ARTICLE

Harris victory may mean more bank regulation; Trump could target ACA, green tax credits

Bloomberg Intelligence

The 2024 US election will be a pivotal catalyst for markets and companies in terms of legislation, regulations, enforcement and other government actions. If Democratic Vice President Kamala Harris wins, banks may face fresh scrutiny over climate change, capital and executive pay, internet-service providers will probably be subject to federal regulation of broadband, and health insurers face a possible $25 billion drop in premium revenue. Antitrust pressure on dominant companies will likely persist, though potentially more targeted at the health care, grocery and housing sectors than big tech. If Republican former President Donald Trump prevails, Obamacare subsidies might be on the chopping block and carmakers’ electric-vehicle demand may fall if tax credits are cut. Headline risk will linger, given neither party is expected to win a filibuster-proof majority in Congress. Whoever wins, US courts will likely remain business friendly.

Industry overview

The winner of the election could bring meaningful change to revenue, costs, taxes, capital and overhead for nearly every sector in the US economy, yet some are more exposed to the outcome than others. Here are six to watch: investment banks, big tech, health care, manufacturers, electric vehicles and clean energy.

Capital requirements for big US banks including Bank of America, Goldman Sachs, Citigroup, Wells Fargo and JPMorgan may hinge on the election’s outcome. If Harris wins, regulators may finalize the last remaining Basel III accord — boosting CET1 requirements by 7-10% in Bloomberg Intelligence’s most likely scenario — and increase stress capital buffers. A victory by Trump will likely lead to a longer-term decoupling of capital rules, with subsequent declines in requirements feasible for the next few years.

Amazon.com, Alphabet, Apple, Meta and Microsoft could benefit from a Harris election win, though this relies mainly on what happens with the antitrust leadership at the Department of Justice and Federal Trade Commission. If replaced, Harris’s appointees will determine how the investigations and legal challenges facing big tech platforms will be treated.

As front-line targets of the Biden administration’s aggressive antitrust enforcement efforts, all five companies face major antitrust lawsuits, some seeking court-ordered breakups. Though most of this litigation will likely continue, there’s a slight uptick in settlement possibilities for weaker cases (which we see as the ones against Apple and Amazon) should Harris win.

Similarly, whether a Trump presidency would bring some easing largely hinges on his appointees to antitrust leadership at the FTC and DOJ. The GOP is split over enforcement policy – some align with the interventionist mission of the Biden administration, while others are more likely to reverse course. Trump and running mate JD Vance have been vocal opponents of big tech platforms, though the basis for the animosity may not be antitrust-driven.

Obamacare health-plan sponsors like Centene and UnitedHealth could see a significant revenue hit if enhanced subsidies that expire at the end of 2025 aren’t extended. The Congressional Budget Office projects ACA enrollment could drop by 4 million people in one year if that happens, a potential $25 billion hit to insurer revenue. A Harris win, or Democratic control of the House, could delay the financial hit for at least two years. Republicans are eager to see the enhanced subsidies expire, pointing to federal data that 30% of the money goes to people with incomes above 400% of the federal poverty level, or about $60,200.

If Harris is elected, taxes on manufacturers such as Deere, Hormel and Keurig could jump, while they’ll likely fall in a Trump presidency. Republicans want to renew capital expensing, which incentivizes spending on new machinery. They’d also like to permit loss carrybacks. Democrats intend to repeal a repatriation incentive, the foreign-derived intangible income (FDII) deduction and raise domestic and international corporate tax rates.

Deere’s revenue surged 26% in 2018, after capital expensing began, and growth has slowed as it’s been phased out. Hormel’s effective tax rate (ETR) declined to 14% in 2018 from 34% in 2017; it’s 22% today. Similarly, Keurig’s ETR has shrunk to 21% from 34% in 2017. FDII is the largest US tax deduction for General Dynamics and Dover.

Electric-vehicle (EV) makers, including Tesla and Rivian, face increased risk with IRA tax credits to promote the purchase of EVs likely on the line, along with emissions policies aimed at phasing in their use across the nation. A Harris win means federal tax credits for consumer purchases of EVs (up to $7,500 for new vehicles, $4,000 for used) will probably stand, while under Trump they could be scrapped or replaced with a “Buy American” program that could benefit traditional automakers like Ford, General Motors and Stellantis.

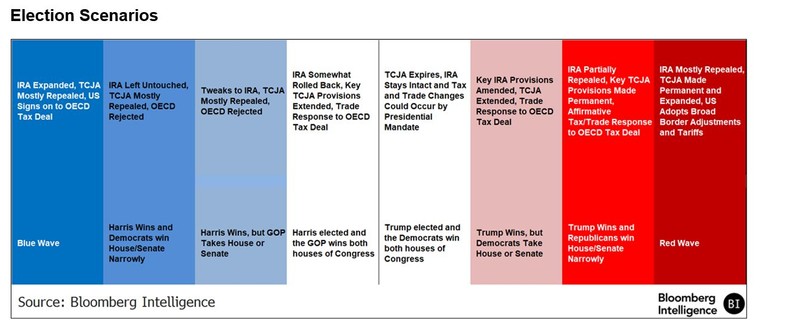

First Solar, Meyer Burger, Enphase, Canadian Solar, Qcells (Hanwha) and other solar equipment suppliers could see beneficial tax provisions weakened if Trump wins in November and works with Congress to modify or repeal the Inflation Reduction Act. US manufacturing spending surged following the August 2022 passage of the IRA, which provides generous subsidies for domestically produced solar modules and other components used to supply clean energy. Should Harris win the presidency, we doubt such incentives would be at risk.

Conclusion

A Harris victory would likely extend similar policies to President Joe Biden’s first term, meaning banks, internet service providers and pharmaceutical companies could face greater scrutiny and tighter regulations than under Trump. If Trump wins, we expect him to sign a series of executive orders across several sectors, potentially helping banks including Citigroup, while hurting tech companies like Meta and Alphabet, drugmakers such as Bristol Myers and health insurers including Centene and UnitedHealth.