ARTICLE

AI, digital investments may be next leg of SE Asia’s FDI growth

Bloomberg Intelligence

This analysis is by Bloomberg Intelligence Equity Strategist Sufianti Sufianti. It appeared first on the Bloomberg Terminal.

Growth of foreign direct investment in Southeast Asia could continue to outpace China during global and regional supply-chain realignment. While flows have remained largely directed into manufacturing, there’s a surge of interest in services and digital industries. Malaysia has staged a strong comeback while Vietnam has fallen victim to a high-base effect.

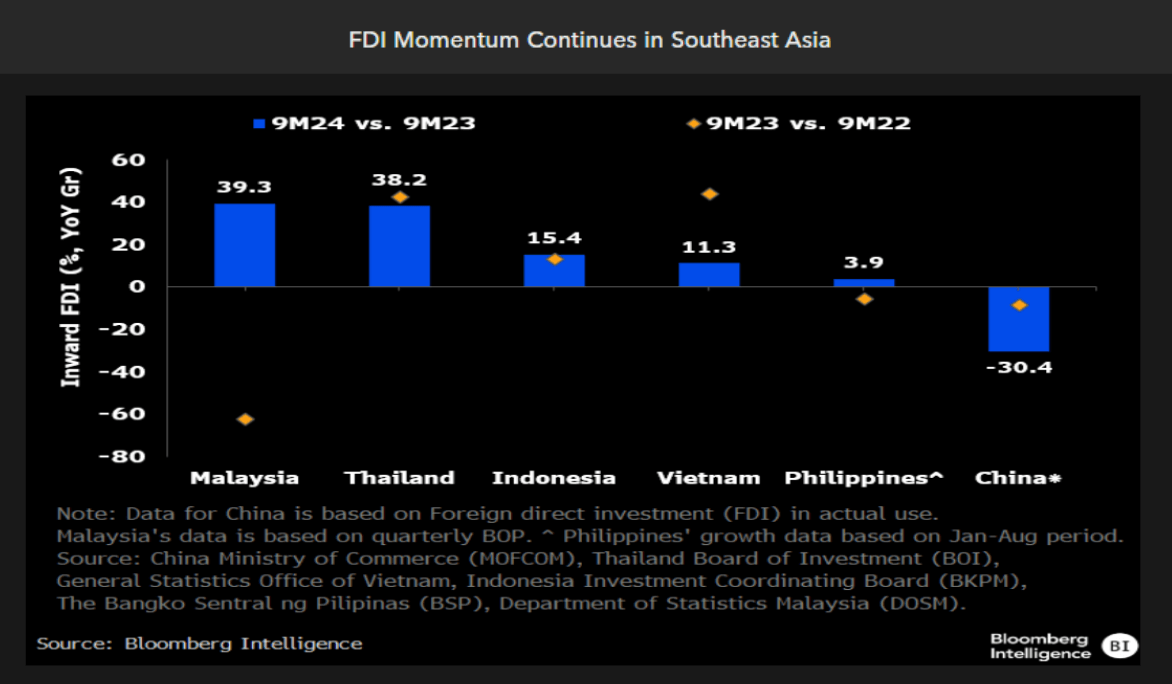

SE Asia’s FDI growth keeps its momentum

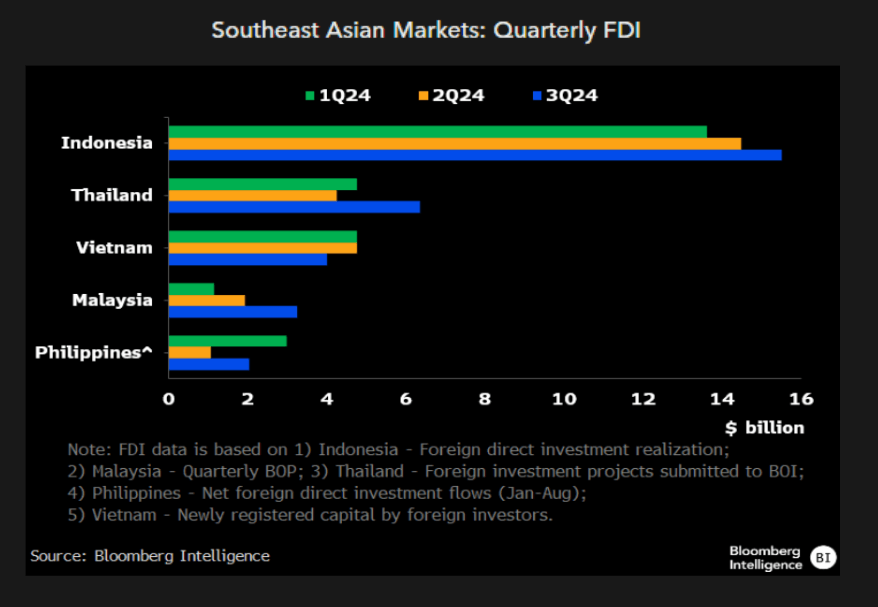

Foreign direct investment in Southeast Asia is continuing an upward trajectory with net inflows reaching about $85 billion so far this year as companies reconfigure the global supply chain, in contrast to the persistent contraction faced by China. According to data from relevant government bodies, all Southeast Asian markets saw higher inflows over the past three quarters with Indonesia leading in dollar value (Philippine data was for January-August).

