Bloomberg Intelligence

This article was written by Bloomberg Intelligence Senior Industry Analyst John Davies. It appeared first on the Bloomberg Terminal.

Updating Focus Idea: Eutelsat’s government operation delivered 18.5% organic revenue growth in fiscal 1Q, comfortably its fastest-growing segment, supporting our thesis that consensus sales may be too low. There’s no benefit yet from the satellite company’s agreement with the French Defense Department — worth up to €1 billion — and planned rights issues need only FCC approval to go ahead after being delayed by the US shutdown.

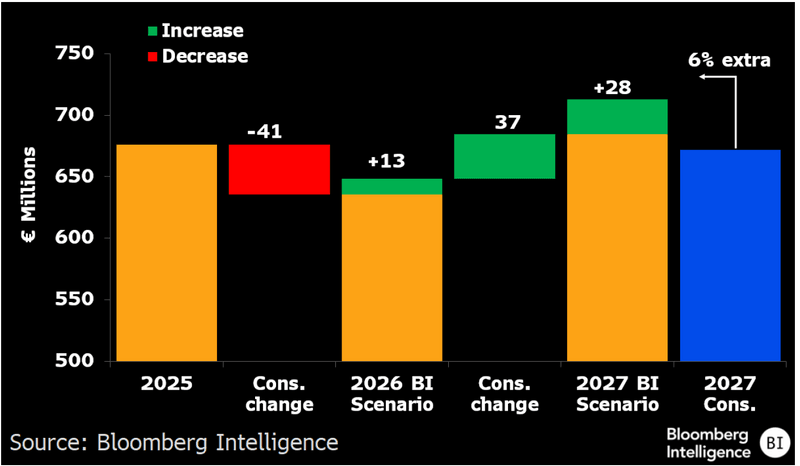

Original Thesis (Oct. 8): Eutelsat’s fiscal 2027 Ebitda could beat consensus by 6% — based on our analysis of its unique satellite communications offerings — as Europe’s governments ramp up investment to bolster security and independence, with the €1 billion French armed forces contract a prime example. The company is a key player in Iris2, the bloc’s sovereign communications network, which is likely to pass key milestones and its scope expand.

Consensus Ebitda-margin estimates look conservative

The market may be underestimating Eutelsat’s fiscal-2027 government-segment sales by €50 million-plus, if organic annual revenue growth rates are 10 percentage points higher than median expectations. High-profitability incremental income could mean the adjusted Ebitda margin expands to 52.4% vs. consensus’ 51.1%, in a small move toward guidance of at least 60% in fiscal 2029. The median consensus 2027 segment sales was raised to €281 million from €252 million at the start of 2025, yet further deals with supportive European governments and thei rallies, plus likely additions to the Iris2 project, could provide further impetus.

The company is part way through its transformation to a satellite operator focused on growing communications segments from a shrinking video-distributor with a stretched balance sheet.

Eutelsat Scenario Analysis

Governments show European satellite support via numerous routes

We believe these catalysts could act as important triggers for this idea in coming months.

Timeline of Key Catalysts:

- 4Q: Rights Issues Bolster Eutelsat’s Balance Sheet and Its Appeal as a Reliable Government Supplier

- Early 2026: ‘Rendezvous One’ for Iris2, Firming Up Costs, Capabilities and Timelines

- 2026-27: Additional Government-Contract Announcements Following June’s 10-Year Agreement With France of as Much as €1 Billion for LEO Services Ahead of Iris2

