Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Analyst Edmond Christou and Analyst Salome Skhirtladze. It appeared first on the Bloomberg Terminal.

The Dubai property market’s resilience to external shocks has been tested by economic uncertainty, elevated rates and Middle East conflicts. The Gulf region’s biggest gains since the pandemic peak were generated by UAE real estate — and Dubai in particular — after reforms boosted its worldwide connectivity and safe-haven status, luring foreign inflows. Developers are betting on a new wave of interest from investors as affordability is a concern for locals. Major developers maintain supply-demand imbalances, but unit-handover could peak in 2026-27. Prior property sales help developers’ EPS visibility in 2024-26 v. banks. Our survey takeaway is that the shortage of green and quality commercial buildings and employee preferences are key to the outlook for UAE office occupancy.

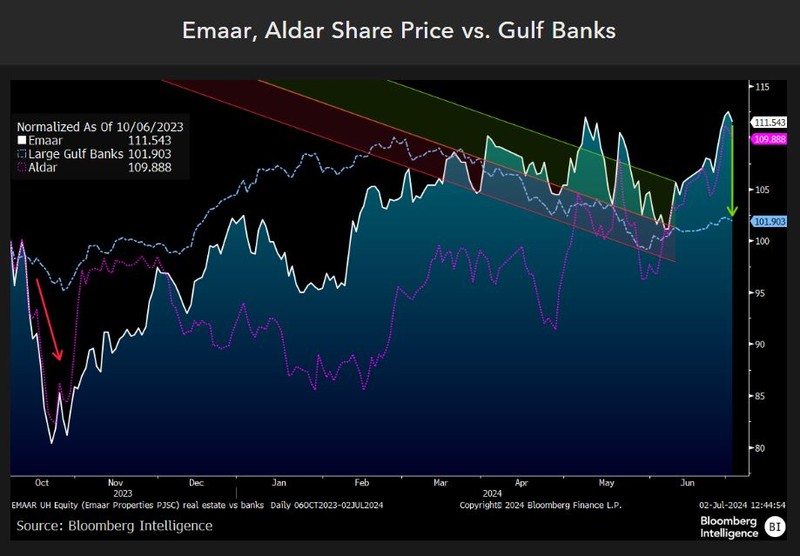

Emaar and Aldar outperform as Gulf banks’ fortunes turn

Disappointing 1Q earnings from Gulf banks (down 3% so far this year) widened the gap with the top real estate equities, Emaar Properties (up 9%), Emaar Development (19%) and Aldar (up 17%). Developers’ profit will be propped up in 2024-26 by prior sale bookings. Banks’ fortunes have turned after two years of profit gains from elevated interest rates. They may struggle to improve lending margins while also being vulnerable to uncertainties over the path of US rates.

When the Israel-Hamas conflict broke out in October, Gulf developers showed more vulnerability to geopolitical risk premium than banks because of fear of an overseas cash influx, a drop in tourism and a potential expat exodus. Yet the conflict so far has been confined and the risk premium has unwound in the equity and oil markets.

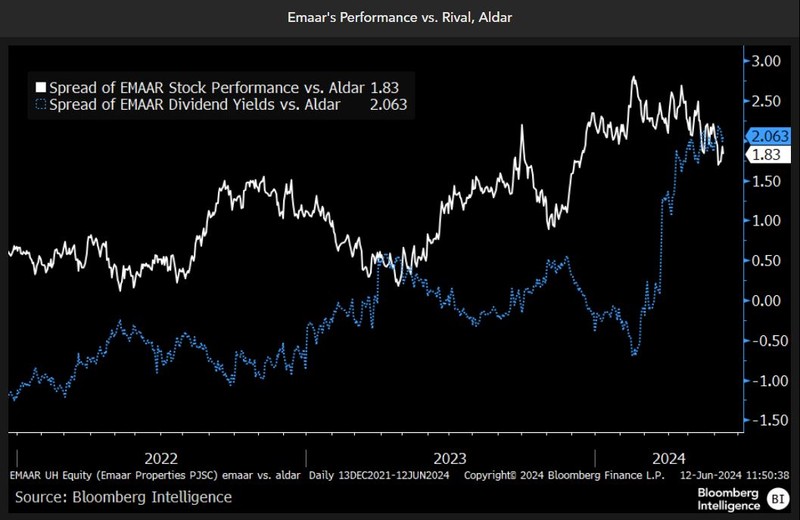

Emaar-Aldar valuation gap wider on returns, dividends

Emaar’s performance gap to Aldar narrowed since 2021, helped by a better dividend policy, a strong revival of Dubai’s real estate market as well as relaxing the foreign-ownership limit to 100% in 2022 from 49%. Emaar doubled its dividend last year, paying 50 fils a share and seeks to link its dividend policy to cashflow generation, with Emaar Development as a large contributor. Emaar’s dividend yield is at 5.4% for this year (3% last year), above Aldar’s 3.3%. But Emaar is still trading at 0.8x forward price to book or 6.4x price to earnings — under Aldar’s 1.4x forward P/B and 9.7x forward P/E. Emaar’s development business is valued at 11% of its net asset value per our sensitivity model calculation.

Clarity on the divided policy in the past 2-3 years and regular engagement with investors has helped the rating.

Emaar Group at discount as UAE developer 11% below fair value

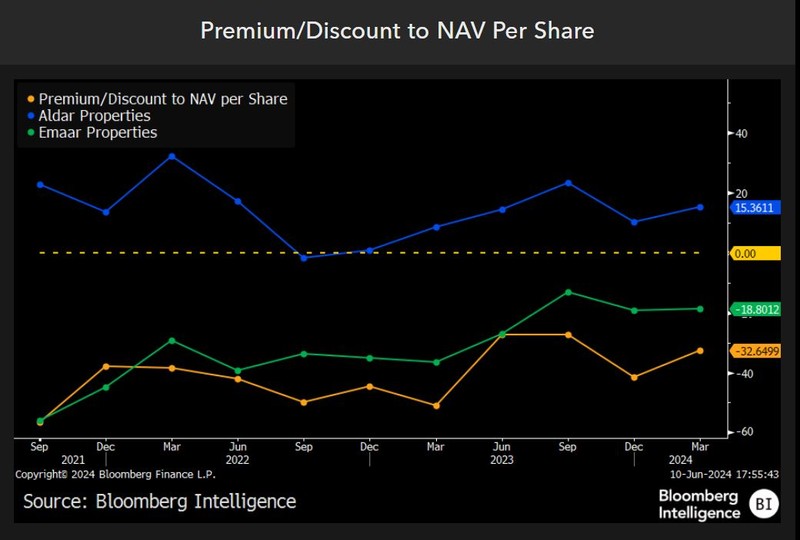

Emaar Properties’ discount to its net asset value (NAV) has narrowed to 19% in 1Q (36% in 2022) vs. 48% in 2021, especially vs. its peer Aldar. Aldar traded without a premium after 3Q22’s inclusion of Apollo’s 11.1% minority interest into the NAV, but its premium rating was restored in March 2023. The market value of Emaar’s UAE Development (its largest unit) is 11% below our calculated NAV of 34 billion dirham. The share of Emaar Development’s market value is growing to 44% of Emaar entire capitalization. When Emaar Malls was delisted, its market value was 34 billion dirham (67% of Emaar Properties’ market cap).

Emaar Misr is performing well, with a gross margin up to 48% in 1Q, but makes up 6% of Emaar group’s gross asset value vs. 12% from its overseas arm. The legacy book in India is being cleaned up to boost returns.