Europe industrials midyear outlook

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Analyst Omid Vaziri, with contributing analysis by Bhawin Thakker. It appeared first on the Bloomberg Terminal.

As key enablers, European industrials’ earnings may benefit from secular growth offered by trends like reshoring, the energy transition and even AI in the medium term, yet their relative valuation to the broader market trend is largely in line with long-term averages. That implies a discount versus the tech sector which is investing heavily in these themes. The direction of 2H returns may hinge on investors’ understanding of AI-driven earnings for industrials. Schneider, ABB, and Siemens’ earnings look better positioned to grow in the medium term, driven by their exposure to secular growth drivers.

Sector earnings could start to recover in 2H after a 1H slowdown, but might not match the double-digit gains seen during the past year. Any consensus move is likely to depend on the pace of normalization in customer inventories.

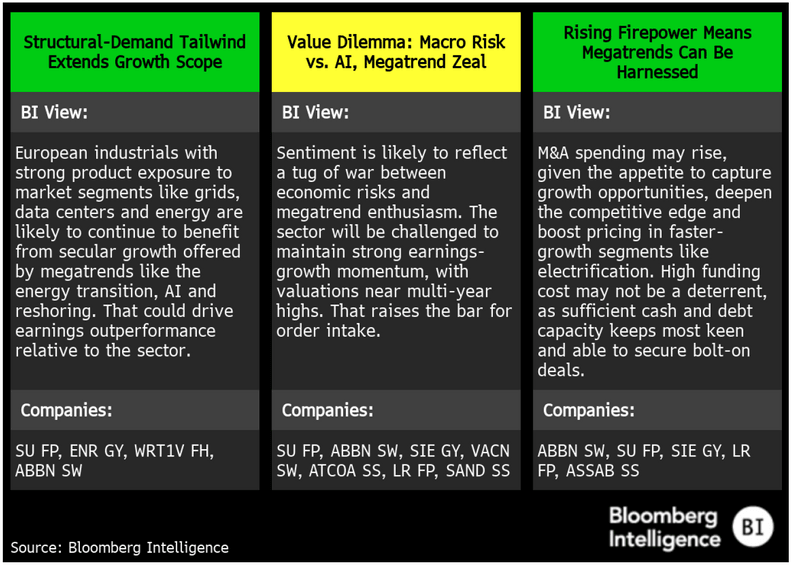

Three keys for 2H: Europe industrials

Key Drivers

Industrials’ macro risk vs. AI, megatrend lure a value dilemma

Sentiment and metrics for industrials diverge over the economic risks and megatrend demand scope (for data-center, grid, clean-energy and electrification end markets), with Schneider and ABB’s forward valuations eyeing earnings resilience. Grasping the sustainability of AI-driven earnings may set the direction for industrials’ returns.

Premium at long-term average despite earnings potential

The European capital-goods sector offers higher free-cash-flow yields vs. the region’s broader market, with the combination of relative-growth prospects and quality characteristics likely to help navigate slowing economies. The companies benefit from themes such as reshoring, the energy transition and even AI (via data-center exposure). Yet industrials themselves — the key enablers — trade at lower valuations vs. the technology giants investing heavily in these themes. Large players’ (Schneider and Siemens) have diversified revenue sources and a strong alignment to secular-growth trends, which reduce some early-cycle risk at a group level.

