Bloomberg Economics

This article was written by Abhishek Gupta, Senior India Economist at Bloomberg Economics and Ankur Shukla, South Asia Economist for Bloomberg Economics. It appeared first on the Bloomberg Terminal.

India’s rapid export diversification is strengthening Prime Minister Narendra Modi’s trade leverage just as the US signals readiness for an agreement. During his Asia tour this week, President Donald Trump said the US is close to signing a trade deal with India — a prospect bolstered by the country’s resilient export structure and the start of its shift away from the US market.

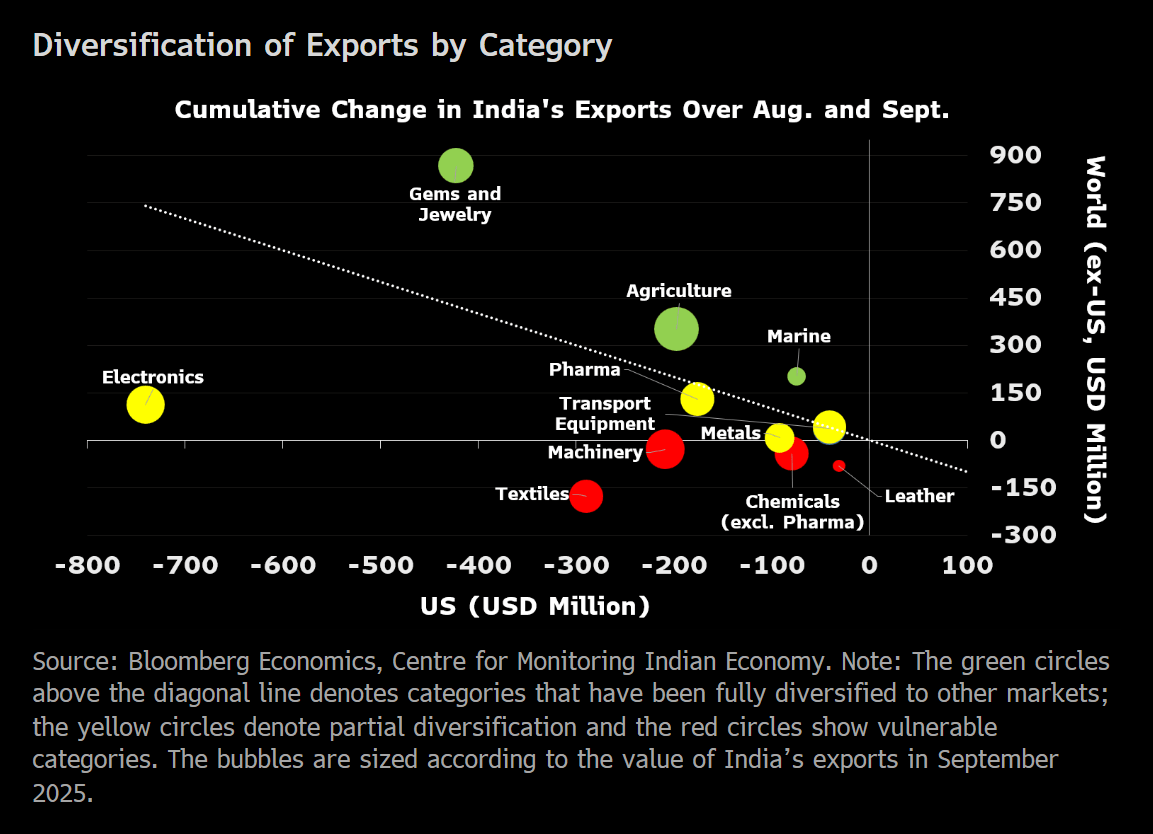

- The US raised tariffs on Indian exports to 25% effective Aug. 7 and doubled them to 50% on Aug. 27. The move triggered a sharp contraction in shipments to the US — India’s top market — particularly in electronics, gems and jewelry, textiles, machinery, agriculture and pharmaceuticals. But shipments to Asia, the Middle East, and Africa surged in some of these categories – cushioning the overall decline in global exports.

- Non-petroleum exports to the US fell 20.7% month on month in September after a 14.4% drop in August. A rapid diversification in September boosted shipments to Hong Kong, the United Arab Emirates, China, and Saudi Arabia. That lifted non-petroleum exports to the world by 2.7% in September following a 6.9% drop in the prior month. The increased exports to the UAE were likely supported by the free-trade agreement in place since May 2022.

- This geographic re-balancing underscores how stronger exports to Asian, Middle Eastern and African nations have significantly offset the adverse impact of higher US tariffs. While some part of this may reflect trade rerouting, a weaker rupee or seasonal patterns, it nevertheless underscores the growing depth of India’s trade and diplomatic engagement across the Global South.

- With exports stabilizing and diversification set to accelerate, India enters trade negotiations with greater confidence. A prospective US deal now appears within reach — one that could preserve India’s key red lines on dairy, farming, and greater access to the Indian automobile market than what it offered the UK in their deal.

Export diversification has resulted in the quick reorientation of some of the most politically sensitive goods within the first full month of the US’ imposition of 50% tariffs. Agricultural exports found new markets across Asia, the Middle East, and Africa, within which marine products were primarily diverted to China.

Gems and jewelry, centered in Prime Minister Narendra Modi’s home state of Gujarat, were also fully diversified. Even as exports to the US slumped 68% over August and September, India’s global shipments (including US) in this category rose 19% during this period, driven by demand from Hong Kong, the UAE and Saudi Arabia.

Other sectors, including transport equipment, pharmaceuticals, electronics, and metals, showed varying degrees of pivot to new markets. By contrast, textiles and apparel, leather goods, non-pharma chemicals, and — to a smaller extent — machinery saw export declines even outside the US, underscoring the need for targeted policy support.

Overall, the data highlight a maturing export ecosystem that’s increasingly powered by regional integration and strategic trade partnerships rather than dependence on a single major market. Looking ahead, India’s free-trade pact with the European Free Trade Association — covering Switzerland, Norway, Iceland and Liechtenstein — which took effect on Oct. 1, should further deepen this diversification away from the US market.

India also signed a landmark trade agreement with the UK in July, which is expected to come into force soon. It has also concluded negotiations with Oman, with a formal signing likely in the near term, while talks with the European Union — that has topped the US to become India’s largest export market after tariffs — are in their final stages. Collectively, these agreements should sustain the momentum of India’s export diversification in the months ahead.