China briefing 2024: Balancing recovery now with investment for future

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Senior Industry Analyst Francis Chan. It appeared first on the Bloomberg Terminal.

After a post-pandemic reopening economic surge stalled in 2023, policy makers are acting to simultaneously stabilize China’s battered property market, reinvigorate struggling financial markets and develop global leadership in areas including technology, autos, planes and energy transition. Prospects for success look promising in some and potentially bleak in others.

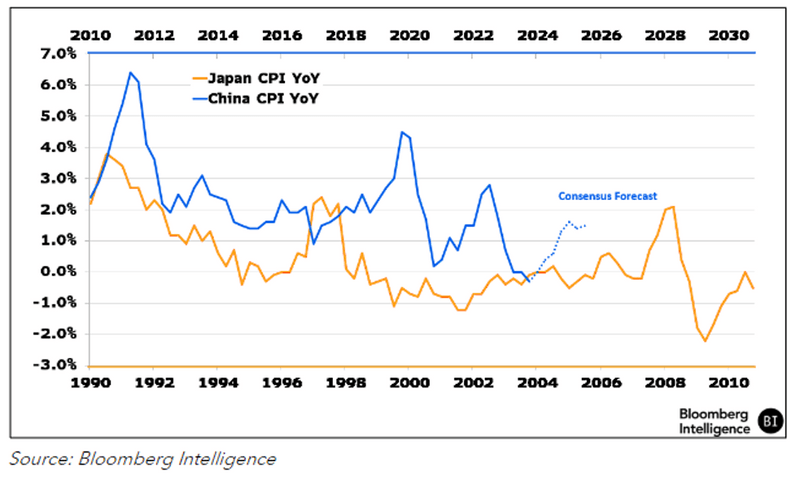

China CPI Growth from 2010 vs. Japan in 1990 – 2010

Briefing highlights

- Technology supply chain: Western companies’ gradual strategic diversification from China-centric supply chains is driving consumer electronics production toward Southeast Asia and India. Though Taiwan will maintain its large advanced-node semiconductor manufacturing base, Europe and the US should gain share, while mainland China dominates in more mature chipmaking.

- Artificial intelligence: China is lagging behind in AI developments such as foundational large language models (LLMs) in Chinese. Tightening export restrictions on Nvidia’s AI accelerator chips will likely hamper China’s research efforts at a time when the leading generative-AI companies seek to build ecosystems around their foundational models.

- Property & banking: Prolonged stagnation looks likely for China’s housing market due to structural challenges and we’re skeptical that traditional policy stimulus can spur a rebound. Property risks and margin pressures notwithstanding, China’s banks have solid capital ratios.

- Consumer: Equity and property market woes are causing a negative wealth effect on consumer activity; our scenario analysis points to 4% retail sales growth vs. consensus at 6%, even as online sales gain share.

- Autos and planes: China leads the charge in electric vehicles and key components like batteries, and its automakers’ global ambitions could be another area of trade concerns with US and Europe in this year’s election cycle. Its development of a narrow-body airliner is another competitive advancement.

- Commodities: Energy-transition investment is replacing real estate as the demand driver for China’s copper appetite (50% of global consumption). Beijing’s focus on reducing dependence on imported oil is propelling the shift to LNG, renewables and electrification, as well as investment in domestic E&Ps.

- Markets: China’s stock market remains depressed, trailing this year’s rally even with policy-induced “national team” buying. Our fair-value analysis suggests gains, but improved foreign sentiment is needed. Domestic credit markets are dominating US dollar-denominated issuance, and high yield performance relies on domestic real estate developments and global monetary policy shifts.

Bloomberg Terminal customers can read the full report, and if you are not already a customer, you can learn more here.

This is a synopsis of the full report. This is not an investment recommendation. All investors are advised to conduct their own independent research and consult a licensed investment professional before making a purchase decision. In addition, investors are advised that past investment performance is no guarantee of future price appreciation or performance.