Bloomberg Intelligence

This article was written by Bloomberg Intelligence Senior Industry Analyst Henik Fung. It appeared first on the Bloomberg Terminal.

US sanctions on Russia likely just short-term jolt to oil supply

The ruble’s pricing and oil options’ volatility suggest the crude market isn’t anxious about oil supply disruption in the long term following US sanctions on Russia’s biggest oil companies, as the country’s sales to India and China are likely to be only slightly affected. The WTI price could hover between $55-$60 in 4Q. The US said the sanctions were a result of Russia’s “lack of serious commitment” to ending the war in Ukraine.

US sanctions on Rosneft, Lukoil aim at peace deal

US President Donald Trump’s tough stance toward Russia includes oil sanctions against Rosneft and Lukoil, the country’s two largest oil firms, aimed at pressuring the Kremlin to reach a peace deal with Ukraine. The oil sanctions could force foreign traders, banks and refineries to stop oil trades with Russia. China and India risk getting caught up, as China imported 662 million barrels (mmbbl) of oil from Russia between January and September 2025, while India purchased about 451 mmbbl.

With sanctions in place, India and China’s refiners could reduce, or stop, oil purchases from Russia in the near term. Yet we don’t expect oil trades between Russia and these two countries to be suspended for long.

Sanctions on Russia won’t tighten oil supply for now

Despite the US’s hawkish stance on Russia, the oil market seems convinced that India and China could continue to buy Russian oil in the long term and that there won’t be a prolonged shortage of global crude supply. In September, Russia’s oil exports picked up by about 170,000 bpd, with India buying about 60 mmbbl and China about 70 mmbbl, we calculate. Together, they accounted for more than 85% of Russia’s oil exports during September.

Yet, if the US and the EU allow Ukraine to launch long-range missiles to damage Russia’s key oil assets, that could threaten global crude supply and lift oil prices immediately.