Vietnam’s newly invested capital from foreign sources only grew 11% year-on-year due to a high-base effect. Investments in Malaysia recovered strongly from a contraction in 2023. Indonesia’s FDI saw stable expansion while the Philippines recorded the lowest growth rate.

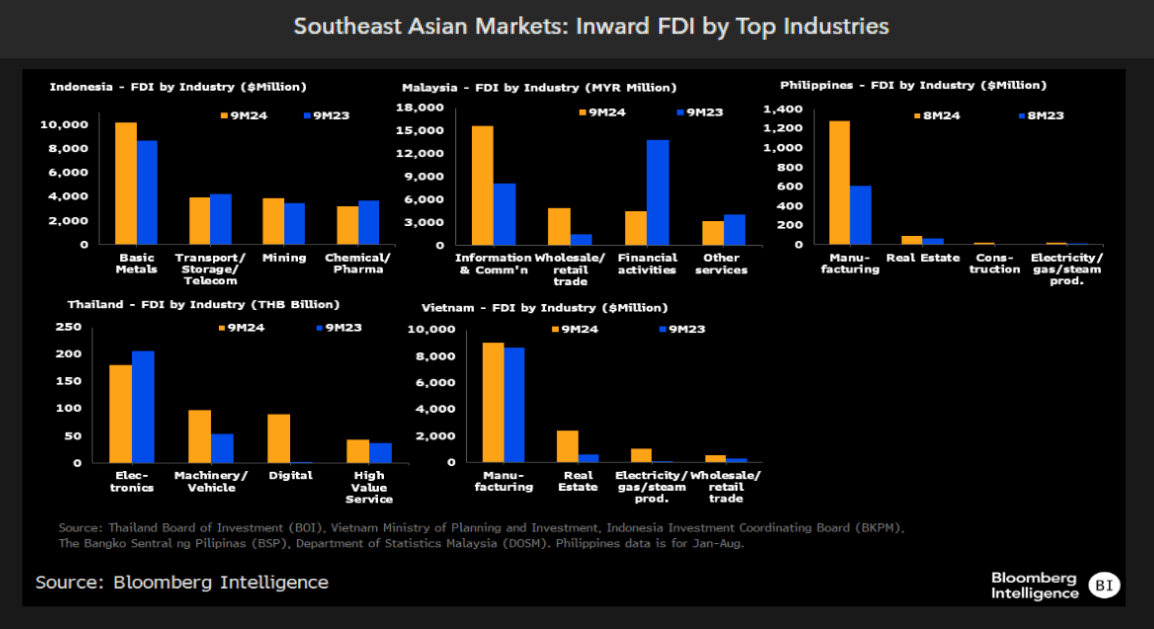

FDI still largely channeled into manufacturing

Manufacturing remains the focus industry for inward FDI in Southeast Asia, except in Malaysia, as supply-chain diversification by global players gains momentum. Investments in Philippine manufacturing grew twofold in the first eight months of 2024, dwarfing other industries in the country. Similarly, Vietnam saw two-thirds of its FDI channeled into manufacturing. Flows into Thailand’s electrical-appliances and electronics industry have abated slightly with the digital industry posting the strongest growth.