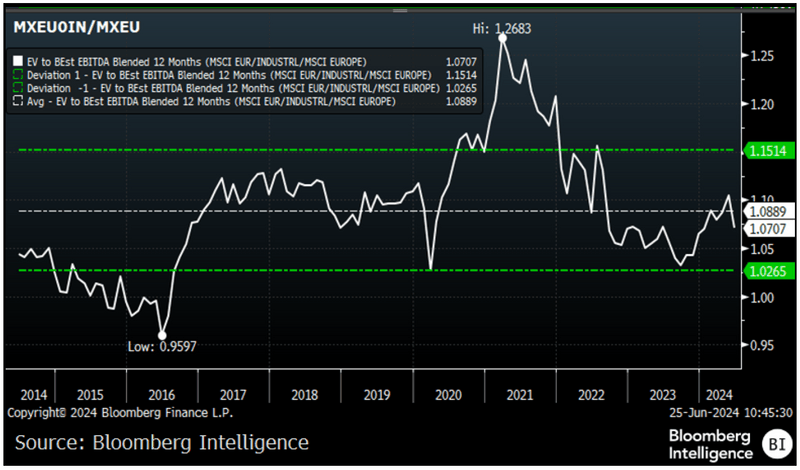

Relative to MSCI Europe, industrials’ valuation premium is in line with its long-term historical average, whereas their earnings power is up on long-term tech megatrend investment.

MSCI Industrials vs. Europe: EV-to-Ebitda Ratios

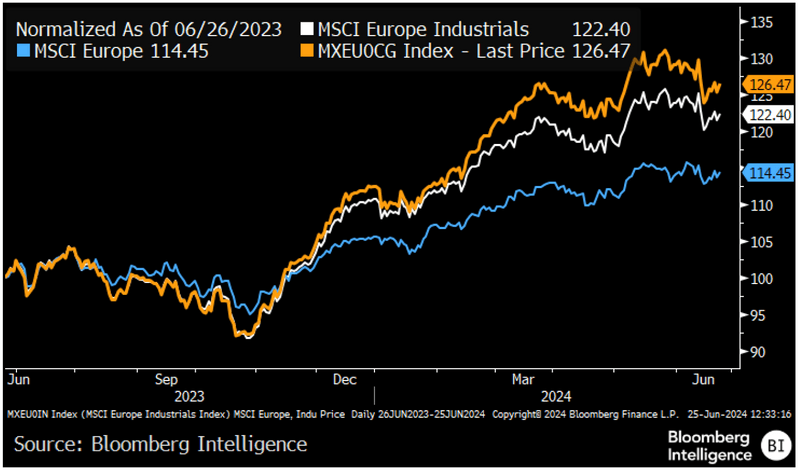

AI zeal, midterm-earnings view drive performance

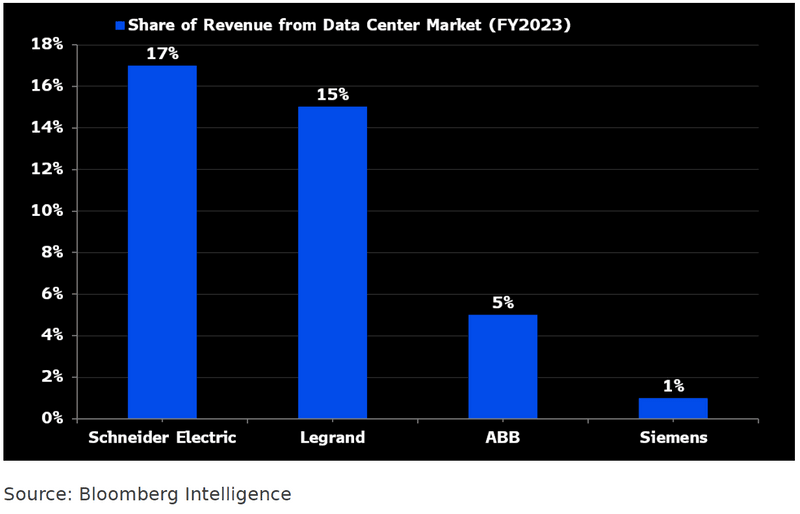

AI-enthusiasm has overshadowed concerns about an economic slowdown and geopolitical risks curbing industrials’ earnings. The excitement has made the focus more long term, even if there’s market uncertainty, with investor day presentations extolling this trend and influencing returns. Many of the share prices of sector peers reflect AI enthusiasm, particularly for those with high data-center exposure like Schneider (17% of sales). Investor’s grasp of the sustainability of AI-driven earnings for industrials could be key to 2H performances.