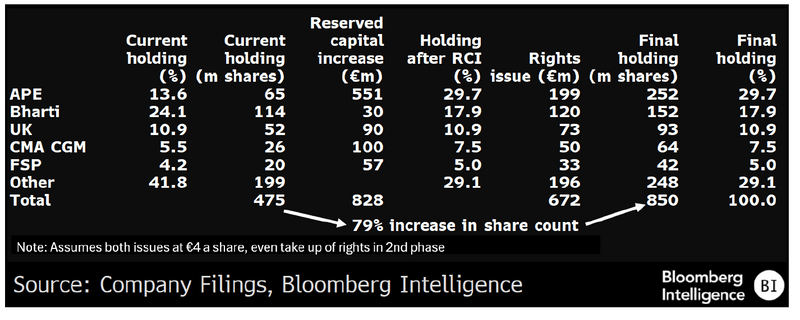

New equity coming via two-phase rights sssue

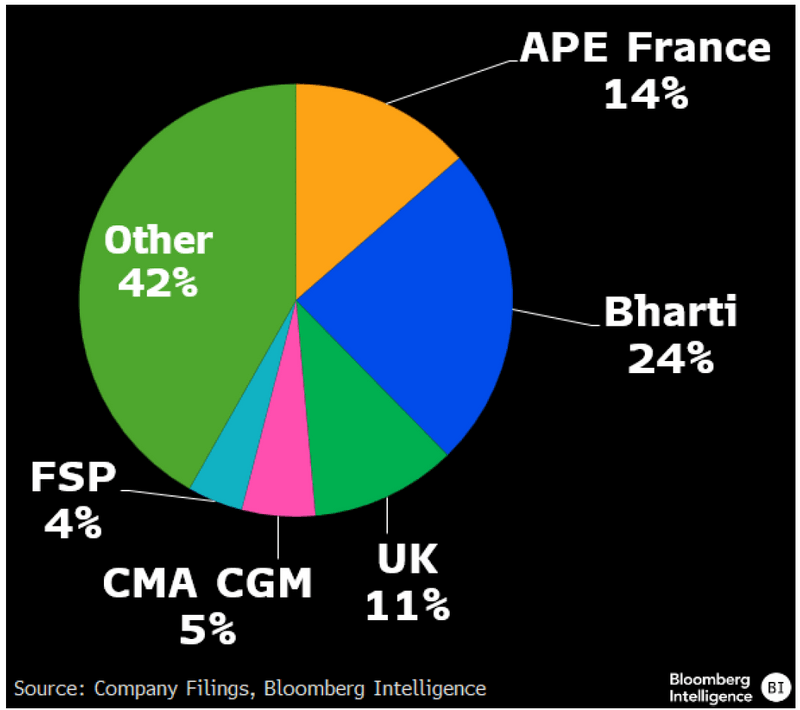

The Sept. 30 EGM approved Eutelsat’s plan for a reserved capital increase (RCI) for the French and UK states, Bharti, CMA CGM and FSP at €4 a share (vs. a current price of €3.6), suggesting a low level of dilution for current investors. All of those participating — except Bharti and the UK government — plan to contribute such that their proportionate shareholding increases. The RCI is set to close quickly, followed by a second rights issue (open to all shareholders in the normal way) to be completed by the end of calendar 4Q.

RCI participants have agreed to support the second capital increase in equal amounts to their post-RCI holdings. This means that of the €1.5 billion Eutelsat intends raising, only €196 million remains to be committed.

Rights-Issue Implications

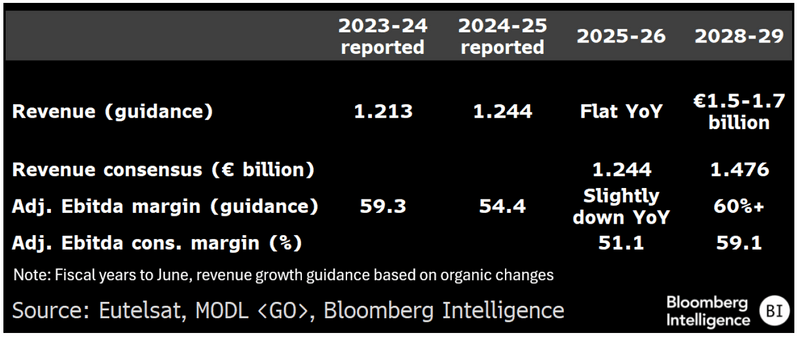

Consensus is slightly below Eutelsat’s fiscal-2029 €1.5-€1.7 billion sales-guidance range and Ebitda-margin aim of at least 60%. That’s probably after prior guidance revisions and full-availability delays to its OneWeb, low earth orbit (LEO) satellite constellation, with global coverage not due until 2026. Eutelsat seeks to beat LEO satellite-market revenue growth in fi scal2029, which might be challenging if any of Amazon Kuiper, Telesat Lightspeed and China’s networks are in service by then. Yet Eutelsat is well placed to sell to European governments and allies.

