ARTICLE

Bank capital levels, deregulation plans at stake in election outcome

Bloomberg Intelligence

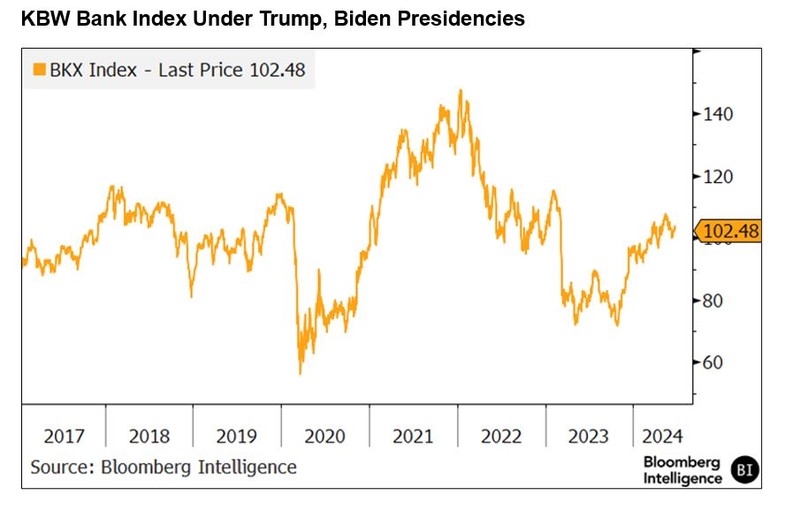

The 2024 US elections will be a powerful force for financial regulation, and an array of firms — from investment banks like Goldman Sachs to alternative managers like Blackstone and hedge funds such as Bridgewater — have issues at stake. If Democratic Vice President Kamala Harris wins, banks could come under increased scrutiny on capital levels as well as climate change and executive compensation. Under Republican former President Donald Trump, deregulation plans could be in the cards.

Debt, capital rules among focus areas for banks

With a Harris win, large and regional banks might face new restrictions on capital increases and debt issuance in 2025. Two key proposals from 2024 – the so-called Basel III endgame and a requirement that regional banks issue long-term debt – may not be finalized this year, making a Harris victory key to their implementation.

The Basel III endgame is a rule that may require banks with more than $100 billion in assets — such as Bank of America, JPMorgan and Goldman Sachs — to increase capital by 5-19%. We ascertain a 60% chance of finalization in 2025 under a Harris victory.

If Trump wins, odds of Basel III endgame implementation would drop to 30%. A second Trump term would also change the mindset of banking regulators, likely tilting toward deregulation. Though key Fed leadership terms extend into 2026, leadership changes at other banking agencies may slow the process. If the rules are finalized, new regulators could tweak them to be more friendly to the industry.

Financial firms also face shifting regulatory landscape

Nonbank financial firms, from asset managers like BlackRock and Charles Schwab to hedge funds, private funds and nonbank mortgage lenders, would likely face a changing — and harsher — regulatory climate under Harris. The Financial Stability Oversight Council has already completed an analysis into the systemic risk of the nonbank financial industry and whether regulations are necessary. A firm designated as systematically important could face higher capital requirements. If Harris wins, we see a 60% chance of new rules 1-2 years into her term given the size of the industry.

Under Trump, much of the regulatory emphasis on nonbank financials would likely be paused in favor of the current regime. A new framework would have only a 20% chance of implementation. Firms would likely continue to face examination risks, but they’d be manageable in terms of cost and burdens. Under both scenarios, we think regulators will analyze the rise of private credit and look to see what role, if any, regulations have in the booming field.

If Harris wins, we also anticipate greater scrutiny of financial companies’ climate policies, leverage limits and a proposal on executive compensation.

ESG and crypto in play

The use of environmental, social and governance (ESG) factors by banks and asset managers may be influenced by the elections. A Harris victory wouldn’t immediately lead to new regulations requiring firms to adhere to ESG principles. Instead, the government would continue to push the private sector on awareness. A Trump victory would carry a fresh threat — headline risk. In 2023, Republican lawmakers called out companies like BlackRock, Bank of America, Citigroup and Goldman Sachs for their use of ESG when making financial decisions or restrictions on lending activities to certain industries.

We don’t foresee many ESG bills passing – it’s highly likely Congress remains gridlocked. Some regulations may be altered, however. For example, a Republican-led Labor Department could tweak its rule on ESG use in 401(k) plans.

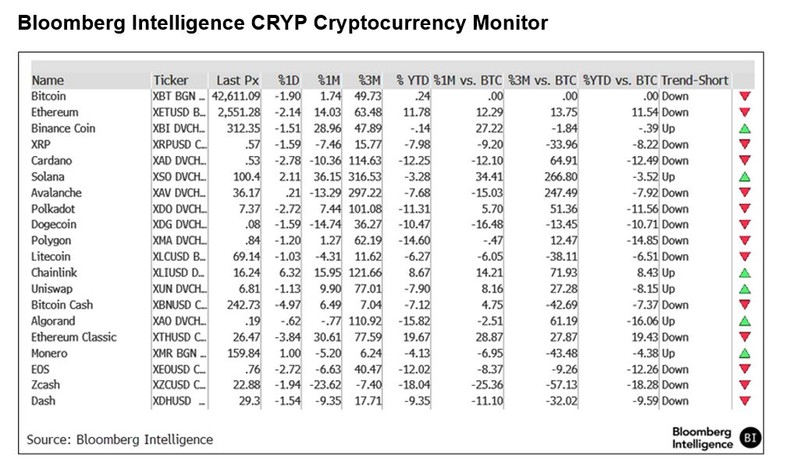

On cryptocurrencies, we see a low likelihood that a new framework passes in 2024. Yet with coins and tokens proliferating, congressional efforts to provide regulatory clarity to platforms and investors may get a new breath of life in 2025 no matter who wins. Court rulings against the SEC’s efforts to police crypto might spur lawmakers to act.

SEC, CFBP leadership makes a difference

On the regulatory side, a Trump victory would bring a change at the SEC, where Chair Gary Gensler has taken a skeptical view toward crypto. A new SEC chair could push a rule providing clarity on where tokens fit within the existing regulatory framework and might change how the agency defends its enforcement-action caseload. If Harris wins, Gensler might stay on longer.

The CFPB’s effort to scrutinize consumer financial companies, as well as fintech, would probably become a lower priority in a Trump administration. The Biden-era CFPB has pursued initiatives related to payments, user data and overdraft fees. Trump may replace the agency’s director, and depending on the new appointee’s agenda, those initiatives could be tweaked or derailed. Examination costs for banks and non-bank financial companies may be eased.

If Harris wins, we see the CFPB renewing its pursuit of policy goals. Scrutiny may intensify on payments, fintech interactions with consumers, credit cards and customer disclosures. Yet any change will take time.

Conclusion

The main takeaway for financials related to the election can be distilled into one word: Regulation. Under Trump, deregulation plans could be in the cards, and if Harris prevails, banks could come under increased scrutiny on capital, debt, compensation and more. The effects will ripple throughout the industry, from investment banks like Goldman Sachs to alternative managers including Blackstone, hedge funds such as Bridgewater and cryptocurrency companies like Bitcoin.