Hedge accounting: What are the benefits of a dynamic risk management strategy?

This article was written by André Pereira, Hedge Accounting APAC Product Manager at Bloomberg.

The difference between the long-term interest rates for loans and the short-term interest rates for deposits – known as the “interest rate margin” – is the main source of profitability for a commercial bank. However, earning that margin is not without risk as interest rates on both the asset and the liability side may not behave as initially expected.

The main objective of interest rate risk management in the banking book is to stabilize the net interest income. That means making the interest margin less exposed to changes in interest rates. This can be achieved by having assets and funding sources with the same risk profile, such as the same maturity and interest rate basis. In practice however, a near-perfect offset is almost impossible to achieve solely by lending/investing in assets and issuing liabilities with the same interest profile. In fact, this might only be possible to achieve by using derivative financial instruments.

Many banks manage this risk dynamically on a portfolio basis, rather than on an individual basis, because such a strategy can make overall risk management more effective and therefore increase the bank’s profitability. Dynamic risk management could be described as a continuous process that involves identifying, analysing, and deciding whether, and how, to mitigate one or more risks associated with an ‘open portfolio’. An open portfolio is made up of managed exposures that change over time as new loans are added or existing ones maturing or prepaid.

An individual or dynamic approach to interest rate risk management?

Interest rate swaps are seen as extremely effective when hedging any simple interest rate risk that arises from the origination of customer products, particularly fixed rate loan products. For example, a five-year fixed rate mortgage initially cash-funded at three-month Libor creates an exposure to the funding rate rising. A five-year pay fixed/receive Libor closes the risk since, if rates rise, the increased cost of the funding is offset by the gain on the swap while, if rates fall, the loss on the swap is offset by the benefit of the cheaper funding.

One could conclude, therefore, that interest rate risk management simply involves hedging all fixed rate products, one for one, with derivatives as they are originated, and that this ‘individual’ approach would make the interest rate risk in the banking book always near zero. But this approach can be impractical and expensive, not just in the cost of the individual instruments, but also in the maintenance and monitoring of the portfolio. In short, it might not always be deemed worthwhile to be constantly correcting a small amount of mismatch. For these reasons, banks generally tend to limit the size of their derivatives portfolio.

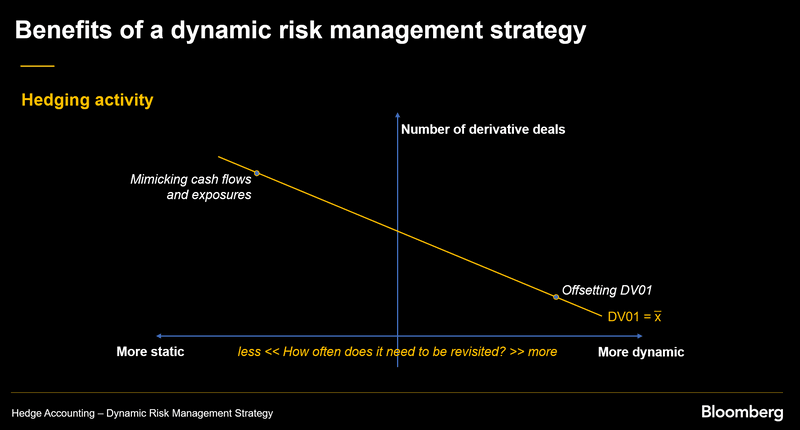

Doing almost the opposite can help banks get round the problems associated with an ‘individual’ approach. Instead of eliminating every individual source of delta exposure, risk managers can offset the overall DV01 from their exposures with a single derivative. However, while this sounds logical on paper, in practice, banks often do something in between these two strategies, as the graph below demonstrates. The yellow line describes hedging strategies that accomplish the objective to fix a desired level of DV01.

The implications of time

From the perspective of a single snapshot in time, it seems obvious that hedging via DV01 offsetting is much more efficient than trying to offset individual exposures and cash flows. However, it is also vital to understand how these hedging strategies function over time.

The first time-related aspect to consider is the sensitivity of the sensitivity: a second order measure known as the gamma measure. The gamma measure allows risk managers to evaluate changes in the delta with respect to changes in the interest rate curve. Based on this measure, an individually hedged portfolio will perform rather well. This is because, as time passes, the risk structure from both the exposures and hedges will evolve in tandem, alongside their own delta measures. There would be no need to make any changes to the relevant derivatives.

On the other hand, a dynamic approach that uses a single swap to offset DV01 would probably fare rather badly when trying to offset Gamma. After a few weeks or months, if not days, the swap would fail to stabilize the net interest rate margin. It would require constant monitoring and revisiting by adding more swaps.

The second aspect to consider, vis-à-vis the passage of time, is that risk managers never deal with closed portfolios. Every month thousands of new loans can be originated and new deposits secured. Moreover, many individual loans behave differently and generate cash flows that diverge from what was initially contractualized.

The individually-hedged portfolio would encounter difficulties under this second criteria, while a more dynamically hedged portfolio would perform better, requiring significantly fewer new swaps in order to be re-adjusted. Banks should look to balance these two strategies, as well as work out the accounting outcome and treatment of the hedging strategy implemented.

Aligning with IFRS

Established to create a common accounting language worldwide, the International Financial Reporting Standards (IFRS) specifies how firms must maintain and report their accounts, defining types of transactions, and other events with financial impact. In its current form, the IFRS contains special requirements for a portfolio fair value hedges of interest rate risk. These allow some hedged items to be included on a behavioral basis rather than contractual basis, which accommodates some aspects of dynamic risk management. This model, however, can only be applied to interest rate risk.

To ensure the accounting for the relevant hedges are IFRS-compliant, dynamic interest rate risk managers must be comfortable with complex workflows. For example, changes could be addressed by treating open portfolios as a series of closed portfolios with a short life span. This would then require periodic de-designation of the previous closed portfolio of items and re-designation of a revised closed portfolio of items. However, such an approach also gives rise to complexities regarding tracking and amortisation of hedge adjustments.

Common challenges for macro hedge relationships

When banks decide to use hedge accounting, several requirements need to be met on a regular basis. It is important for banks to try and automate as much of this multi-step workflow as possible, or they risk getting caught in an extremely time consuming process and making errors due to manual activities.

An integrated hedge accounting workflow should perform the following:

- monitor and measure exposures

- validate and optimise allocations

- calculate the exposure profile

- perform prospective & retrospective effectiveness tests

- obtain correct accounting output

For more information about Bloomberg’s related products, visit the Bloomberg Hedge Accounting webpage or request a demo.