In the shorter term, fast revenue growth looks likely given OneWeb’s minimal market share and still-improving availability of capable user terminals and access to markets with unmet demand like India and S. Africa.

Guidance and Consensus

UK government could add Iris2 to Eutelsat deal

The 2023 all-share deal for OneWeb saw the UK government become a new Eutelsat holder. It hasn’t been a willing long-term owner of listed shares and could achieve many of its aims via a separate B share, but joining Europe’s sovereign-satellite communications network Iris2 to add to its extra investment in Eutelsat could be a cost-effective way to gain a space-systems backup (“redundancy” being a Strategic Defence Review aim).

State ownerships also provide an opportunity for the company to boost its government-segment sales, and for European states to funnel cash to the sector alongside grants, loans and equity. The UK plans to spend €163 million in the rights issues to keep its Eutelsat stake constant.

Eutelsat Shareholders

Iris2 brings significant European Union support to industry

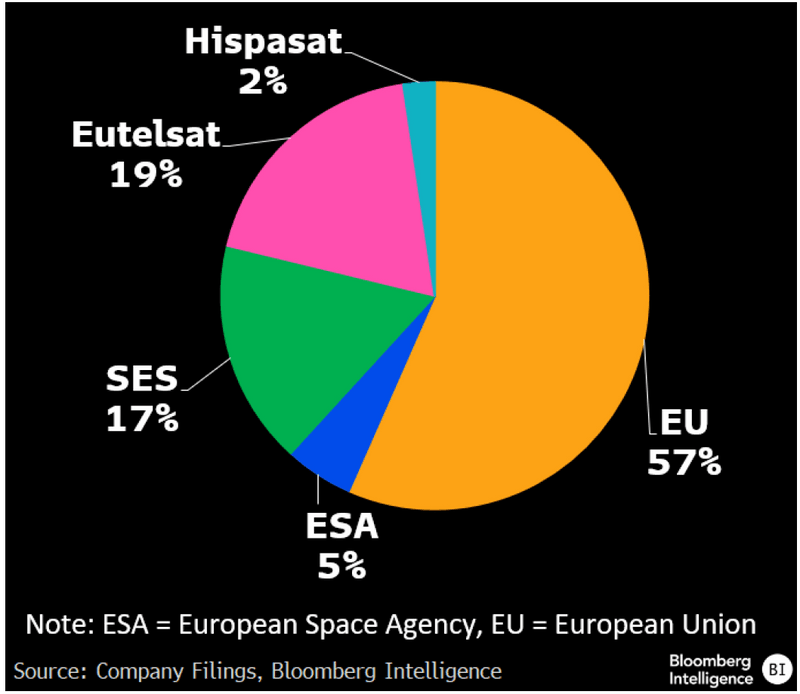

European satellite operators SES, Eutelsat and Hispasat are set to receive a boost from the European Union’s Iris2 network, contributing 38% of the cost among them and commercializing most of its capacity. Eutelsat targets revenue of €6.5 billion over 12 years for its share, though the EC’s only pledged “several hundred” million euro to the consortium as a whole. SES expects an internal rate of return of more than 10% from its investment.

The companies hope to secure additional revenue from European governments and other bodies as well as international partners, which looks plausible given the common desire to reduce reliance on US technology. Outside the government segment, they may face stiff competition from SpaceX, Amazon, Telesat and Chinese networks, some of which may be available earlier.

Iris2 Capital Cost (€10.6 Billion)

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2025 Bloomberg.