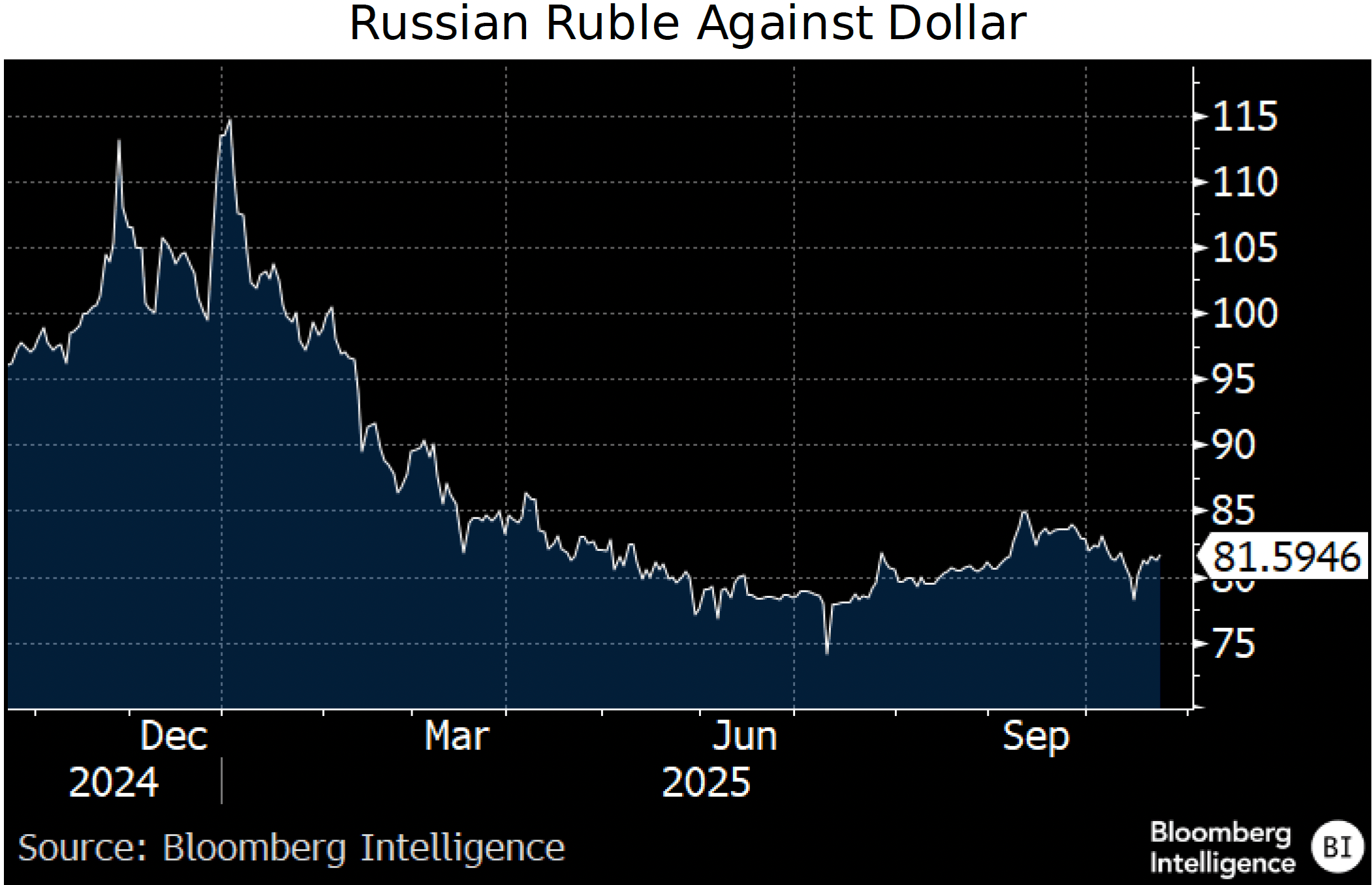

Ruble suggests sanctions won’t hurt Russia’s economy

Russia’s ruble should reflect odds for disruption of the Kremlin’s oil exports, yet it has hovered around the 80-85 level against the dollar. This suggests energy and currency markets seem convinced that the sanctions on Russian exports could be temporary and won’t hurt the country’s economy, at least for now.

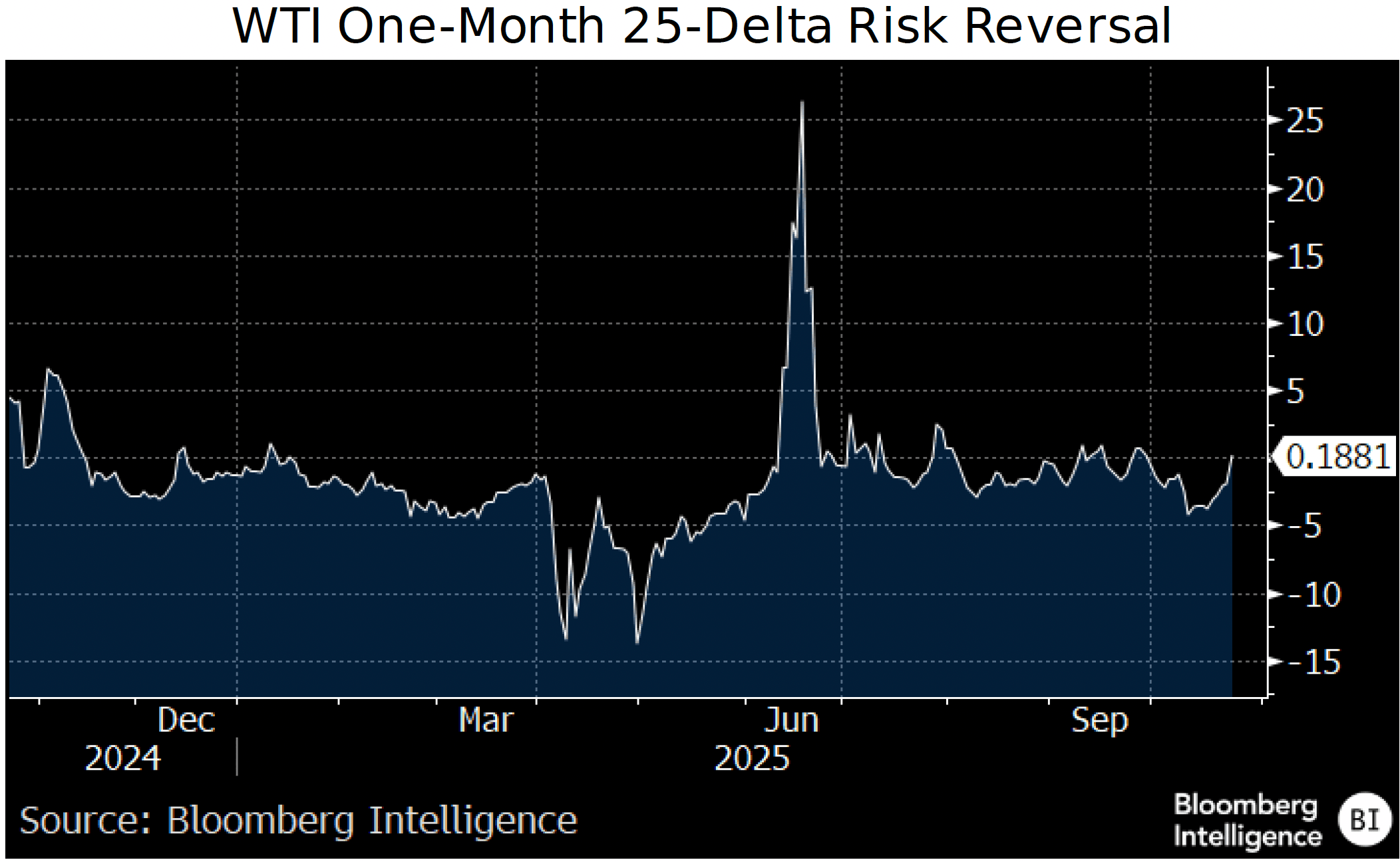

WTI options volatility signals oil market in balance

West Texas Intermediate crude’s one-month 25-delta risk reversal has hovered between 1 and minus 4 since July, with the reading on Oct. 22 at 0.18, suggesting the oil market won’t face a massive supply risk amid US sanctions on Russian oil exports. The 25-delta risk reversal strategy refers to the difference between the volatility of a 25-delta call and that of the 25-delta put –options that expire within a month with strike prices chosen such that the delta is minus 25%.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo.

All rights reserved. © 2025 Bloomberg.