for short-term rates — the London Interbank Offered Rate (LIBOR) — readies for retirement by end-2021, and for some U.S. dollar settings on June 30, 2023. The transition to a risk-free rate will, in our view, spark sweeping operational and conduct risks that could lead to fines, litigation and loss of market share. Banks in Asia, especially in emerging markets, are among the most exposed, chiefly due to the region’s fragmented regulatory landscape and heavy use of dollar LIBOR in local indexes.

The beleaguered benchmark underpins about $400 trillion of financial product globally, including bonds, loans and derivatives.

Regulatory pressure to remove LIBOR reliance may pressure banks

Banks may find the transition from the London Interbank Offered Rate (LIBOR) one of their biggest regulatory efforts, with a web of operational and compliance challenges. Despite Covid-19 diverting operational resources, banks are unlikely to delay LIBOR’s retirement, though we believe some contractual relief may be granted.

Covid-19 disrupts timeline, but only a little

With resources diverted to critical operational tasks due to the pandemic, lenders face a tight schedule to move away from LIBOR by the end of 2021 or, for some U.S. dollar settings, the extended June 30, 2023, deadline, which lets more legacy contracts mature before the benchmark ends. Yet U.K. regulators remain committed to retiring the benchmark by these dates, meaning lenders globally need to actively develop new products and engage with clients.

In the U.K., they’re expected to complete the conversion of all British pound LIBOR contracts maturing from 2022 by the end of 3Q and, if not viable, ensure robust fallbacks are adopted. With consultations still in the works on tough legacy contracts, time is tight.

LIBOR transition: Key milestones

Tough legacy contracts winning regulatory shield

Companies with tough legacy exposures — contracts without robust fallbacks that aren’t likely to be amended to reference a suitable alternative rate before LIBOR ends — win some protection with legislative changes that let the FCA create a time-limited synthetic LIBOR rate beyond the due date. Though this could give companies a safe harbor from litigation in the short term, it may lead to conflict if regulators worldwide fail to harmonize their proposed methodologies for managing legacy contracts.

The FCA expects to use its powers for British pound LIBOR and it’s assessing the case for Japanese yen and U.S. dollar LIBOR settings. Other regulators around the world are taking a similar approach, including the European Commission and the Federal Reserve Bank of New York.

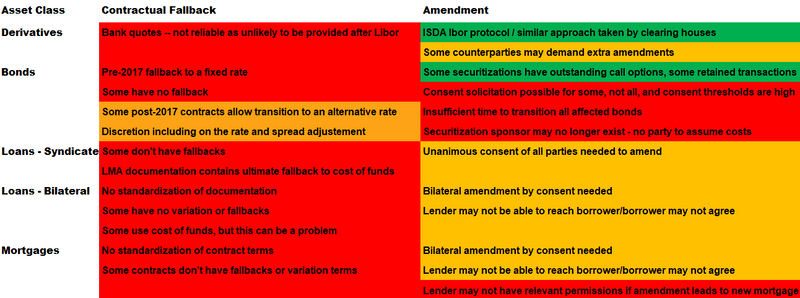

Tough legacy LIBOR contracts

What’s the problem with LIBOR?

Regulators are retiring LIBOR due to widespread concern over its reliability after the rate-rigging scandal. Based on a large number of overnight money transactions, risk-free rates are less susceptible to manipulation. The Secured Over Night Indexed Average (SONIA) rate is the preferred rate in sterling markets, with the Secured Overnight Financing Rate (SOFR) the preference for dollar-denominated contracts, with 973 corporate floating-rate notes in the market. Asia’s extensive use of USD LIBOR means banks and regulators in the region have hard decisions to make.

Some 22 banks are on the LIBOR panel, including Barclays, BNP, Credit Suisse, HSBC, Mizuho, the Royal Bank of Canada and UBS. From 2022, the FCA will no longer require them to contribute, retiring LIBOR.

Key points:

- LIBOR is a polled rate, based on a mix of estimated submissions made by a group of panel banks every business day before 11am.

- It is calculated for five currencies (CHF, EUR, GBP, JPY, USD) across seven tenors for each (overnight/spot next, one week, one month, two months, three months, six months, 12 months).

- From Dec. 31, 2021, the Financial Conduct Authority will phase out the troubled benchmark, moving toward risk-free rates.

Additional reading:

The Future of LIBOR — Andrew Bailey (Former FCA Chief)

LIBOR: Preparing for the End (Andrew Bailey)