Asset managers race against the clock to meet derivatives rules

This article was written by William Shaw with assistance from Greg Ritchie. It appeared first on the Bloomberg Terminal.

- ‘It is already too late for many,’ NatWest says in client note

- Firms will have to post more collateral from September

Asset managers are struggling to prepare for impending rules that are expected to drive up costs in the $12.4 trillion derivatives market.

Hedge funds, pension funds and money managers are battling to find attorneys and risk a “legal logjam” when preparing documents for the sixth and final phase of the so-called uncleared margin rules that go live in September, according to NatWest Group Plc’s securities unit.

The reforms, aimed at cutting risk in the market, will force firms with more than the equivalent of $8 billion of uncleared derivatives to post extra collateral, known as initial margin. A group of the world’s largest economies decided after the financial crisis to push trading of over-the-counter derivatives through clearinghouses where possible to reduce systemic risk in case of default.

“There just aren’t enough lawyers in the world” to get all the negotiations finished on time, Phil Lloyd and John Stevenson-Hamilton at NatWest Markets wrote in a note to clients this week. “With the average length of time to negotiate initial margin documents of three to four months, it is already too late for many.”

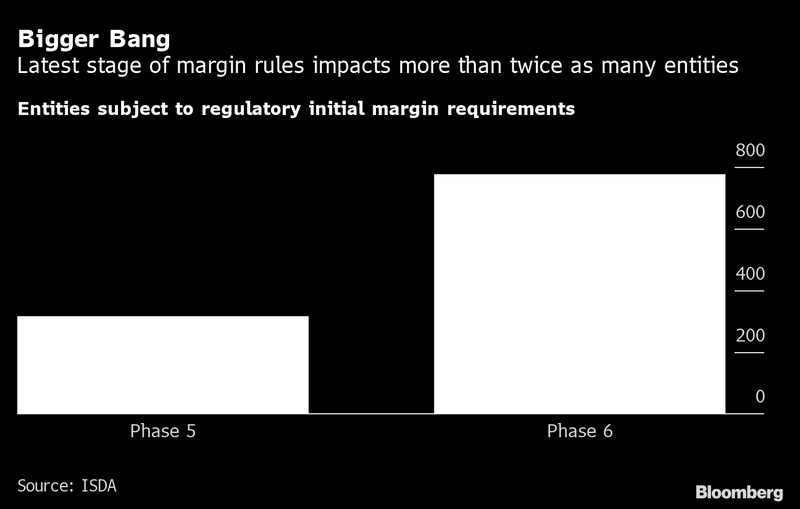

The reforms will apply to at least 775 entities, more than double those captured by the previous phase last September, according to the International Swaps and Derivatives Association. Some 5,400 relationships between counterparties potentially need to be documented.

If firms aren’t able to exchange collateral they may need to explain this to their regulators, said Deepak Sitlani, capital markets partner at the law firm Linklaters. Other market participants “may be prevented from dealing with them to avoid their own regulatory non-compliance,” he said in an interview. This could impede their ability to trade.

Cascading Losses

The rules, which originated with the Basel Committee on Banking Supervision and the International Organization of Securities Commissions, were first applied to major banks in 2016. The changes were meant to limit cascading losses after over-the-counter derivatives were blamed for worsening the global crisis more than a decade ago.

The risks from uncleared derivatives were underscored more recently by the implosion of Archegos Capital Management, which accumulated leverage through contracts that are traded off exchanges.

The most recent stage of the rules was introduced without significant market disruption. But Scott O’Malia, chief executive officer of the ISDA, warned in March that the final phase might run less smoothly and that compliance would take much longer than most people anticipate.

Companies like OSTTRA are supporting clients in calculating and managing the extra collateral they will need to post with custodian firms like JPMorgan Chase & Co. and Bank of New York Mellon Corp.

“They have to go through know-your-customer checks and there’s quite a complex onboarding process,” Neil Murphy, triResolve business manager at OSTTRA said, adding that about about 300 firms will have to exchange margin. Some dealers have said they will defer their need for counterparties to complete their legal documents to pay and receive collateral. But there are still plenty struggling to meet the deadline.

“There are some firms that have only now confirmed that they are in scope and they will be the ones that are adding to the bottleneck,” he said. “They are the ones that will be sweating.”

Possible Workarounds

Some customers of CME Group Ltd. are using listed FX futures instead of over-the-counter FX to mange their exposure and bring them below the $8 billion threshold, according to Paul Houston, global head of foreign-exchange products. Those that do meet the threshold are trading products such as listed FX options, which in some cases can reduce the amount of additional margin firms need to post by up to 86%, he said, citing a study by OpenGamma.

Asset managers and hedge funds are negotiating hard with counterparties over issues including how and when they will get their collateral back if a dealer defaults, said Linklaters’ Sitlani. Firms are also weighing up whether to use internal models to calculate their collateral requirements or to outsource this.

Businesses need to notify all their counterparties as soon as possible if they breach the compliance threshold, Tara Kruse, global head of infrastructure, data and non-cleared margin at ISDA, said in an email. They also need to have systems in place to monitor their exposures with each individual counterparty.

“Don’t wait,” said Ilene Froom, a partner at law firm Reed Smith in New York. “I don’t think it’s something where institutions want to test what the consequences are of not being compliant.”