ARTICLE

Risk budgeting for Chinese equities: Exception proves the rule

This article was written by Bloomberg Intelligence analyst Kumar Gautam, Quantitative Equity Strategist and Claudio Fontana, Data Scientist. It appeared first on the Bloomberg Terminal.

Risk budgeting, often applied across asset classes to improve risk-adjusted returns, appears to work for Chinese equities despite their idiosyncrasies. Allocations might differ significantly from the benchmark, but controls can easily be incorporated into the process and still achieve major improvement over the index.

PRODUCT MENTIONS

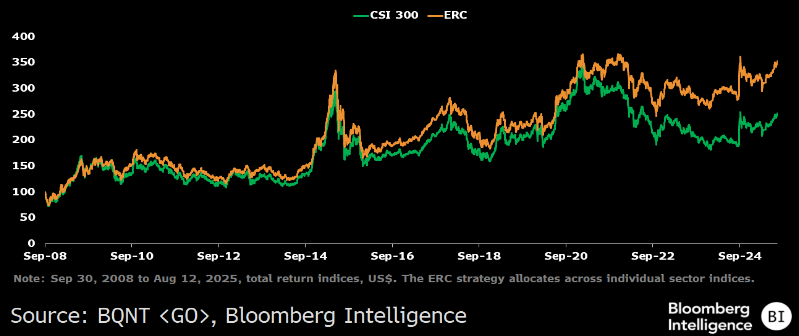

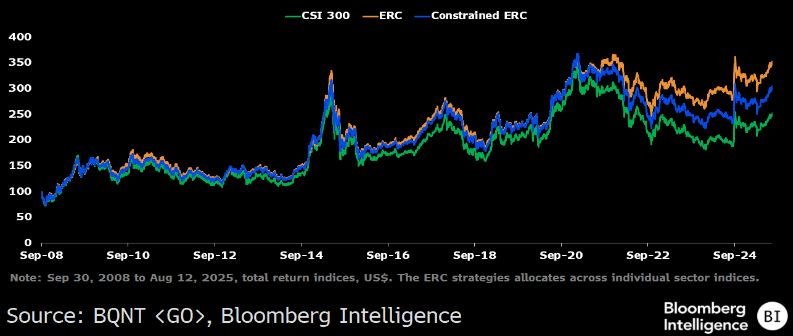

Strategy Reduced Losses During Recent Drawdown

Risk budgeting proved to be an effective strategy in reducing losses during the recent drawdown in Chinese domestic equities. The CSI 300 Index fell over 45% from 2021 to 2024. A strategy that allocates quarterly to individual sectors so that each contributes equally to the portfolio’s total risk — the equal-risk-contribution (ERC) approach — limited the drawdown to 33%. The strategy also shows a stronger risk-return profile over a longer period. Since September 2007, annualized return, volatility and Sharpe ratio (which measures risk-adjusted return) are 7.7%, 21.9% and 0.44 vs. the benchmark’s 5.6%, 23.1% and 0.34. The probability of outperforming the benchmark over one-, three- and five-year horizons is 59%, 73% and 82%.