The services sector was the largest recipient of FDI in Malaysia, led by information and communications. Basic metal manufacturing continued to receive the largest inflows in Indonesia, followed by investments in logistics infrastructure and mining.

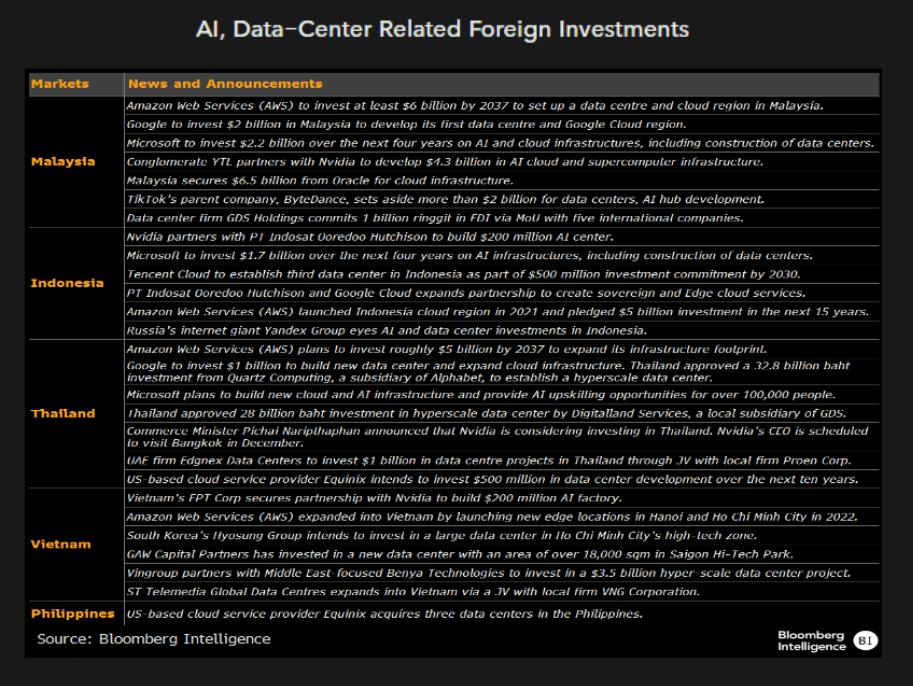

Emerging AI, data-center investment is hot spot

While a large chunk of FDI continues to be directed at traditional sectors such as manufacturing, Southeast Asia is emerging as a global hot spot for AI infrastructure. The region has become a battleground for global tech giants and increasing AI-related investments may be the next key driver of FDI momentum.

Amazon, Google, Microsoft, Nvidia and Tencent are among companies looking to expand their AI footprints in the region. Malaysia appears to be the preferred destination among the five markets, followed by Indonesia and Thailand. The trio has attracted over $30 billion of planned investments in AI-related projects, though some projects haven’t yet started or even been approved.

Vietnam is fourth, but a new law opening its digital industry to 100% foreign ownership may help attract interest. The Philippines lags.