European industrials’ 7% outperformance of the MSCI Europe Index — 22% gain on robust earnings momentum and the promise of demand from megatrends over the past 12 months — has pushed valuations significantly above historical levels.

MSCI Industrials vs. MSCI Europe (Normalized)

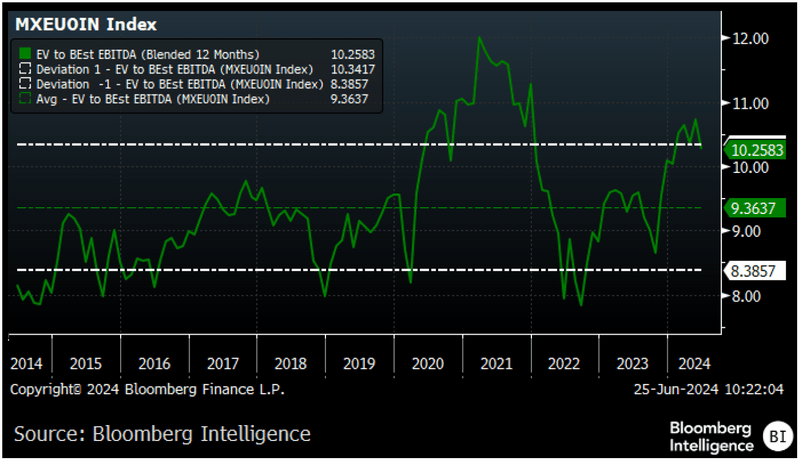

All eyes on sustainability of earnings momentum

Higher interest rates and their uncertain path means valuations are at the top of investors’ agendas, with multiples sensitive to the pace of cuts. Our analysis shows industrials’ balance sheets are generally in good shape, limiting earnings damage if the economic environment deteriorates. Many sector heavyweights have quality attributes and solid midterm-growth scope fueled by the global push for AI, energy security and decarbonization that’s driving a structural demand shift. Unprecedented public funding on industries such as grids, clean energy and the electrification of transport, buildings and industry offers a secular tailwind.

The sector’s challenge lie in the ability to maintain strong earnings-growth momentum to justify valuations near multiyear highs. That raises the bar high for midterm orders.

MSCI Industrials: EV-to-Ebitda Ratios

AI, bolt-on M&A provide additional growth levers

Industrials like Schneider and Legrand enable AI by supplying data centers and the electrical grid with power supplies, cooling equipment, switchgears, transfer switches, transformers and software. Customers’ multiyear growth plans suggest data-center orders will grow faster than sales, boosting Schneider’s backlog in this segment from its current 21%. Strategic acquisitions are also bearing fruit as Schneider’s Aveva takeover bolsters its software capability, adding margin and growth. ABB’s focus is shifting to growth and M&A after years of margin emphasis.

Bolt-on M&A is set to be a key driver of additional expansion. Industrials could build a competitive edge through targeted acquisitions to consolidate in fragmented markets, which might go beyond the purchase of small local competitors.

Select EU Industrials’ Data-Center Exposure

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2024 Bloomberg.

Bloomberg Intelligence is a service provided by Bloomberg Finance L.P. and its affiliates. Bloomberg Intelligence likewise shall not constitute, nor be construed as, investment advice or investment recommendations, or as information sufficient upon which to base an investment decision. The Bloomberg Intelligence function, and the information provided by Bloomberg Intelligence, is impersonal and is not based on the consideration of any customer’s individual circumstances. You should determine on your own whether you agree with Bloomberg Intelligence. Bloomberg Intelligence Credit and Company research is offered only in certain jurisdictions. Bloomberg Intelligence should not be construed as tax or accounting advice or as a service designed to facilitate any Bloomberg Intelligence subscriber’s compliance with its tax, accounting, or other legal obligations. Employees involved in Bloomberg Intelligence may hold positions in the securities analyzed or discussed on Bloomberg Intelligence.