Performance: Risk Budgeting in Chinese Sectors

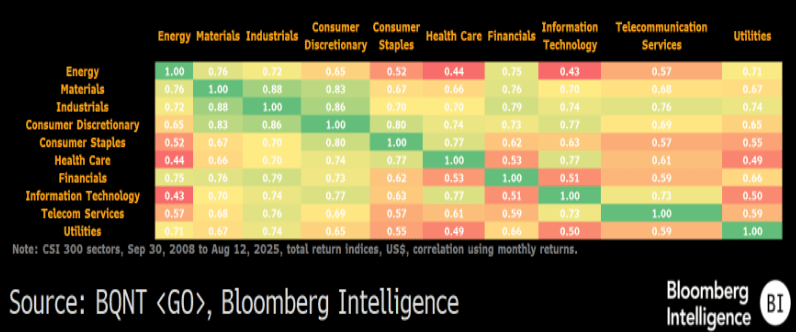

Strategy Exploits Low Correlation, Volatility Difference

Chinese equity sectors are far from perfectly correlated, and their volatility profiles vary widely — conditions that favor a risk-budgeting approach. Over the full sample, the average pairwise monthly correlation between sectors is about 67%, allowing diversification to reduce overall portfolio variance. Historical sector volatilities range from roughly 24% to 34% annualized. Utilities and consumer discretionary have been the least volatile, while telecoms and IT have been the most volatile. The ERC approach systematically adjusts exposures to these differences, increasing allocations to low-volatility, low-correlation sectors and scaling down those with higher and more correlated risk. This results in a more balanced and resilient portfolio.

Sector Correlations

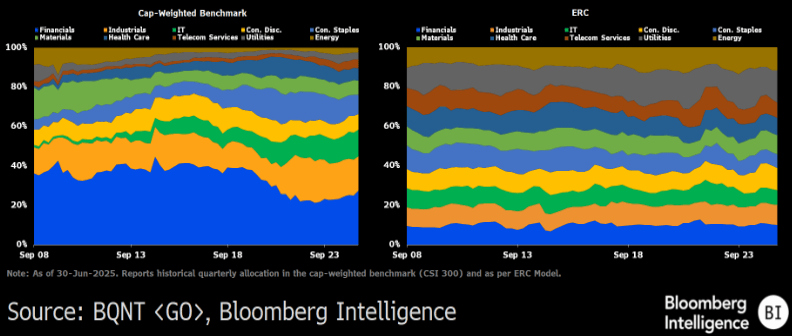

Risk Budgeting Shifts Sector Weights in China Equities

Sector allocation in risk-budgeting strategies can be markedly different from weights in the cap-weighted benchmark. Financials, for example, have the highest weight (27%) in the CSI 300, but ERC reduces this to around 11% so that its risk contribution is equal to that of the other nine sectors. As of June 2025, utilities received the highest weight (16%), while consumer staples had the lowest (7%) in the ERC portfolio.

Sector Allocation: Benchmark vs. Risk Budgeting

Customizing Risk Budgeting Reduces Tracking Error

Large deviations from benchmark weights can result in tracking errors that some portfolio managers prefer to limit. The unconstrained ERC strategy has an annualized tracking error of about 5.6%. A constrained version — capping sector deviations at 5% for small sectors and 10% for large sectors — reduces tracking error to 2.8% while preserving much of the downside protection and maintaining superior risk-adjusted returns relative to the cap-weighted benchmark. This allows risk-budgeting to serve as a benchmark alternative with greater proximity to index weights.

Performance: Benchmark, ERC, Constrained ERC

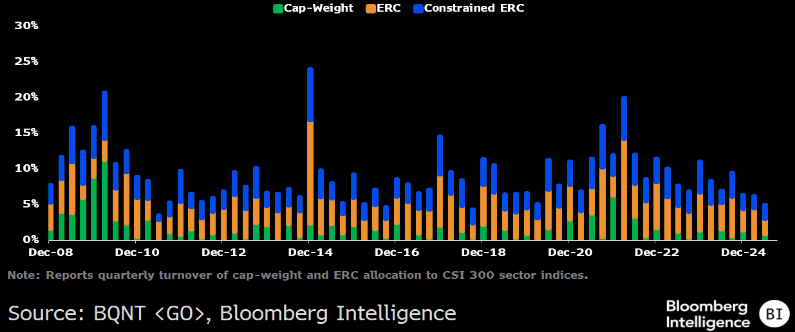

ERC Strategies Show Modest Turnover

ERC portfolios exhibit relatively low turnover given the stability of sector allocations through time. For the CSI 300 cap-weighted benchmark, average quarterly turnover is 1.7%. For ERC, turnover averages 4.4% for the constrained version and 3.1% for the unconstrained version. The limited trading activity reflects adjustments driven by changes in sector volatility and correlation rather than frequent tactical shifts, keeping implementation costs contained.

Quarterly Turnover