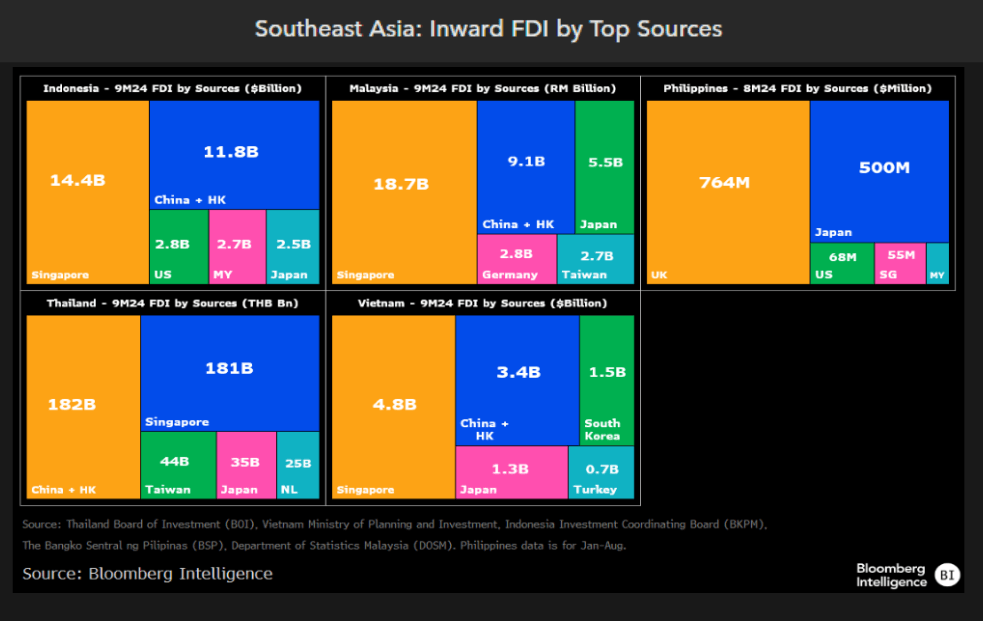

Singapore, China top FDI sources; US less prominent

Singapore, among the top contributors of FDI to China, has notably increased investments in neighboring Southeast Asia countries, except for the Philippines. Indonesia remains the preferred avenue for Singapore but FDI interest in Thailand and Vietnam has seen the largest jumps. China, including Hong Kong, is a key FDI source for four of the five markets.

The US plays a less prominent role in emerging Southeast Asia — most of its FDI is channeled into Singapore — but surging interest in AI-related investments could change that. The “China plus one” investment strategy of many multinationals has also drawn overseas capital to the region from other places such as Japan, South Korea and European countries.

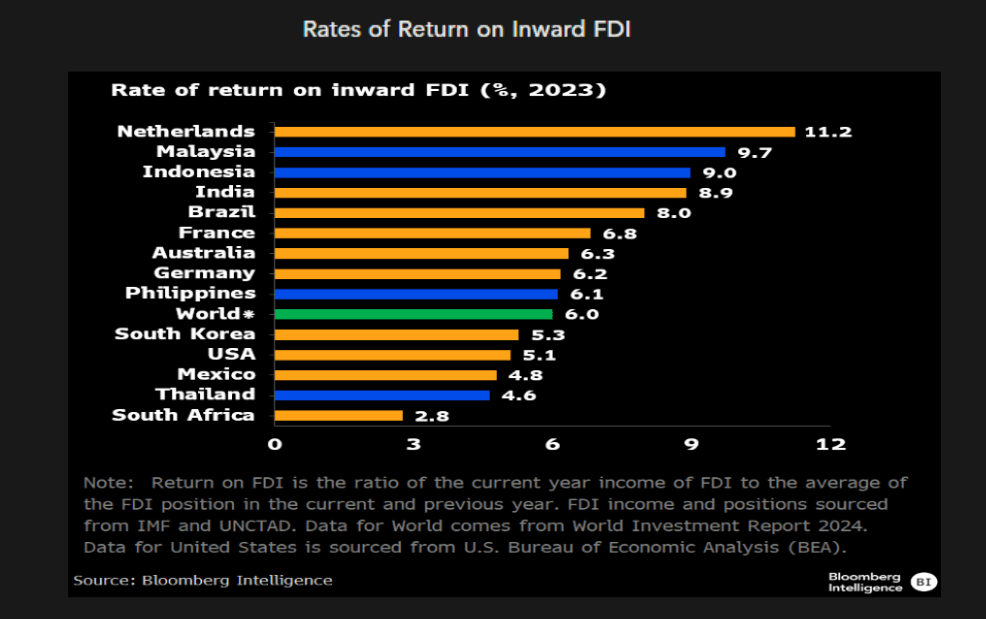

Malaysia, Indonesia have higher returns on FDI

Rates of return on inward FDI show the appeal of investing in Southeast Asian economies and could help draw more interest to the region. Malaysia and Indonesia rank high in return on investment relative to some of the world’s top destinations for FDI, such as the US and Brazil. The Philippines’ return is in line with the global average, according to data presented in the World Investment Report 2024 by UNCTAD. Return on direct investment in Thailand looks lower, while no FDI income data are available for Vietnam.

