Bloomberg Intelligence

This article was written by Bloomberg Intelligence Emerging Markets Economist Yvonne Mhango. It appeared first on the Bloomberg Terminal.

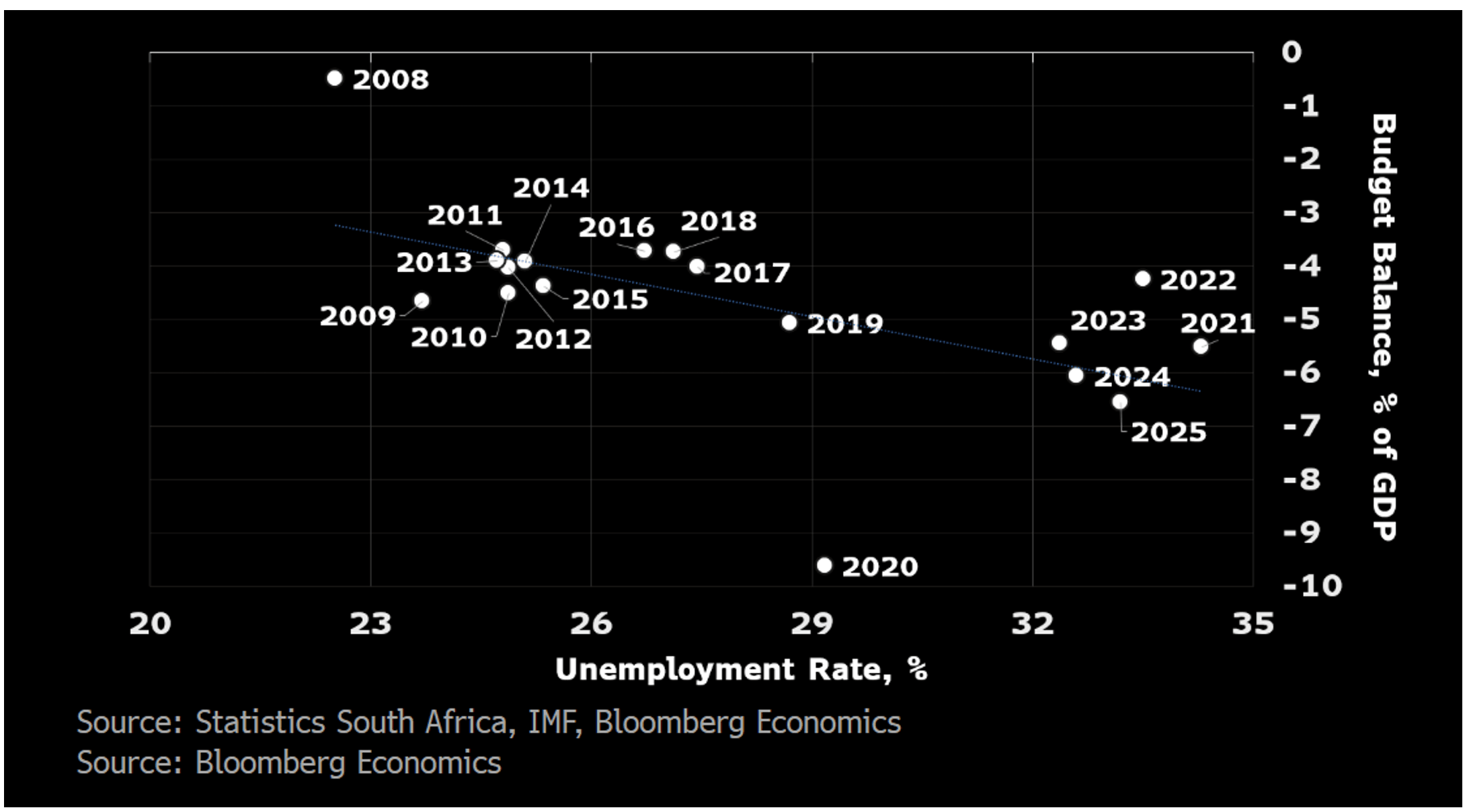

Rising unemployment typically strains government budgets by eroding tax revenue and lifting social transfers. In South Africa, the deteriorating jobs outlook compounds existing pressures that will likely prevent the government from narrowing the deficit and stabilizing debt this year.

- The high jobless rate stems from years of sluggish growth, compounded by chronic power shortages that curbed industrial activity and undermined investor confidence.

- This cyclical weakness worsened an already-high jobless rate rooted in structural legacies – including a skills mismatch, spatial inequalities, high barriers to entry for small and informal businesses, and rigid labor protections that discourage hiring.

- As unemployment has climbed, the budget deficit has widened in tandem – reflecting slowing revenues in an anemic economy.

- A special social grant for unemployed adults introduced during the Covid pandemic sped up this deterioration.

Budget balance widens alongside the rise in the jobless rate

- South Africa was already operating one of the largest social grant systems in the developing world, serving millions of children, elderly and disabled.

- The new grant, launched in 2020, extended support to working-age adults – the group hit hardest as lockdowns wiped out jobs. Meant as a temporary measure, the grant has been repeatedly extended as the labor market stays weak and the economy struggles.

- Unemployment pressures are set to intensify further. New US tariffs and rising competition from Asian imports are likely to hurt local manufacturers. South Africa faces the continent’s highest levy — 30% — which will hit its automotive and agriculture sectors particularly hard.

- Local carmakers, already squeezed by rising imports from Asia, have announced jobs cuts. A major steelmaker plans to close this year due to high costs, logistical bottlenecks, and import competition, eliminating more than 3,000 jobs.

- Weaker-than-expected growth will cut tax revenue, with tariff-hit sectors and a rising jobless rate adding to the shortfall. At the same time, spending on social grants is likely to rise as more of the unemployed qualify for support.

- As a result, the consolidated budget deficit will likely exceed the government’s planned 4.8% of GDP for this year and 3.8% next year, delaying the stabilization of public debt – which stood at 76.9% of GDP in March – beyond 2026.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo.

All rights reserved. © 2025 Bloomberg.