Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Analyst Nathan Dean. It appeared first on the Bloomberg Terminal.

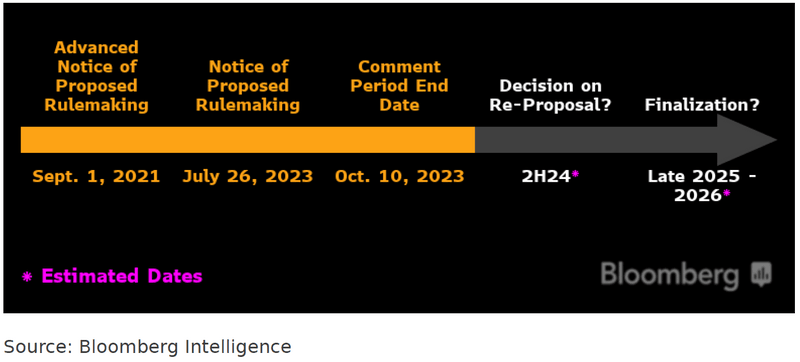

April news reports suggesting the SEC may rethink its predictive analytics proposal — combined with the fact that time is short before the 2024 elections — has lowered chances to 60% that the proposal’s finalized this year, we believe. We think SEC Chairman Gary Gensler wants the regulation off his plate this year, but if the agency opts to re-propose the rule to combat potential lawsuits, that would make it almost impossible to finalize this year.

Our thesis: A 2023 SEC proposal requiring firms to “eliminate or neutralize the effect of conflicts of interest” as well as have written policies to prevent violations probably won’t have a material effect on revenue or business operations. We estimate, however, that compliance costs for the largest brokers and advisers in the US will run just above $1 billion over five years.

What’s the outlook?

60% chance of finalization in 2024.

The SEC has a lot on its plate for finalization in 2024, including rules on market structure, and we think this regulation is a second-tier priority that will come after those initiatives are completed. And while artificial intelligence is a key topic of Chairman Gary Gensler’s, recent news reports suggesting the agency may rethink the rule in the wake of considerable criticism lowers our chances of finalization this year. As of now, we think Gensler will want to keep going, but if a reproposal comes, it will be more likely 2025 — assuming a Biden victory — for finalization. If finalized this year, compliance requirements would likely start in 2025.

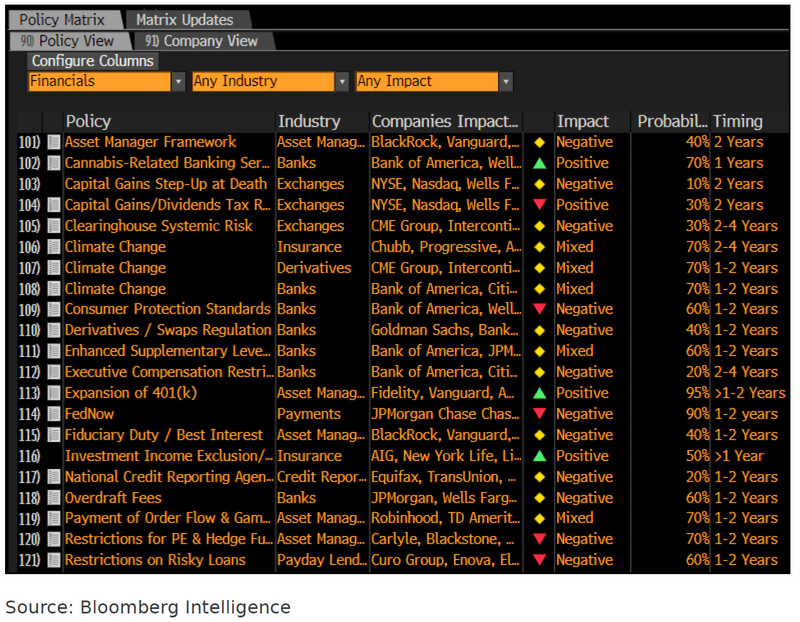

BI Policy Matrix

What’s at stake?

More than $1 billion in new costs.

Compliance costs for the largest brokers will likely increase in response to the SEC proposal on preventing conflicts of interest when using technology including predictive analytics and artificial intelligence. Firms will be required to both ensure their technology usage meets US financial rules and maintain policies that prevent such conflicts. Though the proposal shouldn’t have much impact on revenue, BI estimates costs for the largest brokers and advisers could run just north of $1 billion over five years. Some firms may try to pass such costs on to clients via higher commissions or fees.

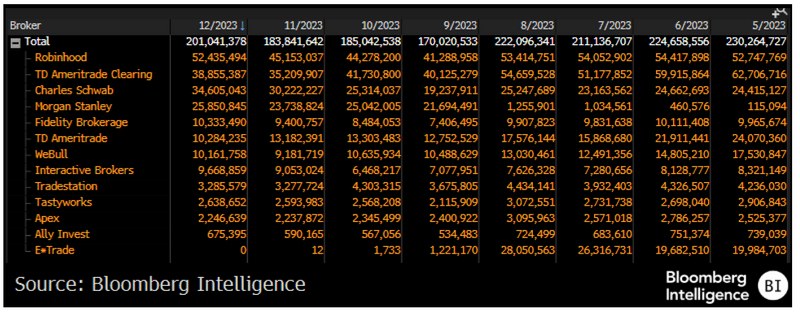

Payment for Order Flow Volume, May – December 2023

And… Third-party technology firms.

Third-party firms that provide and sell predictive analytics and artificial intelligence technology may also fall under heightened scrutiny due to the rule. The SEC estimates that many brokers and advisers outsource complex technological needs to third parties and questions whether those firms should also be scrutinized. At a minimum, those third-party firms probably will face greater scrutiny by their clients to ensure that the product doesn’t push conflicts of interest. Such firms may also see compliance costs rise.

What’s the timeline?

Anticipated Rulemaking Timeline

What’s the issue?

Technology use by brokers.

In response to high volatility in some equities trading in January 2021, the SEC conducted a review of “gamification” and whether it hurts retail investors. Initially, the agency requested market participants’ comments to learn more about so-called digital engagement practices. Then, with increased use of artificial intelligence, the SEC broadened the review. The proposal released in July 2023 is a result of that effort, with the SEC focused on preventing conflicts of interests when offering investment advice. Technologies that don’t offer advice — like customer balance information or web sites — are not impacted.