Return on FDI is calculated as the ratio of the current year’s income from FDI to the average of FDI positions in current and previous years. FDI income and positions are sourced from the International Monetary Fund and UNCTAD databases.

Five nations draw about $85 billion in FDI so far this year

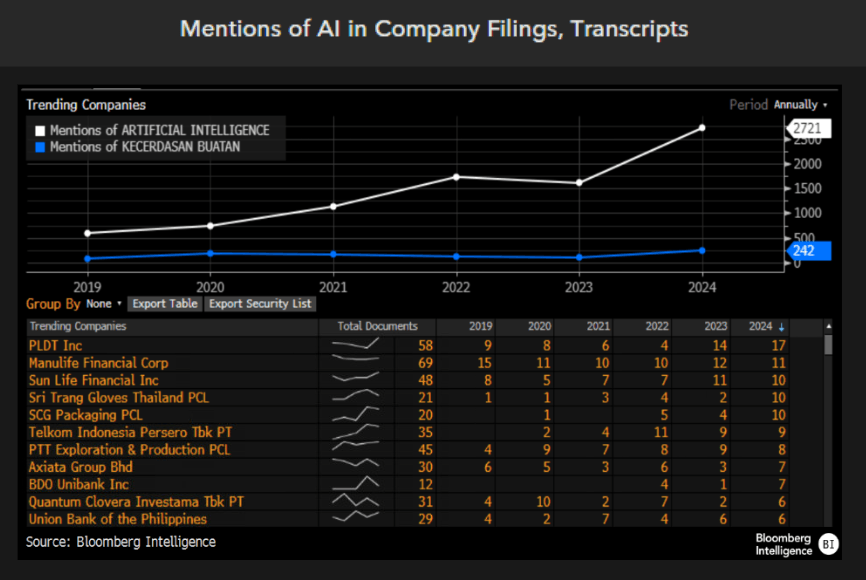

More mentions of AI by Southeast Asian firms

Our analysis of company documents, found at DS <GO>, searches for “artificial intelligence” or “kecerdasan buatan” mentioned in filings and transcripts of firms in the Jakarta Stock Exchange Composite Index, FTSE Bursa Malaysia EMAS Index, Philippines Stock Exchange All Shares Index, SET Index and Vietnam Ho Chi Minh Stock Index.

The data included in these materials are for illustrative purposes only. The BLOOMBERG TERMINAL service and Bloomberg data products (the “Services”) are owned and distributed by Bloomberg Finance L.P. (“BFLP”) except (i) in Argentina, Australia and certain jurisdictions in the Pacific Islands, Bermuda, China, India, Japan, Korea and New Zealand, where Bloomberg L.P. and its subsidiaries (“BLP”) distribute these products, and (ii) in Singapore and the jurisdictions serviced by Bloomberg’s Singapore office, where a subsidiary of BFLP distributes these products. BLP provides BFLP and its subsidiaries with global marketing and operational support and service. Certain features, functions, products and services are available only to sophisticated investors and only where permitted. BFLP, BLP and their affiliates do not guarantee the accuracy of prices or other information in the Services. Nothing in the Services shall constitute or be construed as an offering of financial instruments by BFLP, BLP or their affiliates, or as investment advice or recommendations by BFLP, BLP or their affiliates of an investment strategy or whether or not to “buy”, “sell” or “hold” an investment. Information available via the Services should not be considered as information sufficient upon which to base an investment decision. The following are trademarks and service marks of BFLP, a Delaware limited partnership, or its subsidiaries: BLOOMBERG, BLOOMBERG ANYWHERE, BLOOMBERG MARKETS, BLOOMBERG NEWS, BLOOMBERG PROFESSIONAL, BLOOMBERG TERMINAL and BLOOMBERG.COM. Absence of any trademark or service mark from this list does not waive Bloomberg’s intellectual property rights in that name, mark or logo. All rights reserved. © 2024 Bloomberg.